Answered step by step

Verified Expert Solution

Question

1 Approved Answer

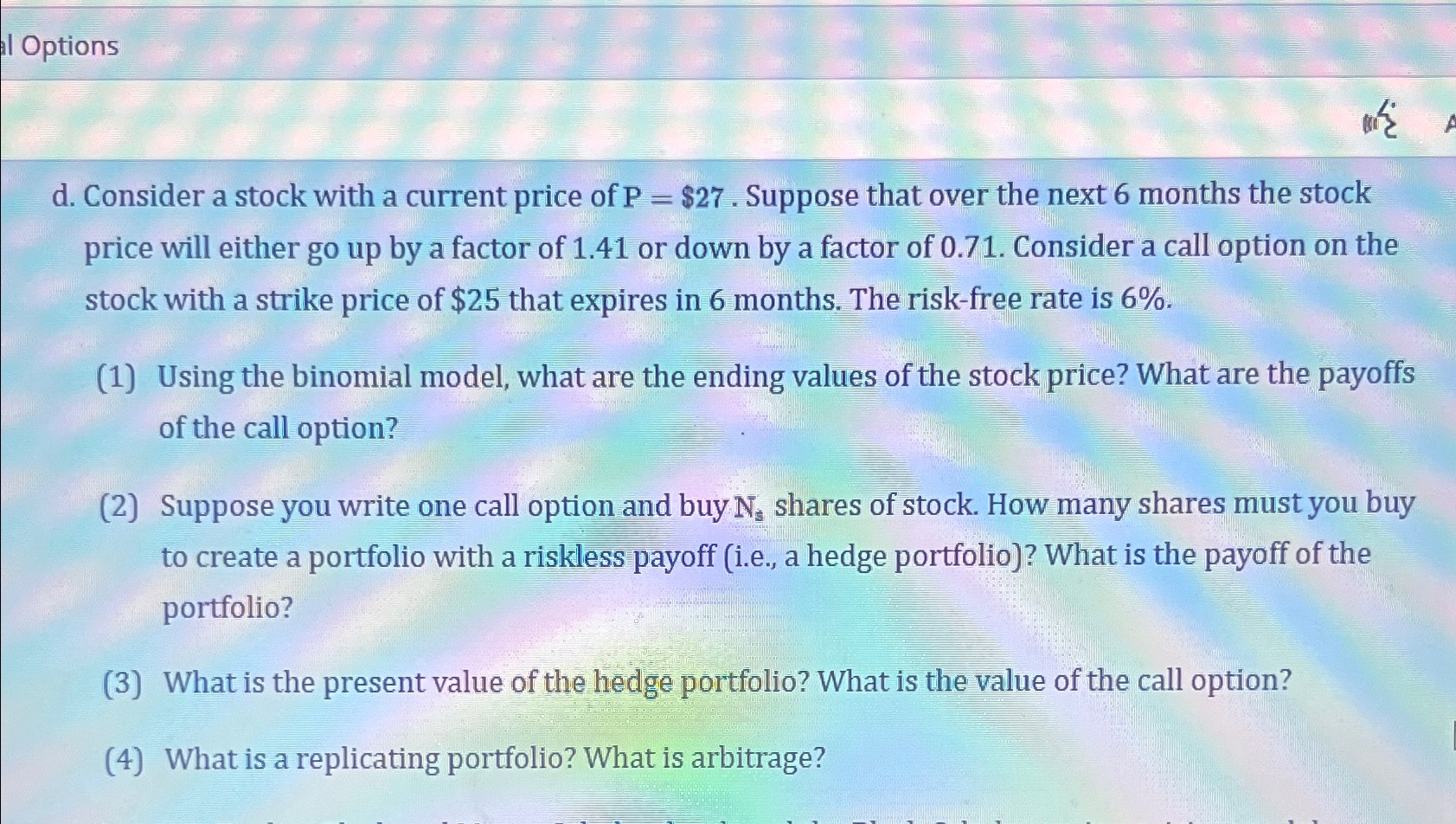

I Options d . Consider a stock with a current price of P = $ 2 7 . Suppose that over the next 6 months

I Options

d Consider a stock with a current price of $ Suppose that over the next months the stock price will either go up by a factor of or down by a factor of Consider a call option on the stock with a strike price of $ that expires in months. The riskfree rate is

Using the binomial model, what are the ending values of the stock price? What are the payoffs of the call option?

Suppose you write one call option and buy shares of stock. How many shares must you buy to create a portfolio with a riskless payoff ie a hedge portfolio What is the payoff of the portfolio?

What is the present value of the hedge portfolio? What is the value of the call option?

What is a replicating portfolio? What is arbitrage?

Please please can you type the answers for each question that wouod help me understand what the answers better thank you I appreciate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started