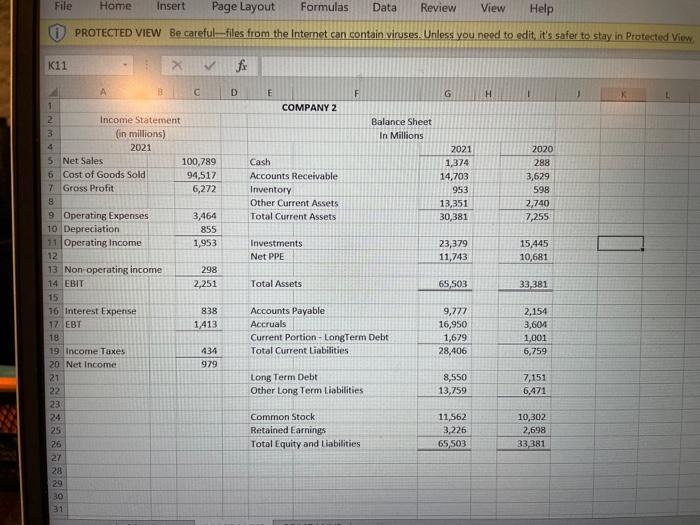

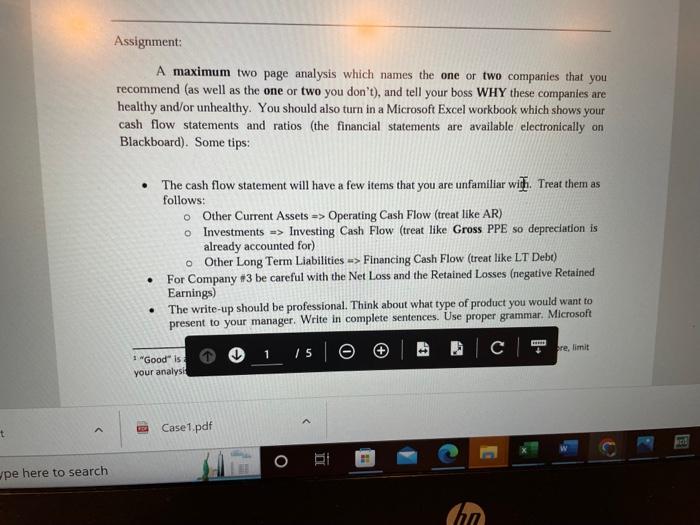

(i) PROTECTED VIEW Be careful-files from the Intemet can contain viruses. Unless you need to edit, it's safer to stay in Protected View A maximum two page analysis which names the one or two companies that you recommend (as well as the one or two you don't), and tell your boss WHY these companies are healthy and/or unhealthy. You should also turn in a Microsoft Excel workbook which shows your cash flow statements and ratios (the financial statements are available electronically on Blackboard). Some tips: - The cash flow statement will have a few items that you are unfamiliar wh. Treat them as follows: - Other Current Assets Operating Cash Flow (treat like AR) - Investments Investing Cash Flow (treat like Gross PPE so depreciation is already accounted for) - Other Long Term Liabilities => Financing Cash Flow (treat like LT Debt) - For Company #3 be careful with the Net Loss and the Retained Losses (negative Retained Earnings) - The write-up should be professional. Think about what type of product you would want to present to your manager. Write in complete sentences. Use proper grammar. Microsoft (i) PROTECTED VIEW Be careful-files from the Intemet can contain viruses. Unless you need to edit, it's safer to stay in Protected View A maximum two page analysis which names the one or two companies that you recommend (as well as the one or two you don't), and tell your boss WHY these companies are healthy and/or unhealthy. You should also turn in a Microsoft Excel workbook which shows your cash flow statements and ratios (the financial statements are available electronically on Blackboard). Some tips: - The cash flow statement will have a few items that you are unfamiliar wh. Treat them as follows: - Other Current Assets Operating Cash Flow (treat like AR) - Investments Investing Cash Flow (treat like Gross PPE so depreciation is already accounted for) - Other Long Term Liabilities => Financing Cash Flow (treat like LT Debt) - For Company #3 be careful with the Net Loss and the Retained Losses (negative Retained Earnings) - The write-up should be professional. Think about what type of product you would want to present to your manager. Write in complete sentences. Use proper grammar. Microsoft