Answered step by step

Verified Expert Solution

Question

1 Approved Answer

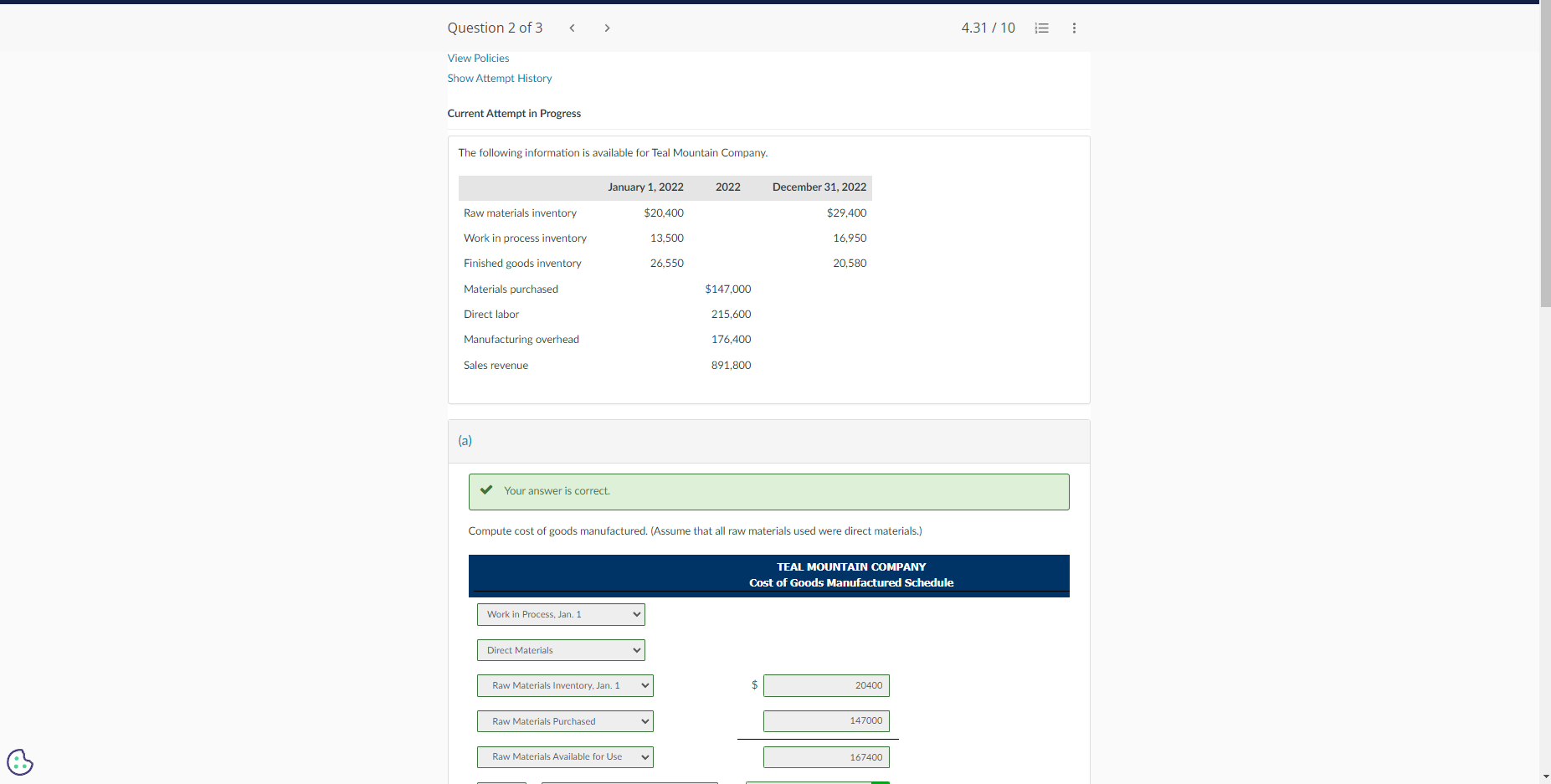

I previously asked this question and was given the incorrect result Current Attempt in Progress The following information is available for Teal Mountain Company. (a)

I previously asked this question and was given the incorrect result

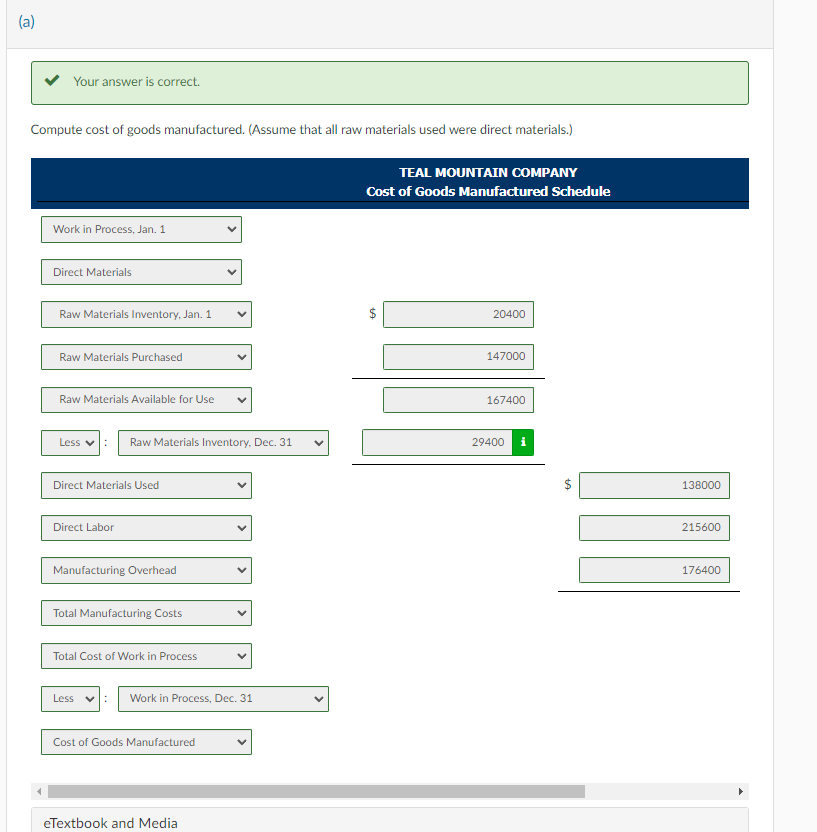

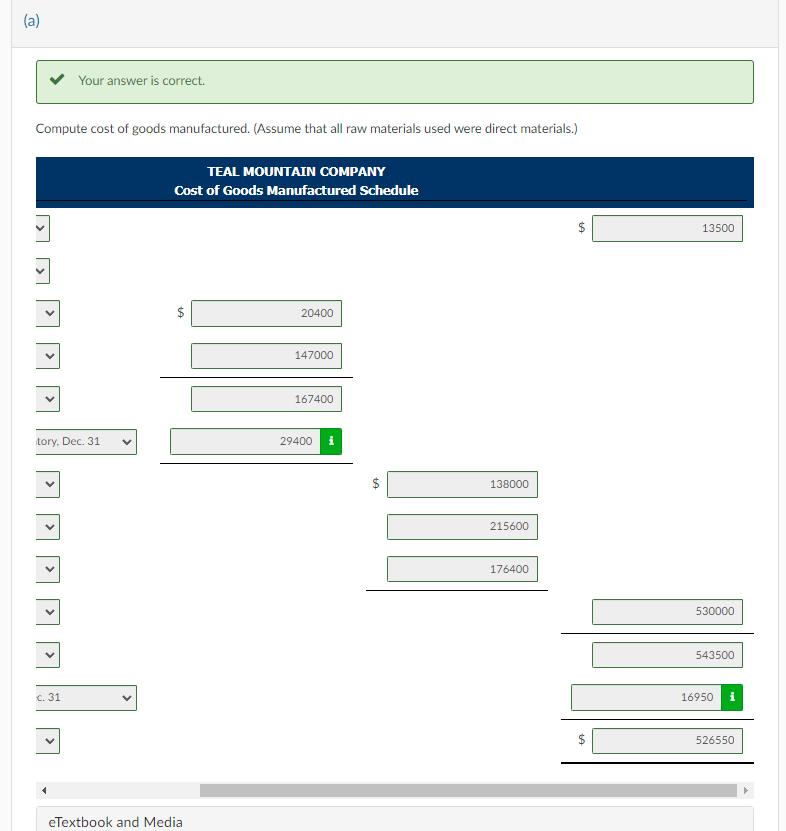

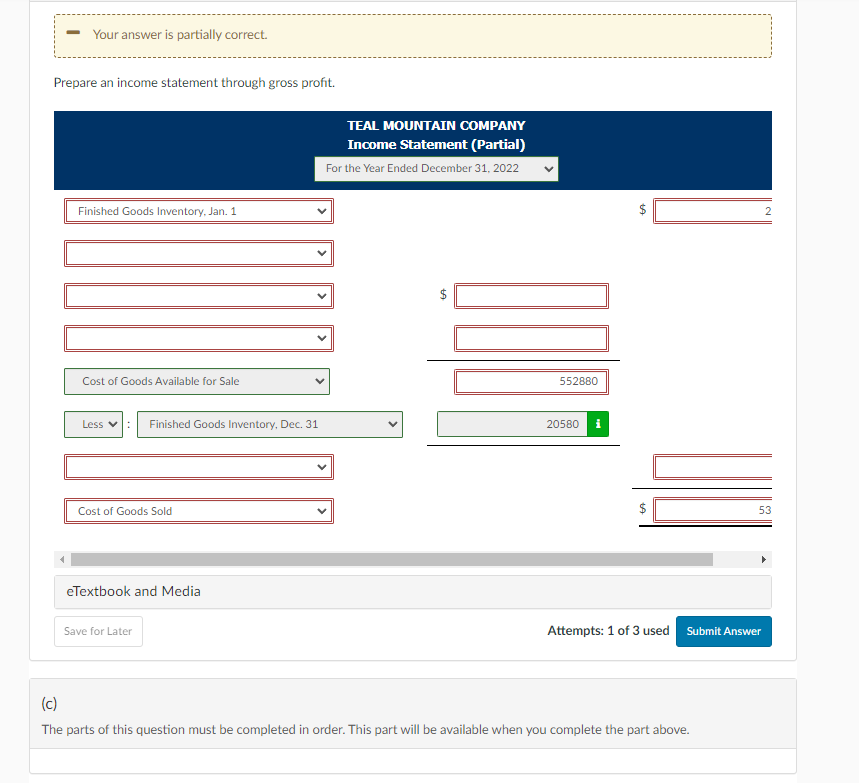

Current Attempt in Progress The following information is available for Teal Mountain Company. (a) Your answer is correct. Compute cost of goods manufactured. (Assume that all raw materials used were direct materials.) (a) Your answer is correct. Compute cost of goods manufactured. (Assume that all raw materials used were direct materials.) TEAL MOUNTAIN COMPANY Cost of Goods Manufactured Schedule Work in Process, Jan. 1 Direct Materials Raw Materials Inventory, Jan. 1 Raw Materials Purchased Raw Materials Available for Use Less : Raw Materials Inventory, Dec. 31 Direct Materials Used Direct Labor Manufacturing Overhead Total Manufacturing Costs Total Cost of Work in Process Less : Work in Process, Dec. 31 Cost of Goods Manufactured 147000 215600 176400 eTextbook and Media (a) Your answer is correct. Compute cost of goods manufactured. (Assume that all raw materials used were direct materials.) TEAL MOUNTAIN COMPANY Cost of Goods Manufactured Schedule $13500 $20400 c. 31 eTextbook and Media Your answer is partially correct. Prepare an income statement through gross profit. TEAL MOUNTAIN COMPANY Income Statement (Partial) For the Year Ended December 31, 2022 Finished Goods Inventory, Jan. 1 Cost of Goods Available for Sale Cost of Goods Sold $ $ eTextbook and Media Save for Later Attempts: 1 of 3 used Submit Answer (c) The parts of this question must be completed in order. This part will be available when you complete the part above. Current Attempt in Progress The following information is available for Teal Mountain Company. (a) Your answer is correct. Compute cost of goods manufactured. (Assume that all raw materials used were direct materials.) (a) Your answer is correct. Compute cost of goods manufactured. (Assume that all raw materials used were direct materials.) TEAL MOUNTAIN COMPANY Cost of Goods Manufactured Schedule Work in Process, Jan. 1 Direct Materials Raw Materials Inventory, Jan. 1 Raw Materials Purchased Raw Materials Available for Use Less : Raw Materials Inventory, Dec. 31 Direct Materials Used Direct Labor Manufacturing Overhead Total Manufacturing Costs Total Cost of Work in Process Less : Work in Process, Dec. 31 Cost of Goods Manufactured 147000 215600 176400 eTextbook and Media (a) Your answer is correct. Compute cost of goods manufactured. (Assume that all raw materials used were direct materials.) TEAL MOUNTAIN COMPANY Cost of Goods Manufactured Schedule $13500 $20400 c. 31 eTextbook and Media Your answer is partially correct. Prepare an income statement through gross profit. TEAL MOUNTAIN COMPANY Income Statement (Partial) For the Year Ended December 31, 2022 Finished Goods Inventory, Jan. 1 Cost of Goods Available for Sale Cost of Goods Sold $ $ eTextbook and Media Save for Later Attempts: 1 of 3 used Submit Answer (c) The parts of this question must be completed in order. This part will be available when you complete the part aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started