Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There are three factors that can affect the shape of the Treasury yield curve (rt, IP, and MRP) and five factors that can affect the

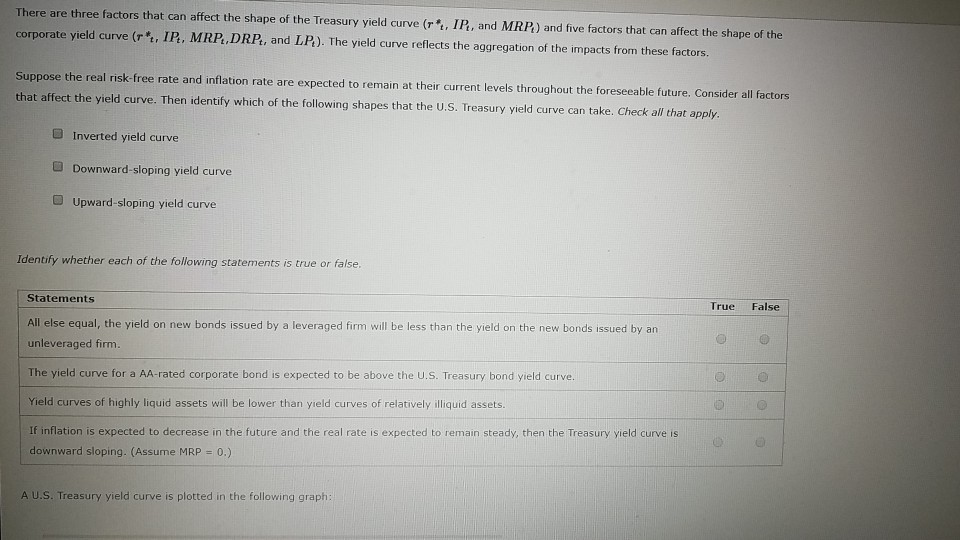

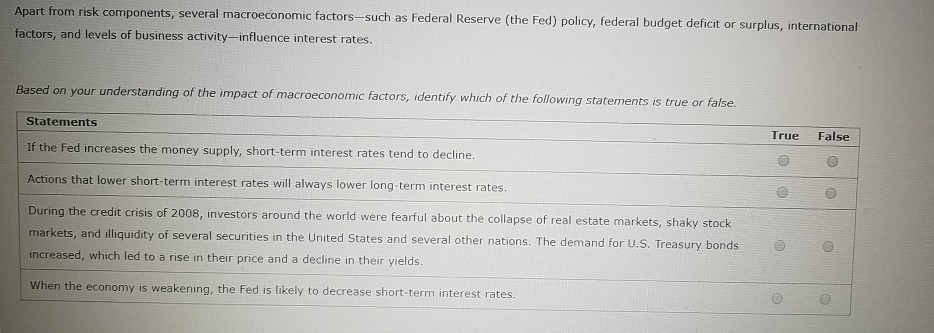

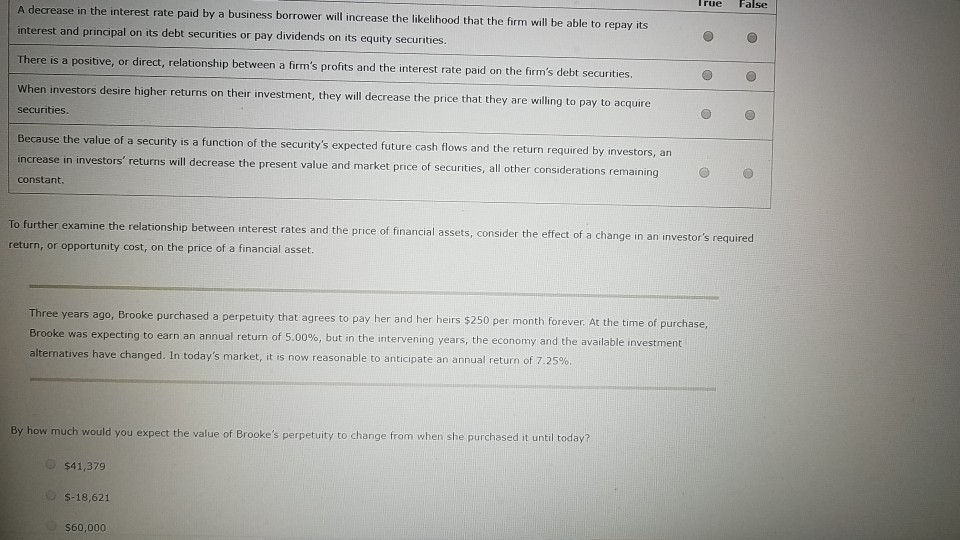

There are three factors that can affect the shape of the Treasury yield curve (rt, IP, and MRP) and five factors that can affect the shape of the corporate yield curve (r*, IP, MRP,DRP, and LP). The yield curve reflects the aggregation of the impacts from these factors. Suppose the real risk-free rate and inflation rate are expected to remain at their current levels throughout the foreseeable future. Consider all factors that affect the yield curve. Then identify which of the following shapes that the U.S. Treasury yield curve can take. Check all that apply. Inverted yield curve Downward-sloping yield curve Upward-sloping yield curve Identify whether each of the following statements is true or false. Statements True False All else equal, the yield on new bonds issued by a leveraged firm will be less than the yield on the new bonds issued by an unleveraged firm. The yield curve for a AA-rated corporate bond is expected to be above the U.S. Treasury bond yield curve. Yield curves of highly liquid assets will be lower than yield curves of relatively illiquid assets. If inflation is expected to decrease in the future and the real rate is expected to remain steady, then the Treasury yield curve is downward sloping. (Assume MRP = 0.) A U.S. Treasury yield curve is plotted in the following graph: Apart from risk components, several macroeconomic factors-such as Federal Reserve (the Fed) policy, federal budget deficit or surplus, international factors, and levels of business activity-influence interest rates. Based on your understanding of the impact of macroeconomic factors, identify which of the following statements is true or false. True False Statements If the Fed increases the money supply, short-term interest rates tend to decline. Actions that lower short-term interest rates will always lower long-term interest rates, During the credit crisis of 2008, investors around the world were fearful about the collapse of real estate markets, shaky stock markets, and illiquidity of several securities in the United States and several other nations. The demand for U.S. Treasury bonds increased, which led to a rise in their price and a decline in their yields. When the economy is weakening, the Fed is likely to decrease short-term interest rates. A decrease in the interest rate paid by a business borrower will increase the likelihood that the firm will be able to repay its interest and principal on its debt securities or pay dividends on its equity securities. There is a positive, or direct, relationship between a firm's profits and the interest rate paid on the firm's debt securities When investors desire higher returns on their investment, they will decrease the price that they are willing to pay to acquire securities. Because the value of a security is a function of the security's expected future cash flows and the return required by investors, an increase in investors' returns will decrease the present value and market price of securities, all other considerations remaining constant. To further examine the relationship between interest rates and the price of financial assets, consider the effect of a change in an investor's required return, or opportunity cost, on the price of a financial asset. Three years ago, Brooke purchased a perpetuity that agrees to pay her and her heirs $250 per month forever. At the time of purchase, Brooke was expecting to earn an annual return of 5.00%, but in the intervening years, the economy and the available investment alternatives have changed. In today's market, it is now reasonable to anticipate an annual return of 7.25%. By how much would you expect the value of Brooke's perpetuity to change from when she purchased it until today? $41,379 $-18,621 560.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started