Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I posted problem #3. twice by accident, I could not figure out how to remove it. 1. A company considers the following investment projects. Both

I posted problem #3. twice by accident, I could not figure out how to remove it.

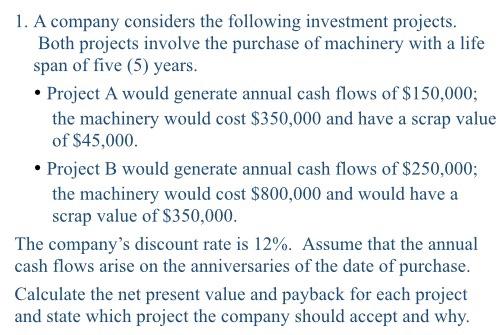

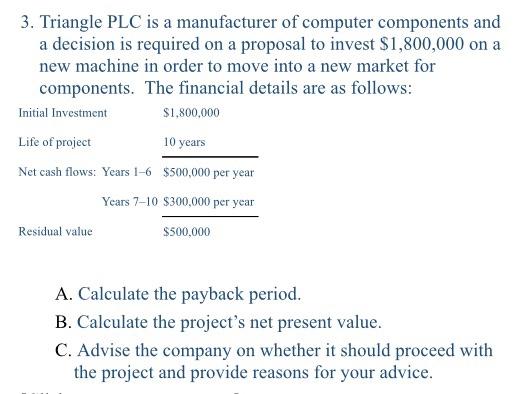

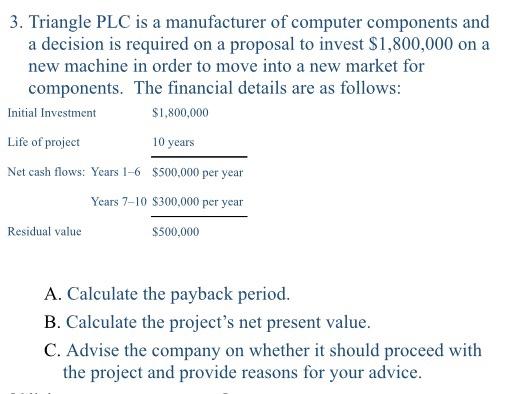

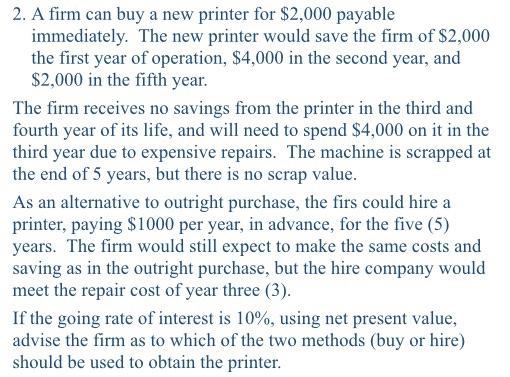

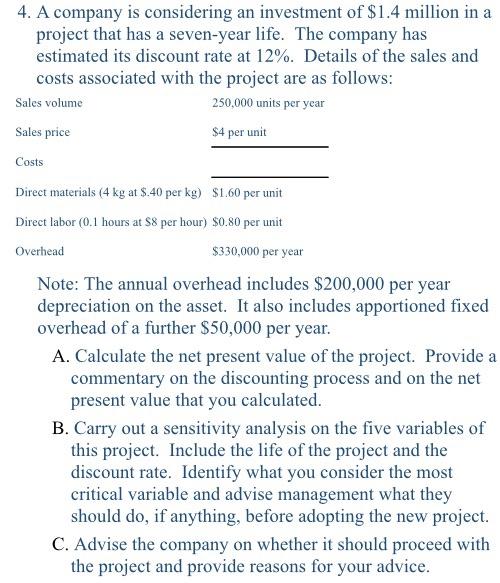

1. A company considers the following investment projects. Both projects involve the purchase of machinery with a life span of five (5) years. Project A would generate annual cash flows of $150,000; the machinery would cost $350,000 and have a scrap value of $45,000. Project B would generate annual cash flows of $250,000; the machinery would cost $800,000 and would have a scrap value of $350,000. The company's discount rate is 12%. Assume that the annual cash flows arise on the anniversaries of the date of purchase. Calculate the net present value and payback for each project and state which project the company should accept and why. 3. Triangle PLC is a manufacturer of computer components and a decision is required on a proposal to invest $1,800,000 on a new machine in order to move into a new market for components. The financial details are as follows: Initial Investment $1,800,000 Life of project 10 years Net cash flows: Years 1-6 $500,000 per year Years 7-10 $300,000 per year Residual value $500,000 A. Calculate the payback period. B. Calculate the project's net present value. C. Advise the company on whether it should proceed with the project and provide reasons for your advice. 3. Triangle PLC is a manufacturer of computer components and a decision is required on a proposal to invest $1,800,000 on a new machine in order to move into a new market for components. The financial details are as follows: Initial Investment $1,800,000 Life of project 10 years Net cash flows: Years 1-6 $500,000 per year Years 7-10 $300,000 per year Residual value $500,000 A. Calculate the payback period. B. Calculate the project's net present value. C. Advise the company on whether it should proceed with the project and provide reasons for your advice. 2. A firm can buy a new printer for $2,000 payable immediately. The new printer would save the firm of $2,000 the first year of operation, $4,000 in the second year, and $2,000 in the fifth year. The firm receives no savings from the printer in the third and fourth year of its life, and will need to spend $4,000 on it in the third year due to expensive repairs. The machine is scrapped at the end of 5 years, but there is no scrap value. As an alternative to outright purchase, the firs could hire a printer, paying $ 1000 per year, in advance, for the five (5) years. The firm would still expect to make the same costs and saving as in the outright purchase, but the hire company would meet the repair cost of year three (3). If the going rate of interest is 10%, using net present value, advise the firm as to which of the two methods (buy or hire) should be used to obtain the printer. 4. A company is considering an investment of $1.4 million in a project that has a seven-year life. The company has estimated its discount rate at 12%. Details of the sales and costs associated with the project are as follows: Sales volume 250,000 units per year Sales price $4 per unit Costs Direct materials (4 kg at $.40 per kg) $1.60 per unit Direct labor (0.1 hours at 88 per hour) $0.80 per unit Overhead $330,000 per year Note: The annual overhead includes $200,000 per year depreciation on the asset. It also includes apportioned fixed overhead of a further $50,000 per year. A. Calculate the net present value of the project. Provide a commentary on the discounting process and on the net present value that you calculated. B. Carry out a sensitivity analysis on the five variables of this project. Include the life of the project and the discount rate. Identify what you consider the most critical variable and advise management what they should do, if anything, before adopting the new project. C. Advise the company on whether it should proceed with the project and provide reasons for your advice Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started