Answered step by step

Verified Expert Solution

Question

1 Approved Answer

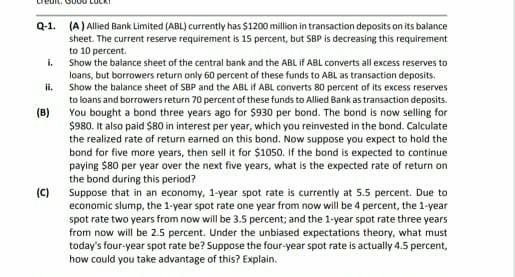

i. Q-1. (A) Allied Bank Limited (ABL) currently has $1200 million in transaction deposits on its balance sheet. The current reserve requirement is 15 percent,

i. Q-1. (A) Allied Bank Limited (ABL) currently has $1200 million in transaction deposits on its balance sheet. The current reserve requirement is 15 percent, but SBP is decreasing this requirement to 10 percent Show the balance sheet of the central bank and the ABL if ABL converts all excess reserves to loans, but borrowers return only 60 percent of these funds to ABL as transaction deposits. 11. Show the balance sheet of SBP and the ABL I ABL converts 80 percent of its excess reserves to loans and borrowers return 70 percent of these funds to Allied Bank as transaction deposits. (8) You bought a bond three years ago for $930 per bond. The bond is now selling for $980. It also paid $BO in interest per year, which you reinvested in the bond. Calculate the realized rate of return earned on this bond. Now suppose you expect to hold the bond for five more years, then sell it for $1050. If the bond is expected to continue paying $80 per year over the next five years, what is the expected rate of return on the bond during this period? (C) Suppose that in an economy, 1-year spot rate is currently at 5.5 percent. Due to economic slump, the 1-year spot rate one year from now will be 4 percent, the 1-year spot rate two years from now will be 3.5 percent; and the 1-year spot rate three years from now will be 25 percent. Under the unbiased expectations theory, what must today's four-year spot rate be? Suppose the four-year spot rate is actually 4.5 percent, how could you take advantage of this? Explain. i. Q-1. (A) Allied Bank Limited (ABL) currently has $1200 million in transaction deposits on its balance sheet. The current reserve requirement is 15 percent, but SBP is decreasing this requirement to 10 percent Show the balance sheet of the central bank and the ABL if ABL converts all excess reserves to loans, but borrowers return only 60 percent of these funds to ABL as transaction deposits. 11. Show the balance sheet of SBP and the ABL I ABL converts 80 percent of its excess reserves to loans and borrowers return 70 percent of these funds to Allied Bank as transaction deposits. (8) You bought a bond three years ago for $930 per bond. The bond is now selling for $980. It also paid $BO in interest per year, which you reinvested in the bond. Calculate the realized rate of return earned on this bond. Now suppose you expect to hold the bond for five more years, then sell it for $1050. If the bond is expected to continue paying $80 per year over the next five years, what is the expected rate of return on the bond during this period? (C) Suppose that in an economy, 1-year spot rate is currently at 5.5 percent. Due to economic slump, the 1-year spot rate one year from now will be 4 percent, the 1-year spot rate two years from now will be 3.5 percent; and the 1-year spot rate three years from now will be 25 percent. Under the unbiased expectations theory, what must today's four-year spot rate be? Suppose the four-year spot rate is actually 4.5 percent, how could you take advantage of this? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started