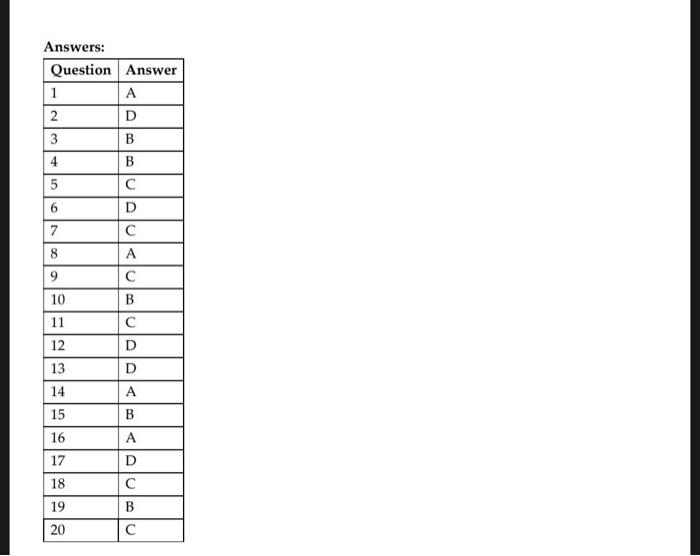

i provide the right answers in one of the pictures all I need is an explanation why it correct and why other answer choices are wrong.

note: don't do #7,8,9,10,13, and 17

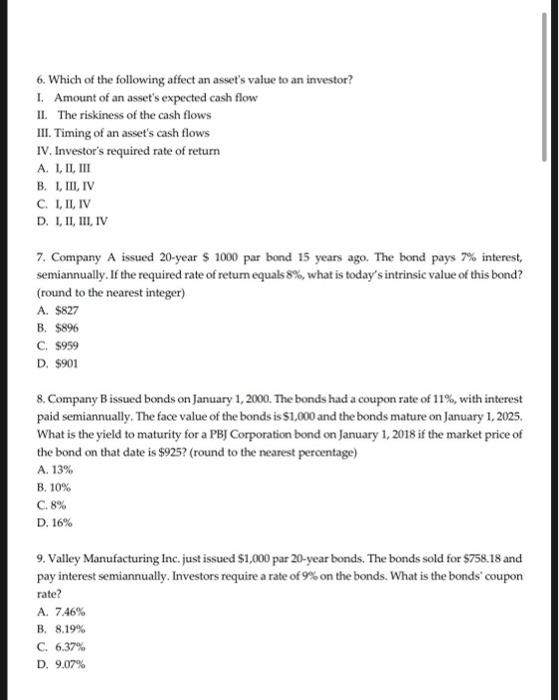

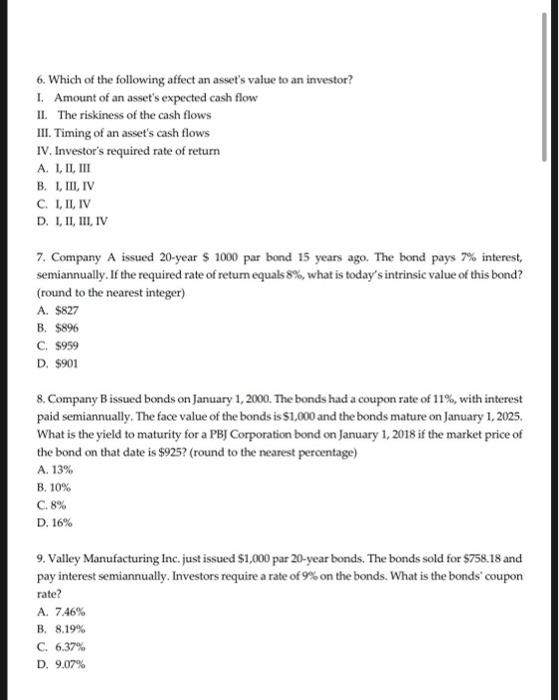

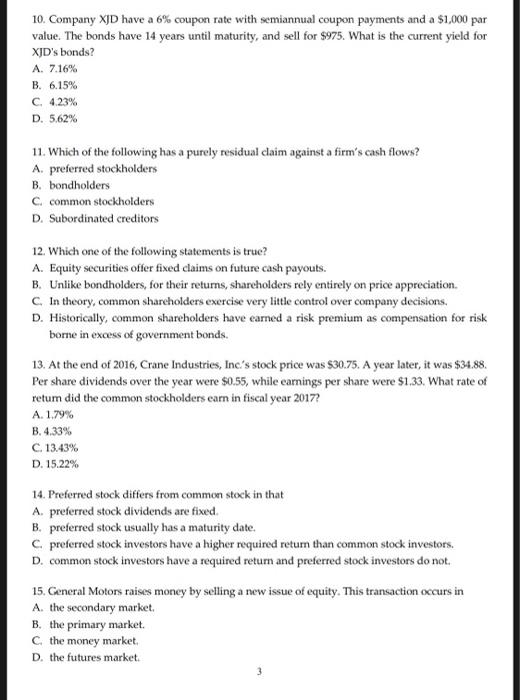

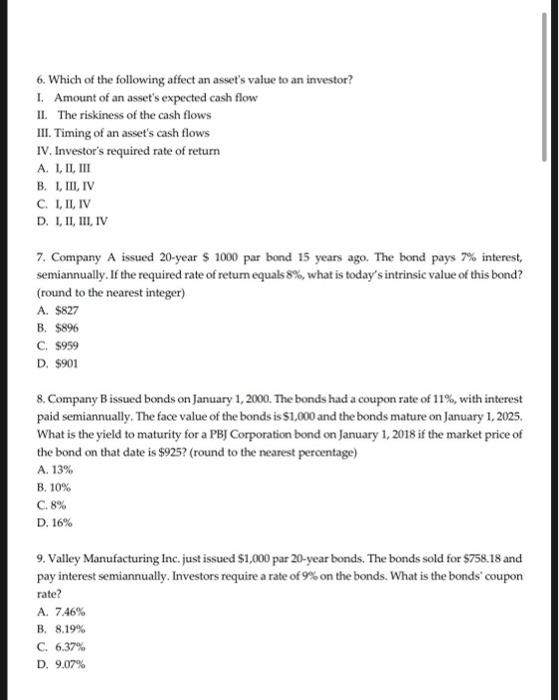

6. Which of the following affect an asset's value to an investor? 1. Amount of an asset's expected cash flow II. The riskiness of the cash flows III. Timing of an asset's cash flows IV. Investor's required rate of return A. I, II, III B. I, II, IV C. I, ILIV D. I, II, III, IV 7. Company A issued 20-year $ 1000 par bond 15 years ago. The bond pays 7% interest, semiannually. If the required rate of retum equals 8%, what is today's intrinsic value of this bond? (round to the nearest integer) A. $827 B. $896 C. $959 D. $901 8. Company B issued bonds on January 1, 2000. The bonds had a coupon rate of 11%, with interest paid semiannually. The face value of the bonds is $1,000 and the bonds mature on January 1, 2025, What is the yield to maturity for a PBJ Corporation bond on January 1, 2018 if the market price of the bond on that date is $925? (round to the nearest percentage) A. 13% B. 10% C.8% D. 16% 9. Valley Manufacturing Inc. just issued $1,000 par 20-year bonds. The bonds sold for $758.18 and pay interest semiannually. Investors require a rate of 9% on the bonds. What is the bonds' coupon rate? A. 7.46% B. 8.19% C. 6.37% D. 9.07% 10. Company XJD have a 6% coupon rate with semiannual coupon payments and a $1,000 par value. The bonds have 14 years until maturity, and sell for $975. What is the current yield for XJD's bonds? A. 7.16% B. 6.15% C. 4.23% D. 5.62% 11. Which of the following has a purely residual claim against a firm's cash flows? A. preferred stockholders B. bondholders C common stockholders D. Subordinated creditors 12. Which one of the following statements is true? A. Equity securities offer fixed claims on future cash payouts. B. Unlike bondholders, for their retums, shareholders rely entirely on price appreciation. C. In theory, common shareholders exercise very little control over company decisions. D. Historically, common shareholders have earned a risk premium as compensation for risk bome in excess of government bonds. 13. At the end of 2016, Crane Industries, Inc.'s stock price was $30.75. A year later, it was $34.88 Per share dividends over the year were $0.55, while earnings per share were $1.33. What rate of retum did the common stockholders earn in fiscal year 2017? A. 1.79% B. 4.33% C. 13.43% D. 15.22% 14. Preferred stock differs from common stock in that A. preferred stock dividends are fixed B. preferred stock usually has a maturity date. C preferred stock investors have a higher required return than common stock investors. D. common stock investors have a required return and preferred stock investors do not 15. General Motors raises money by selling a new issue of equity. This transaction occurs in A. the secondary market. B. the primary market. C the money market D. the futures market 3 20. Which of the following are the most likely reasons for why a stock price might not react at all on the day that new information related to the stock issuer is released? I. Insiders knew the information prior to the announcement II. Investors need time to digest the information prior to reacting. III. The information has no bearing on the value of the firm. IV. The information was anticipated. A. I and II B. I and III C. III and IV D. II and III Answers: Question Answer 1 A 2 D 3 B 4 B 5 6 D 7 8 A 9 10 11 12 13 B D D 14 A B A 15 16 17 18 D 19 B 20