I posted two annual reports one is Microsoft and other one is Game Stop can i plzz know what are the similarity and difference

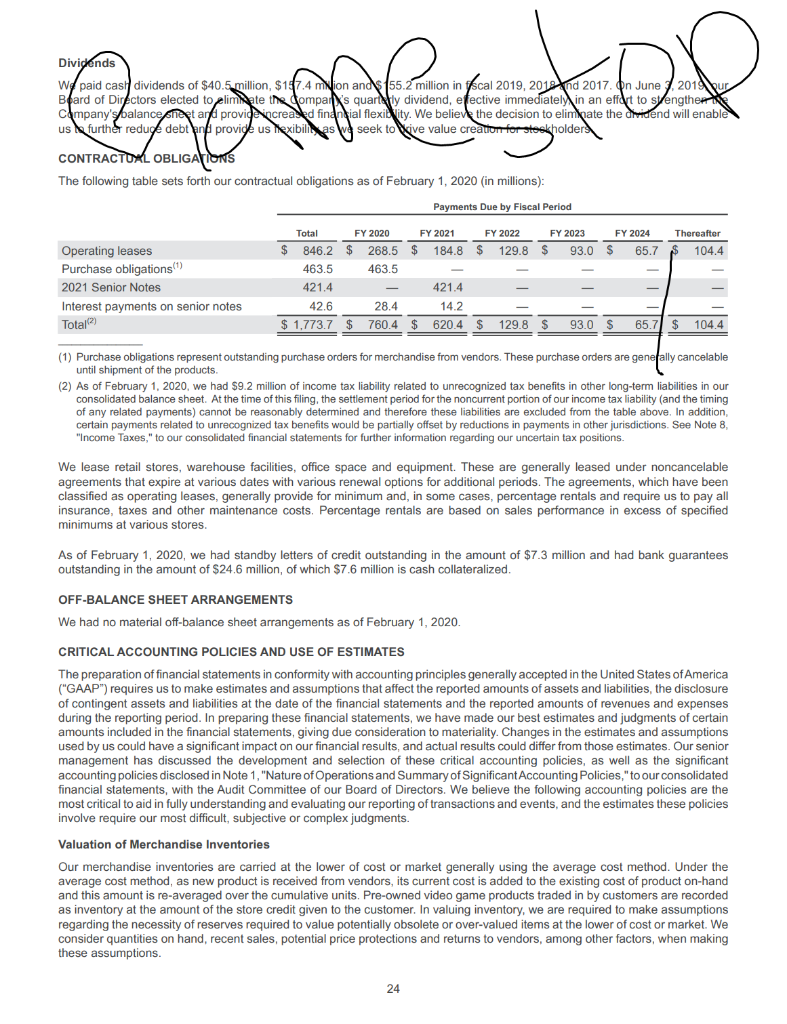

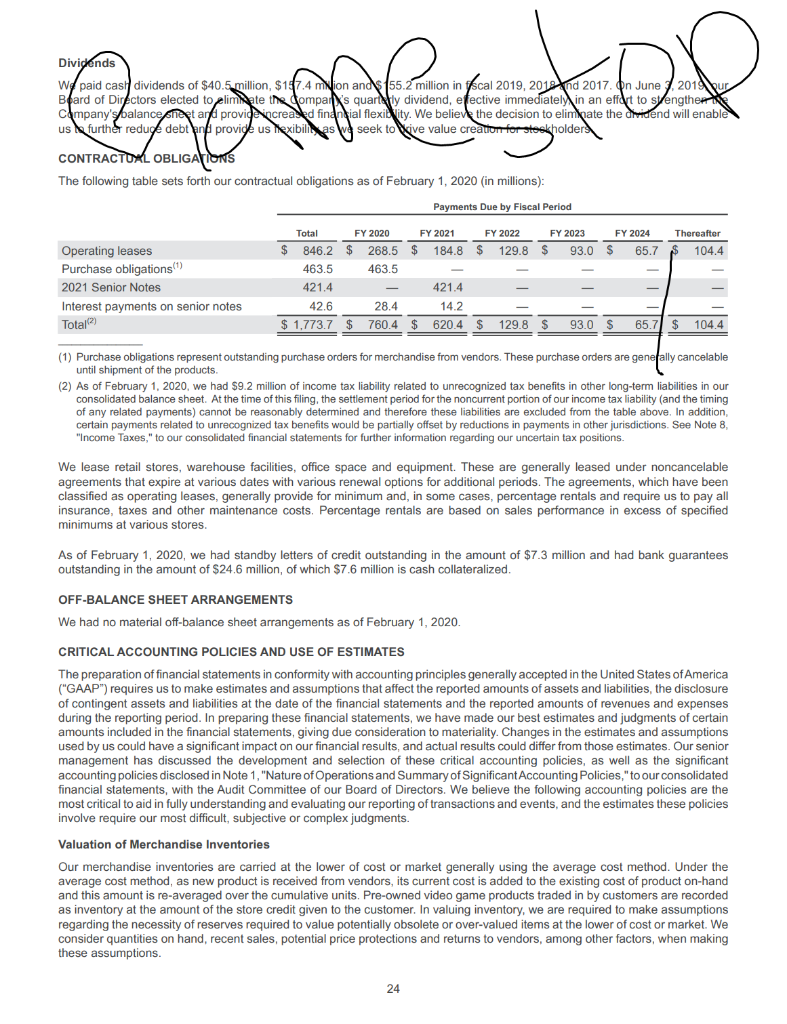

Dividends we paid cast dividends of $40.5 million, $17.4 milion and $155.2 million in scal 2019, 2012 nd 2017. on June 2016 Bpard of Directors elected to eliminate the company's quartetly dividend, efective immediately in an effort to syengther Campany's balance sheet and provide increased financial flexivity. We believe the decision to eliminate the dwidend will enable us further reduce debt and provide us lexibilitas We seek to live value creation for stokholders CONTRACTUAL OBLIGATIONS The following table sets forth our contractual obligations as of February 1, 2020 (in millions): Payments Due by Fiscal Period Thereafter 104.4 Operating leases Purchase obligations) 2021 Senior Notes Interest payments on senior notes Total) Total FY 2020 FY 2021 FY 2022 FY 2023 FY 2024 $ 846.2 $ 268.5 $ 184.8 $ 129.8 $ 93,0 $ 65.7 463,5 463.5 421,4 421.4 42.6 28.4 14.2 $ 1.7737 760.4 620.4 $ 129.8 S 93.0 S 65.7 $ 104.4 (1) Purchase obligations represent outstanding purchase orders for merchandise from vendors. These purchase orders are geneally cancelable until shipment of the products. (2) As of February 1, 2020, we had $9.2 million of income tax liability related to unrecognized tax benefits in other long-term liabilities in our consolidated balance sheet. At the time of this filing, the settlement period for the noncurrent portion of our income tax liability (and the timing of any related payments) cannot be reasonably determined and therefore these liabilities are excluded from the table above. In addition, certain payments related to unrecognized tax benefits would be partially offset by reductions in payments in other jurisdictions. See Note 8, "Income Taxes," to our consolidated financial statements for further information regarding our uncertain tax positions. We lease retail stores, warehouse facilities, office space and equipment. These are generally leased under noncancelable agreements that expire at various dates with various renewal options for additional periods. The agreements, which have been classified as operating leases, generally provide for minimum and, in some cases, percentage rentals and require us to pay all insurance, taxes and other maintenance costs. Percentage rentals are based on sales performance in excess of specified minimums at various stores. As of February 1, 2020, we had standby letters of credit outstanding in the amount of $7.3 million and had bank guarantees outstanding in the amount of $24.6 million, of which $7.6 million is cash collateralized. OFF-BALANCE SHEET ARRANGEMENTS We had no material off-balance sheet arrangements as of February 1, 2020. CRITICAL ACCOUNTING POLICIES AND USE OF ESTIMATES The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America ("GAAP") requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. In preparing these financial statements, we have made our best estimates and judgments of certain amounts included in the financial statements, giving due consideration to materiality. Changes in the estimates and assumptions used by us could have a significant impact on our financial results, and actual results could differ from those estimates. Our senior management has discussed the development and selection of these critical accounting policies, as well as the significant accounting policies disclosed in Note 1, "Nature of Operations and Summary of Significant Accounting Policies, "to our consolidated financial statements, with the Audit Committee of our Board of Directors. We believe the following accounting policies are the most critical to aid in fully understanding and evaluating our reporting of transactions and events, and the estimates these policies involve require our most difficult, subjective or complex judgments. Valuation of Merchandise Inventories Our merchandise inventories are carried at the lower of cost or market generally using the average cost method. Under the average cost method, as new product is received from vendors, its current cost is added to the existing cost of product on-hand and this amount is re-averaged over the cumulative units. Pre-owned video game products traded in by customers are recorded as inventory at the amount of the store credit given to the customer. In valuing inventory, we are required to make assumptions regarding the necessity of reserves required to value potentially obsolete or over-valued items at the lower of cost or market. We consider quantities on hand, recent sales, potential price protections and returns to vendors, among other factors, when making these assumptions. 24 Our ability to gauge these factors is dependent upon our ability to forecast customer demand and to provide a well-balanced merchandise assortment. Any inability to forecast customer demand properly could lead to increased costs associated with write- downs of inventory to reflect volumes or pricing of inventory which we believe represents the net realizable value. A 10% change in our obsolescence reserve percentage at February 1, 2020 would have affected net earnings by approximately $2.3 million in fiscal 2019. points is Customer Liabilities Our PowerUp Rewards loyalty program allows enrolled members to earn points on purchases in our stores and on some of our websites that can be redeemed for rewards and discounts. We allocate the transaction price between the product and loyalty points earned based on the relative stand-alone selling prices and expected point redemption. The portion allocated to the loyalty s initially recorded as deferred revenue and subsequently recognized as revenue upon redemption or expiration. The two primary estimates utilized to record the deferred revenue for loyalty points earned by members are the estimated retail price per point and estimated amount of points that will never be redeemed, which is a concept known in the retail industry as "breakage." Additionally, we sell gift cards to our customers in our retail stores, through our website and through selected third parties. At the point of sale, a liability is established for the value of the gift card. We recognize revenue from gift cards when the card is redeemed by the customer and recognize estimated breakage on gift cards in proportion to historical redemption patterns, regardless of the age of the unredeemed gift cards. The two primary estimates utilized to record the balance sheet liability for loyalty points earned by members are the estimated redemption rate and the estimated weighted-average retail price per point redeemed. We use historical redemption rates experienced under our loyalty program as a basis for estimating the ultimate redemption rate of points earned. The estimated retail price per point is based on the actual historical retail prices of product purchased through the redemption of loyalty points. We estimate breakage of loyalty points and unredeemed gift cards based on historical redemption rates. A weighted average retail price per point redeemed is used to estimate the value of our deferred revenue associated with loyalty points. The weighted- average retail price per point redeemed is based on our most recent actual loyalty point redemptions and is adjusted as appropriate for recent changes in redemption values, including the mix of rewards redeemed. Our estimate of the amount and timing of gift card redemptions is based primarily on historical transaction experience. We continually evaluate our methodology and assumptions based on developments in redemption patterns, retail price per point redeemed and other factors. Changes in the ultimate redemption rate and weighted average retail price per point redeemed have the effect of either increasing or decreasing the deferred revenue balance through current period revenue by an amount estimated to cover the retail value of all points previously earned but not yet redeemed by loyalty program members as of the end of the reporting period. A 10% change in our customer loyalty program redemption rate or a 10% change in our weighted average retail value per point redeemed at February 1, 2020, in each case, would have affected net earnings by approximately $2.1 million in fiscal 2019. A 10% change in our gift card breakage rate at February 1, 2020 would have affected net earnings by approximately $11.3 million in fiscal 2019. Goodwill Goodwill results from acquisitions and represents the excess purchase price over the net identifiable assets acquired. We are required to evaluate our goodwill for impairment at least annually or whenever indicators of impairment are present. During fiscal 2019, we recognized an impairment charge for our remaining goodwill in the amount of $363.9 million, all of which related to our United States segment. As of February 1, 2020, we had no remaining goodwill. See Note 7, "Goodwill and Intangible Assets" to our consolidated financial statements for additional information. In order to test goodwill for impairment, we compare a reporting unit's carrying amount to its estimated fair value. If the reporting unit's carrying value exceeds its estimated fair value, then an impairment charge is recorded in the amount of the excess. In fiscal 2019, we estimated the fair value of our United States segment by using a combination of the income approach and market approach. The income approach is based on the present value of future cash flows, which are derived from our long-term financial forecasts, and requires significant assumptions including, among others, a discount rate and a terminal value. The market approach is based on the observed ratios of enterprise value to earnings of the Company and other comparable, publicly-traded companies. Considerable management judgment is necessary to estimate the fair value of a reporting unit. The discounted cash flows analyses utilize a five- to seven-year cash flow projection with a terminal value, which are discounted using a risk-adjusted weighted- average cost of capital. The projected cash flows include numerous assumptions such as, among others, future sales trends, operating margins, store count and capital expenditures, all of which are derived from our long-term financial forecasts. The projected sales trends include estimates related to the growth rate of the digital distribution of new video game software. In addition, we corroborate the aggregate fair value of our reporting units with our market capitalization, which may impact certain assumptions in our discounted cash flows analyses. 25 Income Taxes We account for income taxes utilizing an asset and liability approach, and deferred taxes are determined based on the estimated future tax effect of differences between the financial reporting and tax bases of assets and liabilities using enacted tax rates. As a result of our operations in many foreign countries, our global tax rate is derived from a combination of applicable tax rates in the various jurisdictions in which we operate. We maintain accruals for uncertain tax positions until examination of the tax year is completed by the taxing authority, available review periods expire or additional facts and circumstances cause us to change our assessment of the appropriate accrual amount. Our liability for uncertain tax positions was $9.2 million as of February 1, 2020 Additionally, a valuation allowance is recorded against a deferred tax asset if it is not more likely than not that the asset will be realized. We assess the available positive and negative evidence to estimate whether sufficient future taxable income will be generated to permit use of the existing deferred tax assets. Several factors are considered in evaluating the realizability of our deferred tax assets, including the remaining years available for carry forward, the tax laws for the applicable jurisdictions, the future profitability of the specific business units, and tax planning strategies. We have therefore established valuation allowances in certain foreign jurisdictions where the Company has determined existing deferred tax assets are not more likely than not to be realized. Our valuation allowance increased to $112.7 million as of February 1, 2020. See Note 8, "Income Taxes" to our consolidated financial statements for further information regarding income taxes. We continue to evaluate the realizability of all deferred tax assets on a jurisdictional basis as it relates to expected future earnings. Should the Company fail to achieve its expected earnings in the coming periods, it may be necessary to establish an additional valuation allowance against some or all of its deferred tax assets in those jurisdictions not currently subject to a valuation allowance. Considerable management judgment is necessary to assess the inherent uncertainties related to the interpretations of complex tax laws, regulations and taxing authority rulings, as well as to the expiration of statutes of limitations in the jurisdictions in which we operate. We base our estimate of an annual effective tax rate at any given point in time on a calculated mix of the tax rates applicable to our operations and to estimates of the amount of income to be derived in any given jurisdiction. We file our tax returns based on our understanding of the appropriate tax rules and regulations. However, complexities in the tax rules and our operations, as well as positions taken publicly by the taxing authorities, may lead us to conclude that accruals for uncertain tax positions are required. Additionally, several factors are considered in evaluating the realizability of our deferred tax assets, including the remaining years available for carry forward, the tax laws for the applicable jurisdictions, the future profitability of the specific business units, and tax planning strategies. Our judgments and estimates concerning uncertain tax positions may change as a result of evaluation of new information, such as the outcome of tax audits or changes to or further interpretations of tax laws and regulations. Our judgments and estimates concerning realizability of deferred tax assets could change if any of the evaluation factors change. If such changes take place, there is a risk that our effective tax rate could increase or decrease in any period, impacting our net earnings. RECENT ACCOUNTING STANDARDS AND PRONOUNCEMENTS See Note 1, "Nature of Operations and Summary of Significant Accounting Policies," to our consolidated financial statements for recent accounting standards and pronouncements. ITEM 7A QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK We are exposed to market risk due to foreign currency and interest rate fluctuations, each as described more fully below. Foreign Currency Risk We use forward exchange contracts to manage currency risk primarily related to intercompany loans denominated in non-functional currencies. The forward exchange contracts are not designated as hedges and, therefore, changes in the fair values of these derivatives are recognized in earnings, thereby offsetting the current earnings effect of the re-measurement of related intercompany loans. We recognized a gain of $4.1 million and $9.6 million in selling, general and administrative expenses related to derivative instruments for the fiscal years ended February 1, 2020 and February 2, 2019, respectively. The aggregate fair value of the forward exchange contracts as of February 1, 2020 and February 2, 2019 was a net asset of $1.1 million and a net liability of $0.2 million, respectively, as measured by observable inpuls obtained from market news reporting services, such as Bloomberg, and industry-standard models that consider various assumptions, including quoted forward prices, time value, volatility factors, and contractual prices for the underlying instruments, as well as other relevant economic measures. A hypothetical strengthening or weakening of 10% in the foreign exchange rates underlying the foreign currency contracts from the market rate as of February 2020 would result in a gain of $10.2 million or a loss of $8.4 million in value of the forwards, options and swaps. 26 APPLICATION OF CRITICAL ACCOUNTING POLICIES Our consolidated financial statements and accompanying notes are prepared in accordance with U.S. GAAP. Preparing consolidated financial statements repuires management to make estimates and assumptions that axect the reported armounts of assets, liabilities, revenge and expenses. These estimates and assumptions are affected by Management's application bf accounting policies. Critical accounting policies fokus include revenue recognktion, impairment of investment securities, goodwill, research and develop fent costs, contingencies, income taxes and inventories. Revenue Recognition Revenue recognition for multiple-element arrangements requires judgment to determine if multiple elements exist, whether elements can be accounted for as separate units of accounting, and if so, the fair value for each of the elements. Judgment is also required to assess whether future releases of certain software represent new products or upgrades and enhancements to existing products. Certain volume licensing arrangements include a perpetual license for current products combined with rights to receive unspecified future versions of software products and are accounted for as subscriptions, with billings recorded as unearned revenue and recognized as revenue ratably over the coverage period. Software updates are evaluated on a case-by-case basis to determine whether they meet the definition of an upgrade, which may require revenue to be deferred and recognized when the upgrade is delivered. If it is determined that implied post-contract customer support ("PCS") is being provided, revenue from the arrangement is deferred and recognized over the implied PCS term. If updates are determined to not meet the definition of an upgrade, revenue is generally recognized as products are shipped or made available. Microsoft enters into arrangements that can include various combinations of software, services, and hardware. Where elements are delivered over different periods of time, and when allowed under U.S. GAAP, revenue is allocated to the respective elements based on their relative selling prices at the inception of the arrangement, and revenue is recognized as each element is delivered. We use a hierarchy to determine the fair value to be used for allocating revenue to elements: (i) vendor-specific objective evidence of fair value ("VSOE"), (ii) third-party evidence, and (iii) best estimate of selling price ("ESP"). For software elements, we follow the industry-specific software guidance which only allows for the use of VSOE in establishing fair value. Generally, VSOE is the price charged when the deliverable is sold separately or the price established by management for a product that is not yet sold if it is probable that the price will not change before introduction into the marketplace. ESPs are established as best estimates of what the selling prices would be if the deliverables were sold regularly on a stand-alone basis. Our process for determining ESPs requires judgment and considers multiple factors that may vary over time depending upon the unique facts and circumstances related to each deliverable. Customers purchasing a Windows 10 license will receive unspecified updates and upgrades over the life of their Windows 10 device at no additional cost. As these updates and upgrades will not be sold on a stand-alone basis, we are unable to establish VSOE. Accordingly, revenue from licenses of Windows 10 is recognized ratably over the estimated life of the related device, which ranges between two to four years. The new standard related to revenue recognition will have a material impact on our consolidated financial We review investments quarterly for indicators of other-than-temporary impairment. This determination requires significant judgment. In making this judgment, we employ a systematic methodology quarterly that considers available quantitative and qualitative evidence in evaluating potential impairment of our investments. If the cost of an investment exceeds its fair value, we evaluate, among other factors, general market conditions, credit quality of debt instrument issuers, the duration and extent to which the fair value is less than cost, and for equity securities, our intent and ability to hold, or plans to sell, the investment. For fixed-income securities, we also evaluate whether we have plans to sell the security or it is more likely than not that we will be required to sell the security before recovery. We also consider specific adverse conditions related to the financial health of and business outlook for the investee, including industry and sector performance, changes in technology, and operational and financing cash flow factors. Once a decline in fair value is determined to be other-than-temporary, an impairment charge is recorded to other income (expense), net and a new cost basis in the investment is established. If market, industry, and/or investee conditions deteriorate, we may incur future impairments. Goodwill We allocate goodwill to reporting units based on the reporting unit expected to benefit from the business combination. We evaluate our reporting units on an annual basis and, if necessary, reassign goodwill using a relative fair value allocation approach. Goodwill is tested for impairment at the reporting unit level (operating segment or one level below an operating segment) on an annual basis (May 1 for us) and between annual tests if an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying value. These events or circumstances could include a significant change in the business climate, legal factors, operating performance indicators, competition, or sale or disposition of a significant portion of a reporting unit. Application of the goodwill impairment test requires judgment, including the identification of reporting units, assignment of assets and liabilities to reporting units, assignment of goodwill to reporting units, and determination of the fair value of each reporting unit. The fair value of each reporting unit is estimated primarily through the use of a discounted cash flow methodology. This analysis requires significant judgments, including estimation of future cash flows, which is dependent on internal forecasts, estimation of the long-term rate of growth for our business, estimation of the useful life over which cash flows will occur, and determination of our weighted average cost of capital. The estimates used to calculate the fair value of a reporting unit change from year to year based on operating results, market conditions, and other factors. Changes in these estimates and assumptions could materially affect the determination of fair value and goodwill impairment for each reporting unit. Research and Development Costs Costs incurred internally in researching and developing a computer software product are charged to expense until technological feasibility has been established for the product. Once technological feasibility is established, all software costs are capitalized until the product is available for general release to customers. Judgment is required in determining when technological feasibility of a product is established. We have determined that technological feasibility for our software products is reached after all high-risk development issues have been resolved through coding and testing. Generally, this occurs shortly before the products are released to production. The amortization of these costs is included in cost of revenue over the estimated life of the products. Legal and Other Contingencies The outcomes of legal proceedings and claims brought against us are subject to significant uncertainty. An estimated loss from a loss contingency such as a legal proceeding or claim is accrued by a charge to income if it is probable that an asset has been impaired or a liability has been incurred and the amount of the loss can be reasonably estimated. In determining whether a loss should be accrued we evaluate, among other factors, the degree of probability of an unfavorable outcome and the ability to make a We have determined that technological feasibility for our software products is reached after all high-risk development issues have been resolved through coding and testing. Generally, this occurs shortly before the products are released to production. The amortization of these costs is included in cost of revenue over the estimated life of the products. Legal and Other Contingencies The outcomes of legal proceedings and claims brought against us are subject to significant uncertainty. An estimated loss from a loss contingency such as a legal proceeding or claim is accrued by a charge to income if it is probable that an asset has been impaired or a liability has been incurred and the amount of the loss can be reasonably estimated. In determining whether a loss should be accrued we evaluate, among other factors, the degree of probability of an unfavorable outcome and the ability to make a reasonable estimate of the amount of loss. Changes in these factors could materially impact our consolidated financial statements. Income Taxes The objectives of accounting for income taxes are to recognize the amount of taxes payable or refundable for the current year and deferred tax liabilities and assets for the future tax consequences of events that have been recognized in an entity's financial statements or tax returns. We recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position are measured based on the largest benefit that has a greater than 50% likelihood of being realized upon ultimate settlement. Accounting literature also provides guidance on derecognition of income tax assets and liabilities, classification of deferred income tax assets and liabilities, accounting for interest and penalties associated with tax positions, and income tax disclosures. Judgment is required in assessing the future tax consequences of events that have been recognized on our consolidated financial statements or tax returns. Variations in the actual outcome of these future tax consequences could materially impact our consolidated financial statements. Inventories Inventories are stated at average cost, subject to the lower of cost or market. Cost includes materials, labor, and manufacturing overhead related to the purchase and production of inventories. We regularly review inventory quantities on hand, future purchase commitments with our suppliers, and the estimated utility of our inventory. These reviews include analysis of demand forecasts, product life cycle status, product development plans, current sales levels, pricing strategy, and component cost trends. If our review indicates a reduction in utility below carrying value, we reduce our inventory to a new cost basis through a charge to cost of revenue. Dividends we paid cast dividends of $40.5 million, $17.4 milion and $155.2 million in scal 2019, 2012 nd 2017. on June 2016 Bpard of Directors elected to eliminate the company's quartetly dividend, efective immediately in an effort to syengther Campany's balance sheet and provide increased financial flexivity. We believe the decision to eliminate the dwidend will enable us further reduce debt and provide us lexibilitas We seek to live value creation for stokholders CONTRACTUAL OBLIGATIONS The following table sets forth our contractual obligations as of February 1, 2020 (in millions): Payments Due by Fiscal Period Thereafter 104.4 Operating leases Purchase obligations) 2021 Senior Notes Interest payments on senior notes Total) Total FY 2020 FY 2021 FY 2022 FY 2023 FY 2024 $ 846.2 $ 268.5 $ 184.8 $ 129.8 $ 93,0 $ 65.7 463,5 463.5 421,4 421.4 42.6 28.4 14.2 $ 1.7737 760.4 620.4 $ 129.8 S 93.0 S 65.7 $ 104.4 (1) Purchase obligations represent outstanding purchase orders for merchandise from vendors. These purchase orders are geneally cancelable until shipment of the products. (2) As of February 1, 2020, we had $9.2 million of income tax liability related to unrecognized tax benefits in other long-term liabilities in our consolidated balance sheet. At the time of this filing, the settlement period for the noncurrent portion of our income tax liability (and the timing of any related payments) cannot be reasonably determined and therefore these liabilities are excluded from the table above. In addition, certain payments related to unrecognized tax benefits would be partially offset by reductions in payments in other jurisdictions. See Note 8, "Income Taxes," to our consolidated financial statements for further information regarding our uncertain tax positions. We lease retail stores, warehouse facilities, office space and equipment. These are generally leased under noncancelable agreements that expire at various dates with various renewal options for additional periods. The agreements, which have been classified as operating leases, generally provide for minimum and, in some cases, percentage rentals and require us to pay all insurance, taxes and other maintenance costs. Percentage rentals are based on sales performance in excess of specified minimums at various stores. As of February 1, 2020, we had standby letters of credit outstanding in the amount of $7.3 million and had bank guarantees outstanding in the amount of $24.6 million, of which $7.6 million is cash collateralized. OFF-BALANCE SHEET ARRANGEMENTS We had no material off-balance sheet arrangements as of February 1, 2020. CRITICAL ACCOUNTING POLICIES AND USE OF ESTIMATES The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America ("GAAP") requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. In preparing these financial statements, we have made our best estimates and judgments of certain amounts included in the financial statements, giving due consideration to materiality. Changes in the estimates and assumptions used by us could have a significant impact on our financial results, and actual results could differ from those estimates. Our senior management has discussed the development and selection of these critical accounting policies, as well as the significant accounting policies disclosed in Note 1, "Nature of Operations and Summary of Significant Accounting Policies, "to our consolidated financial statements, with the Audit Committee of our Board of Directors. We believe the following accounting policies are the most critical to aid in fully understanding and evaluating our reporting of transactions and events, and the estimates these policies involve require our most difficult, subjective or complex judgments. Valuation of Merchandise Inventories Our merchandise inventories are carried at the lower of cost or market generally using the average cost method. Under the average cost method, as new product is received from vendors, its current cost is added to the existing cost of product on-hand and this amount is re-averaged over the cumulative units. Pre-owned video game products traded in by customers are recorded as inventory at the amount of the store credit given to the customer. In valuing inventory, we are required to make assumptions regarding the necessity of reserves required to value potentially obsolete or over-valued items at the lower of cost or market. We consider quantities on hand, recent sales, potential price protections and returns to vendors, among other factors, when making these assumptions. 24 Our ability to gauge these factors is dependent upon our ability to forecast customer demand and to provide a well-balanced merchandise assortment. Any inability to forecast customer demand properly could lead to increased costs associated with write- downs of inventory to reflect volumes or pricing of inventory which we believe represents the net realizable value. A 10% change in our obsolescence reserve percentage at February 1, 2020 would have affected net earnings by approximately $2.3 million in fiscal 2019. points is Customer Liabilities Our PowerUp Rewards loyalty program allows enrolled members to earn points on purchases in our stores and on some of our websites that can be redeemed for rewards and discounts. We allocate the transaction price between the product and loyalty points earned based on the relative stand-alone selling prices and expected point redemption. The portion allocated to the loyalty s initially recorded as deferred revenue and subsequently recognized as revenue upon redemption or expiration. The two primary estimates utilized to record the deferred revenue for loyalty points earned by members are the estimated retail price per point and estimated amount of points that will never be redeemed, which is a concept known in the retail industry as "breakage." Additionally, we sell gift cards to our customers in our retail stores, through our website and through selected third parties. At the point of sale, a liability is established for the value of the gift card. We recognize revenue from gift cards when the card is redeemed by the customer and recognize estimated breakage on gift cards in proportion to historical redemption patterns, regardless of the age of the unredeemed gift cards. The two primary estimates utilized to record the balance sheet liability for loyalty points earned by members are the estimated redemption rate and the estimated weighted-average retail price per point redeemed. We use historical redemption rates experienced under our loyalty program as a basis for estimating the ultimate redemption rate of points earned. The estimated retail price per point is based on the actual historical retail prices of product purchased through the redemption of loyalty points. We estimate breakage of loyalty points and unredeemed gift cards based on historical redemption rates. A weighted average retail price per point redeemed is used to estimate the value of our deferred revenue associated with loyalty points. The weighted- average retail price per point redeemed is based on our most recent actual loyalty point redemptions and is adjusted as appropriate for recent changes in redemption values, including the mix of rewards redeemed. Our estimate of the amount and timing of gift card redemptions is based primarily on historical transaction experience. We continually evaluate our methodology and assumptions based on developments in redemption patterns, retail price per point redeemed and other factors. Changes in the ultimate redemption rate and weighted average retail price per point redeemed have the effect of either increasing or decreasing the deferred revenue balance through current period revenue by an amount estimated to cover the retail value of all points previously earned but not yet redeemed by loyalty program members as of the end of the reporting period. A 10% change in our customer loyalty program redemption rate or a 10% change in our weighted average retail value per point redeemed at February 1, 2020, in each case, would have affected net earnings by approximately $2.1 million in fiscal 2019. A 10% change in our gift card breakage rate at February 1, 2020 would have affected net earnings by approximately $11.3 million in fiscal 2019. Goodwill Goodwill results from acquisitions and represents the excess purchase price over the net identifiable assets acquired. We are required to evaluate our goodwill for impairment at least annually or whenever indicators of impairment are present. During fiscal 2019, we recognized an impairment charge for our remaining goodwill in the amount of $363.9 million, all of which related to our United States segment. As of February 1, 2020, we had no remaining goodwill. See Note 7, "Goodwill and Intangible Assets" to our consolidated financial statements for additional information. In order to test goodwill for impairment, we compare a reporting unit's carrying amount to its estimated fair value. If the reporting unit's carrying value exceeds its estimated fair value, then an impairment charge is recorded in the amount of the excess. In fiscal 2019, we estimated the fair value of our United States segment by using a combination of the income approach and market approach. The income approach is based on the present value of future cash flows, which are derived from our long-term financial forecasts, and requires significant assumptions including, among others, a discount rate and a terminal value. The market approach is based on the observed ratios of enterprise value to earnings of the Company and other comparable, publicly-traded companies. Considerable management judgment is necessary to estimate the fair value of a reporting unit. The discounted cash flows analyses utilize a five- to seven-year cash flow projection with a terminal value, which are discounted using a risk-adjusted weighted- average cost of capital. The projected cash flows include numerous assumptions such as, among others, future sales trends, operating margins, store count and capital expenditures, all of which are derived from our long-term financial forecasts. The projected sales trends include estimates related to the growth rate of the digital distribution of new video game software. In addition, we corroborate the aggregate fair value of our reporting units with our market capitalization, which may impact certain assumptions in our discounted cash flows analyses. 25 Income Taxes We account for income taxes utilizing an asset and liability approach, and deferred taxes are determined based on the estimated future tax effect of differences between the financial reporting and tax bases of assets and liabilities using enacted tax rates. As a result of our operations in many foreign countries, our global tax rate is derived from a combination of applicable tax rates in the various jurisdictions in which we operate. We maintain accruals for uncertain tax positions until examination of the tax year is completed by the taxing authority, available review periods expire or additional facts and circumstances cause us to change our assessment of the appropriate accrual amount. Our liability for uncertain tax positions was $9.2 million as of February 1, 2020 Additionally, a valuation allowance is recorded against a deferred tax asset if it is not more likely than not that the asset will be realized. We assess the available positive and negative evidence to estimate whether sufficient future taxable income will be generated to permit use of the existing deferred tax assets. Several factors are considered in evaluating the realizability of our deferred tax assets, including the remaining years available for carry forward, the tax laws for the applicable jurisdictions, the future profitability of the specific business units, and tax planning strategies. We have therefore established valuation allowances in certain foreign jurisdictions where the Company has determined existing deferred tax assets are not more likely than not to be realized. Our valuation allowance increased to $112.7 million as of February 1, 2020. See Note 8, "Income Taxes" to our consolidated financial statements for further information regarding income taxes. We continue to evaluate the realizability of all deferred tax assets on a jurisdictional basis as it relates to expected future earnings. Should the Company fail to achieve its expected earnings in the coming periods, it may be necessary to establish an additional valuation allowance against some or all of its deferred tax assets in those jurisdictions not currently subject to a valuation allowance. Considerable management judgment is necessary to assess the inherent uncertainties related to the interpretations of complex tax laws, regulations and taxing authority rulings, as well as to the expiration of statutes of limitations in the jurisdictions in which we operate. We base our estimate of an annual effective tax rate at any given point in time on a calculated mix of the tax rates applicable to our operations and to estimates of the amount of income to be derived in any given jurisdiction. We file our tax returns based on our understanding of the appropriate tax rules and regulations. However, complexities in the tax rules and our operations, as well as positions taken publicly by the taxing authorities, may lead us to conclude that accruals for uncertain tax positions are required. Additionally, several factors are considered in evaluating the realizability of our deferred tax assets, including the remaining years available for carry forward, the tax laws for the applicable jurisdictions, the future profitability of the specific business units, and tax planning strategies. Our judgments and estimates concerning uncertain tax positions may change as a result of evaluation of new information, such as the outcome of tax audits or changes to or further interpretations of tax laws and regulations. Our judgments and estimates concerning realizability of deferred tax assets could change if any of the evaluation factors change. If such changes take place, there is a risk that our effective tax rate could increase or decrease in any period, impacting our net earnings. RECENT ACCOUNTING STANDARDS AND PRONOUNCEMENTS See Note 1, "Nature of Operations and Summary of Significant Accounting Policies," to our consolidated financial statements for recent accounting standards and pronouncements. ITEM 7A QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK We are exposed to market risk due to foreign currency and interest rate fluctuations, each as described more fully below. Foreign Currency Risk We use forward exchange contracts to manage currency risk primarily related to intercompany loans denominated in non-functional currencies. The forward exchange contracts are not designated as hedges and, therefore, changes in the fair values of these derivatives are recognized in earnings, thereby offsetting the current earnings effect of the re-measurement of related intercompany loans. We recognized a gain of $4.1 million and $9.6 million in selling, general and administrative expenses related to derivative instruments for the fiscal years ended February 1, 2020 and February 2, 2019, respectively. The aggregate fair value of the forward exchange contracts as of February 1, 2020 and February 2, 2019 was a net asset of $1.1 million and a net liability of $0.2 million, respectively, as measured by observable inpuls obtained from market news reporting services, such as Bloomberg, and industry-standard models that consider various assumptions, including quoted forward prices, time value, volatility factors, and contractual prices for the underlying instruments, as well as other relevant economic measures. A hypothetical strengthening or weakening of 10% in the foreign exchange rates underlying the foreign currency contracts from the market rate as of February 2020 would result in a gain of $10.2 million or a loss of $8.4 million in value of the forwards, options and swaps. 26 APPLICATION OF CRITICAL ACCOUNTING POLICIES Our consolidated financial statements and accompanying notes are prepared in accordance with U.S. GAAP. Preparing consolidated financial statements repuires management to make estimates and assumptions that axect the reported armounts of assets, liabilities, revenge and expenses. These estimates and assumptions are affected by Management's application bf accounting policies. Critical accounting policies fokus include revenue recognktion, impairment of investment securities, goodwill, research and develop fent costs, contingencies, income taxes and inventories. Revenue Recognition Revenue recognition for multiple-element arrangements requires judgment to determine if multiple elements exist, whether elements can be accounted for as separate units of accounting, and if so, the fair value for each of the elements. Judgment is also required to assess whether future releases of certain software represent new products or upgrades and enhancements to existing products. Certain volume licensing arrangements include a perpetual license for current products combined with rights to receive unspecified future versions of software products and are accounted for as subscriptions, with billings recorded as unearned revenue and recognized as revenue ratably over the coverage period. Software updates are evaluated on a case-by-case basis to determine whether they meet the definition of an upgrade, which may require revenue to be deferred and recognized when the upgrade is delivered. If it is determined that implied post-contract customer support ("PCS") is being provided, revenue from the arrangement is deferred and recognized over the implied PCS term. If updates are determined to not meet the definition of an upgrade, revenue is generally recognized as products are shipped or made available. Microsoft enters into arrangements that can include various combinations of software, services, and hardware. Where elements are delivered over different periods of time, and when allowed under U.S. GAAP, revenue is allocated to the respective elements based on their relative selling prices at the inception of the arrangement, and revenue is recognized as each element is delivered. We use a hierarchy to determine the fair value to be used for allocating revenue to elements: (i) vendor-specific objective evidence of fair value ("VSOE"), (ii) third-party evidence, and (iii) best estimate of selling price ("ESP"). For software elements, we follow the industry-specific software guidance which only allows for the use of VSOE in establishing fair value. Generally, VSOE is the price charged when the deliverable is sold separately or the price established by management for a product that is not yet sold if it is probable that the price will not change before introduction into the marketplace. ESPs are established as best estimates of what the selling prices would be if the deliverables were sold regularly on a stand-alone basis. Our process for determining ESPs requires judgment and considers multiple factors that may vary over time depending upon the unique facts and circumstances related to each deliverable. Customers purchasing a Windows 10 license will receive unspecified updates and upgrades over the life of their Windows 10 device at no additional cost. As these updates and upgrades will not be sold on a stand-alone basis, we are unable to establish VSOE. Accordingly, revenue from licenses of Windows 10 is recognized ratably over the estimated life of the related device, which ranges between two to four years. The new standard related to revenue recognition will have a material impact on our consolidated financial We review investments quarterly for indicators of other-than-temporary impairment. This determination requires significant judgment. In making this judgment, we employ a systematic methodology quarterly that considers available quantitative and qualitative evidence in evaluating potential impairment of our investments. If the cost of an investment exceeds its fair value, we evaluate, among other factors, general market conditions, credit quality of debt instrument issuers, the duration and extent to which the fair value is less than cost, and for equity securities, our intent and ability to hold, or plans to sell, the investment. For fixed-income securities, we also evaluate whether we have plans to sell the security or it is more likely than not that we will be required to sell the security before recovery. We also consider specific adverse conditions related to the financial health of and business outlook for the investee, including industry and sector performance, changes in technology, and operational and financing cash flow factors. Once a decline in fair value is determined to be other-than-temporary, an impairment charge is recorded to other income (expense), net and a new cost basis in the investment is established. If market, industry, and/or investee conditions deteriorate, we may incur future impairments. Goodwill We allocate goodwill to reporting units based on the reporting unit expected to benefit from the business combination. We evaluate our reporting units on an annual basis and, if necessary, reassign goodwill using a relative fair value allocation approach. Goodwill is tested for impairment at the reporting unit level (operating segment or one level below an operating segment) on an annual basis (May 1 for us) and between annual tests if an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying value. These events or circumstances could include a significant change in the business climate, legal factors, operating performance indicators, competition, or sale or disposition of a significant portion of a reporting unit. Application of the goodwill impairment test requires judgment, including the identification of reporting units, assignment of assets and liabilities to reporting units, assignment of goodwill to reporting units, and determination of the fair value of each reporting unit. The fair value of each reporting unit is estimated primarily through the use of a discounted cash flow methodology. This analysis requires significant judgments, including estimation of future cash flows, which is dependent on internal forecasts, estimation of the long-term rate of growth for our business, estimation of the useful life over which cash flows will occur, and determination of our weighted average cost of capital. The estimates used to calculate the fair value of a reporting unit change from year to year based on operating results, market conditions, and other factors. Changes in these estimates and assumptions could materially affect the determination of fair value and goodwill impairment for each reporting unit. Research and Development Costs Costs incurred internally in researching and developing a computer software product are charged to expense until technological feasibility has been established for the product. Once technological feasibility is established, all software costs are capitalized until the product is available for general release to customers. Judgment is required in determining when technological feasibility of a product is established. We have determined that technological feasibility for our software products is reached after all high-risk development issues have been resolved through coding and testing. Generally, this occurs shortly before the products are released to production. The amortization of these costs is included in cost of revenue over the estimated life of the products. Legal and Other Contingencies The outcomes of legal proceedings and claims brought against us are subject to significant uncertainty. An estimated loss from a loss contingency such as a legal proceeding or claim is accrued by a charge to income if it is probable that an asset has been impaired or a liability has been incurred and the amount of the loss can be reasonably estimated. In determining whether a loss should be accrued we evaluate, among other factors, the degree of probability of an unfavorable outcome and the ability to make a We have determined that technological feasibility for our software products is reached after all high-risk development issues have been resolved through coding and testing. Generally, this occurs shortly before the products are released to production. The amortization of these costs is included in cost of revenue over the estimated life of the products. Legal and Other Contingencies The outcomes of legal proceedings and claims brought against us are subject to significant uncertainty. An estimated loss from a loss contingency such as a legal proceeding or claim is accrued by a charge to income if it is probable that an asset has been impaired or a liability has been incurred and the amount of the loss can be reasonably estimated. In determining whether a loss should be accrued we evaluate, among other factors, the degree of probability of an unfavorable outcome and the ability to make a reasonable estimate of the amount of loss. Changes in these factors could materially impact our consolidated financial statements. Income Taxes The objectives of accounting for income taxes are to recognize the amount of taxes payable or refundable for the current year and deferred tax liabilities and assets for the future tax consequences of events that have been recognized in an entity's financial statements or tax returns. We recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position are measured based on the largest benefit that has a greater than 50% likelihood of being realized upon ultimate settlement. Accounting literature also provides guidance on derecognition of income tax assets and liabilities, classification of deferred income tax assets and liabilities, accounting for interest and penalties associated with tax positions, and income tax disclosures. Judgment is required in assessing the future tax consequences of events that have been recognized on our consolidated financial statements or tax returns. Variations in the actual outcome of these future tax consequences could materially impact our consolidated financial statements. Inventories Inventories are stated at average cost, subject to the lower of cost or market. Cost includes materials, labor, and manufacturing overhead related to the purchase and production of inventories. We regularly review inventory quantities on hand, future purchase commitments with our suppliers, and the estimated utility of our inventory. These reviews include analysis of demand forecasts, product life cycle status, product development plans, current sales levels, pricing strategy, and component cost trends. If our review indicates a reduction in utility below carrying value, we reduce our inventory to a new cost basis through a charge to cost of revenue