Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I only need the part that I got incorrect please! Question 4 of 4 23.13 / 25 = The budget committee of Sunland Company collects

I only need the part that I got incorrect please!

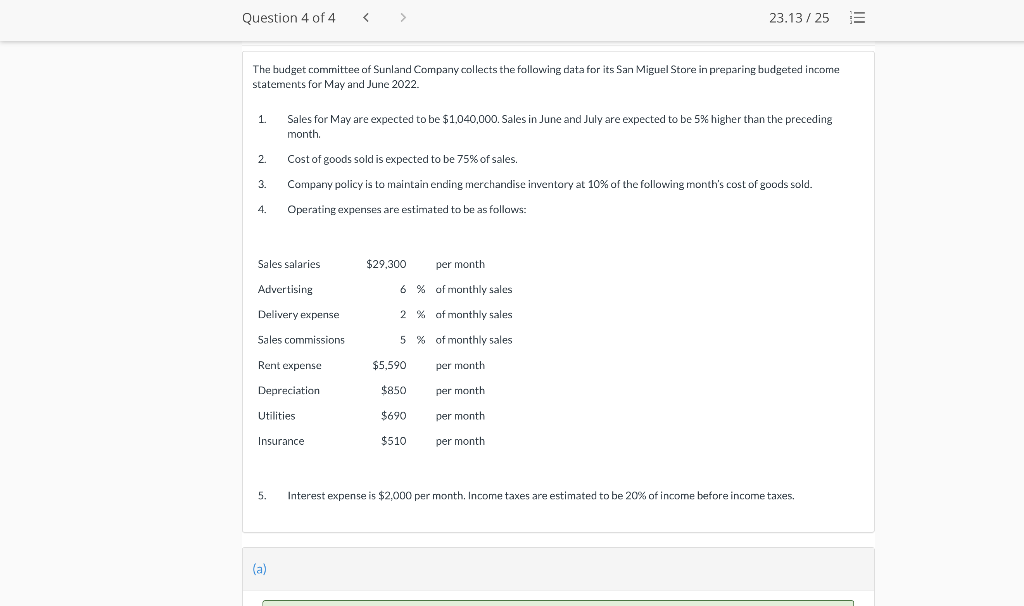

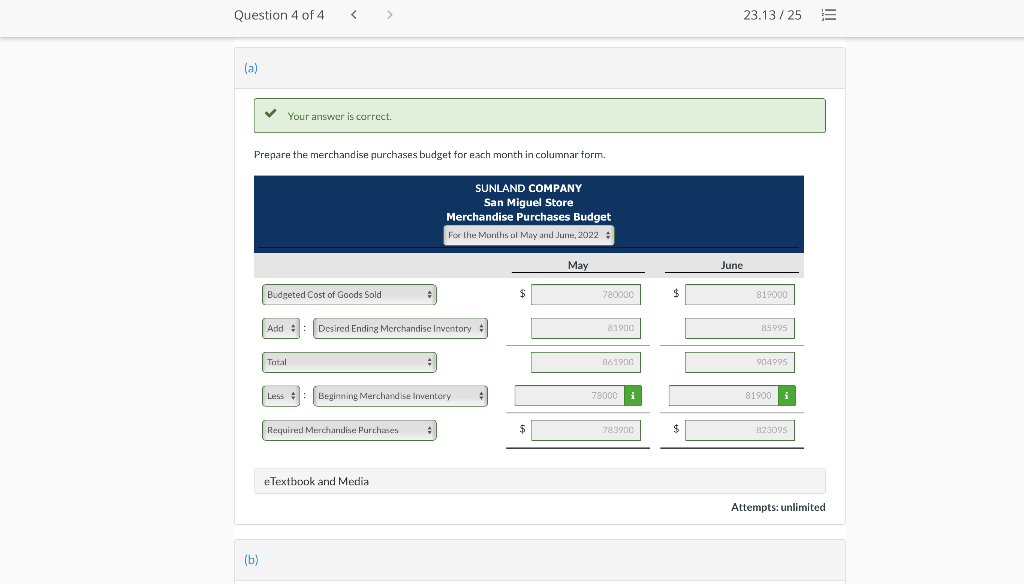

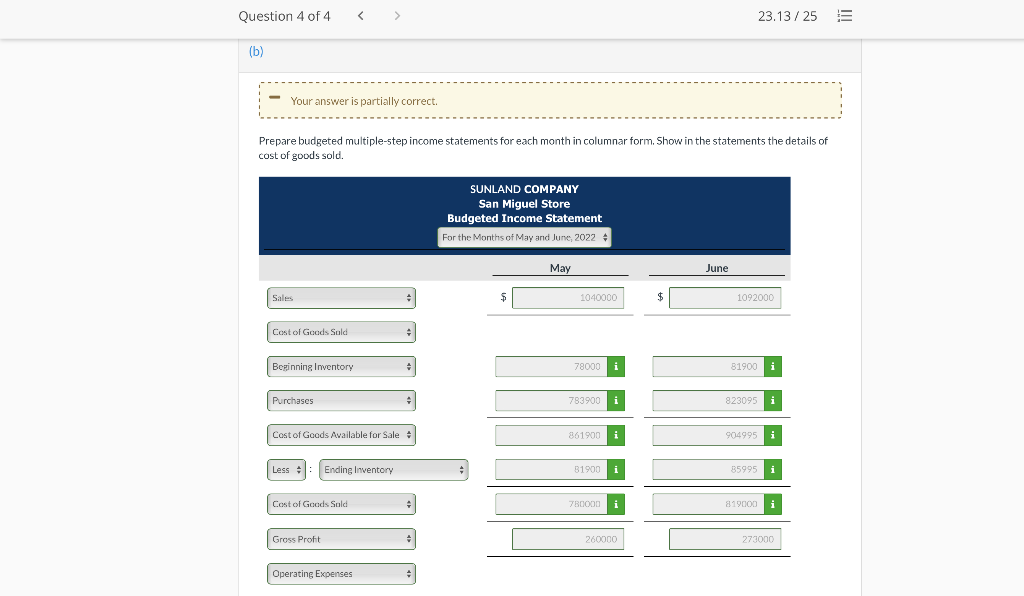

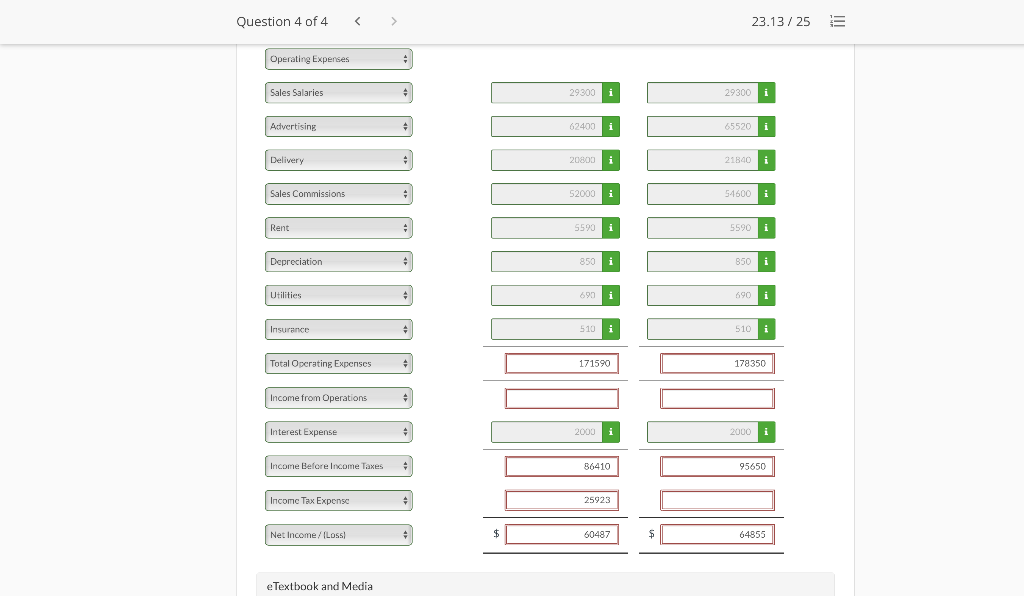

Question 4 of 4 23.13 / 25 = The budget committee of Sunland Company collects the following data for its San Miguel Store in preparing budgeted income statements for May and June 2022. 1. Sales for May are expected to be $1,040,000. Sales in June and July are expected to be 5% higher than the preceding month. 2. Cost of goods sold is expected to be 75% of sales. 3. Company policy is to maintain ending merchandise inventory at 10% of the following month's cost of goods sold. 4. Operating expenses are estimated to be as follows: Sales salaries $29.300 per month Advertising 6 % of monthly sales Delivery expense 2 % of monthly sales Sales commissions 5 % of monthly sales Rent expense $5,590 per month Depreciation $850 per month Utilities $690 per month Insurance $510 per month 5. Interest expense is $2,000 per month, Income taxes are estimated to be 20% of income before income taxes, (a) Question 4 of 4 23.13/25 (a) Your answer is correct. Prepare the merchandise purchases budget for each month in columnar form. SUNLAND COMPANY San Miguel Store Merchandise Purchases Budget For the Months of May and June, 2022 May June Budgeted Cost of Goods Sold . $ 780000 819000 Add : Desired Ending Merchandise Inventory | 81900 85995 Total 8161900 904995 Less Beginning Merchandise Inventory 78000 81900 i Required Merchandise Purchases $ 783900 $ 823095 e Textbook and Media Attempts: unlimited (b) Question 4 of 4 23.13/25 (b) Your answer is partially correct. Prepare budgeted multiple-step income statements for each month in columnar form. Show in the statements the details of cost of goods sold. SUNLAND COMPANY San Miguel Store Budgeted Income Statement For the Months of May and June, 2022 May June Sales 1040000 1092000 Cost of Goods Sold . Beginning Inventory + 78000 81900 i Purchases 783900 i 823095 i Cost of Goods Available for Sale 861900 i 904995 i Less :: Ending Inventory 81900 85995 Cost of Goods Sold 780000 i 819000 Gross Proht 260000 273000 Operating Expenses Question 4 of 4 23.13 / 25 E Operating Expenses : Sales Salaries 29300 i 29300 i Advertising 62400 i 65520 i Delivery 20800 i 21840 i Sales Commissions 52000 i 54600 i Rent 5590 i 5590 i Depreciation . 850 i 850 i Utilities 690 i 690 i i Insurance 510 i 510 i Total Operating Expenses . 171590 178350 Income from Operations + Interest Expense + 2003 i 2000 i Income Before Income Taxes . 86410 95650 2002 Income Tax Expense 25923 Net Income/tLoss ) $ 60487 $ $ 64855 e Textbook and MediaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started