I posted the other part of the homework if you guys want to take a look at them in case you need other supporting info from the other parts of the homework

Part 3 solution

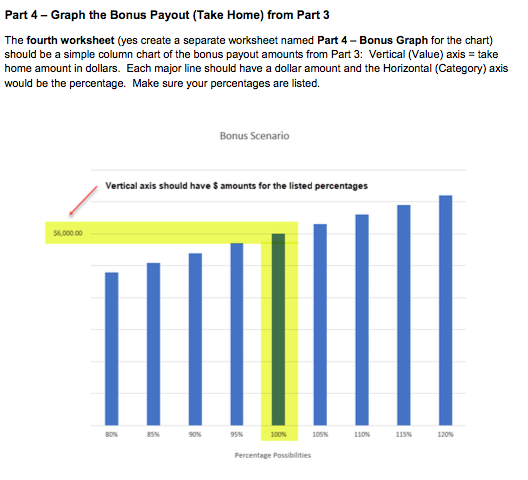

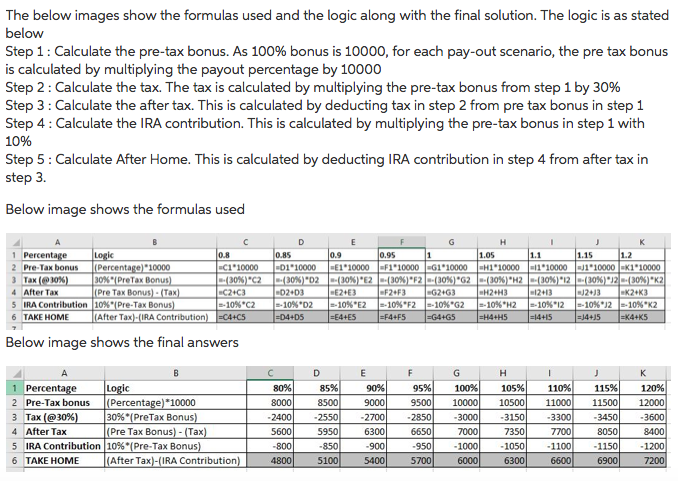

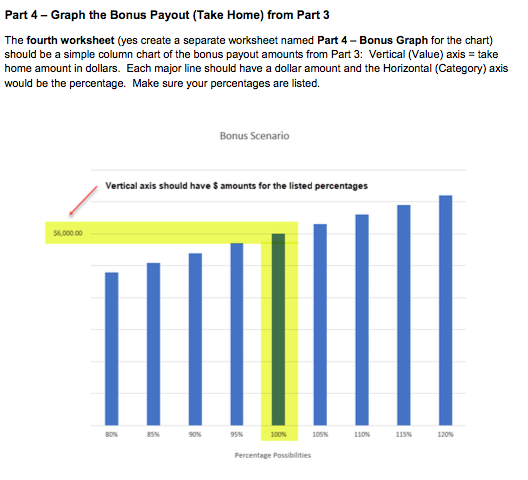

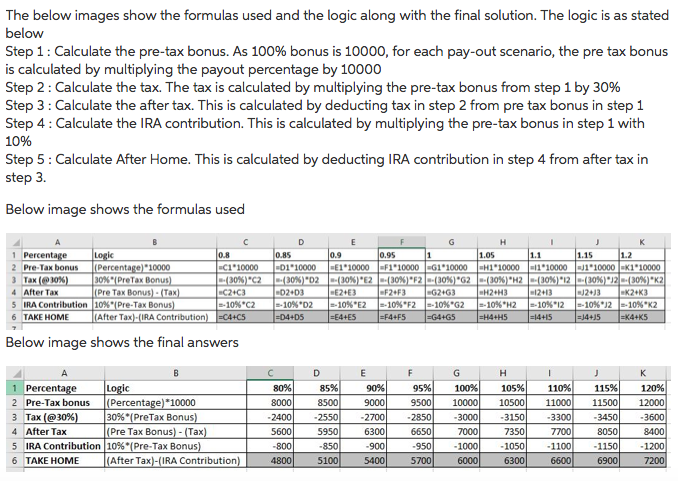

Part 4- Graph the Bonus Payout (Take Home) from Part 3 The fourth worksheet (yes create a separate worksheet named Part 4- Bonus Graph for the chart) should be a simple column chart of the bonus payout amounts from Part 3: Vertical (Value) axis = take home amount in dollars. Each major line should have a dollar amount and the Horizontal (Category) axis would be the percentage. Make sure your percentages are listed. Bonus Scenario Vertical axis should have $ amounts for the listed percentages 90% 95% 105% 110% 115% 120% Percentage Possibilities The below images show the formulas used and the logic along with the final solution. The logic is as stated below Step 1 : Calculate the pre-tax bonus. As 100% bonus is 10000, for each pay-out scenario, the pre tax bonus is calculated by multiplying the payout percentage by 10000 Step 2 : Calculate the tax. The tax is calculated by multiplying the pre-tax bonus from step 1 by 30% Step 3 Calculate the after tax. This is calculated by deducting tax in step 2 from pre tax bonus in step 1 Step 4 Calculate the IRA contribution. This is calculated by multiplying the pre-tax bonus in step 1 with 10% Step 5 Calculate After Home. This is calculated by deducting IRA contribution in step 4 from after tax in step 3. Below image shows the formulas used 0.9 8 C1 10000 D1 10000 E1'10000 F1 10000 G1 10000H1 10000 1 100001 10000 K1 10000 00% C2+C3 , 10%*C2 1.05 1.15 1.2 2 Pre-Tax bonus 10000 30%).12 . 30%,-K2 2413 K2K 3 Tax (@30%) 1300%.PreTax 30% 02+D3 -10%"D2 30% E24E -10%"E2 30%).F2|--(30% --( 30% Pre Tax 4 5 6 After Tax IRA Contribution 110%.(Pre-Tax TAKE HOME Tax H2+H3 12413 |=-10%"2 | -10%"F2 -10%"G2 10%"H2 |=-10%*)2 -10%"K2 After Tax)-(IRA Contribution Below image shows the final answers 95%) 95001 100%) 10000 1 105%) 0500110001 85% 110% 115%) 12096 2 Pre-Tax bonus (Percentage) *10000 8000 150012000 Tax(@30% After Tax IRA Contribution | 1096"(Pre-Tax Bonus 3096"( PreTax Bonus Pre Tax Bonus) - (Tax 3 2700 3300 6300 7350 5 6 TAKE HOME 1100 6600 1000 1050 1150 1200 After Tax)-(IRA Contribution 4800850 5700 Part 4- Graph the Bonus Payout (Take Home) from Part 3 The fourth worksheet (yes create a separate worksheet named Part 4- Bonus Graph for the chart) should be a simple column chart of the bonus payout amounts from Part 3: Vertical (Value) axis = take home amount in dollars. Each major line should have a dollar amount and the Horizontal (Category) axis would be the percentage. Make sure your percentages are listed. Bonus Scenario Vertical axis should have $ amounts for the listed percentages 90% 95% 105% 110% 115% 120% Percentage Possibilities The below images show the formulas used and the logic along with the final solution. The logic is as stated below Step 1 : Calculate the pre-tax bonus. As 100% bonus is 10000, for each pay-out scenario, the pre tax bonus is calculated by multiplying the payout percentage by 10000 Step 2 : Calculate the tax. The tax is calculated by multiplying the pre-tax bonus from step 1 by 30% Step 3 Calculate the after tax. This is calculated by deducting tax in step 2 from pre tax bonus in step 1 Step 4 Calculate the IRA contribution. This is calculated by multiplying the pre-tax bonus in step 1 with 10% Step 5 Calculate After Home. This is calculated by deducting IRA contribution in step 4 from after tax in step 3. Below image shows the formulas used 0.9 8 C1 10000 D1 10000 E1'10000 F1 10000 G1 10000H1 10000 1 100001 10000 K1 10000 00% C2+C3 , 10%*C2 1.05 1.15 1.2 2 Pre-Tax bonus 10000 30%).12 . 30%,-K2 2413 K2K 3 Tax (@30%) 1300%.PreTax 30% 02+D3 -10%"D2 30% E24E -10%"E2 30%).F2|--(30% --( 30% Pre Tax 4 5 6 After Tax IRA Contribution 110%.(Pre-Tax TAKE HOME Tax H2+H3 12413 |=-10%"2 | -10%"F2 -10%"G2 10%"H2 |=-10%*)2 -10%"K2 After Tax)-(IRA Contribution Below image shows the final answers 95%) 95001 100%) 10000 1 105%) 0500110001 85% 110% 115%) 12096 2 Pre-Tax bonus (Percentage) *10000 8000 150012000 Tax(@30% After Tax IRA Contribution | 1096"(Pre-Tax Bonus 3096"( PreTax Bonus Pre Tax Bonus) - (Tax 3 2700 3300 6300 7350 5 6 TAKE HOME 1100 6600 1000 1050 1150 1200 After Tax)-(IRA Contribution 4800850 5700