Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i. Quaypoint Corporation is expanding rapidly and currently needs to retain all of its earnings, hence, it does not pay dividends. However, investors expect Quaypoint

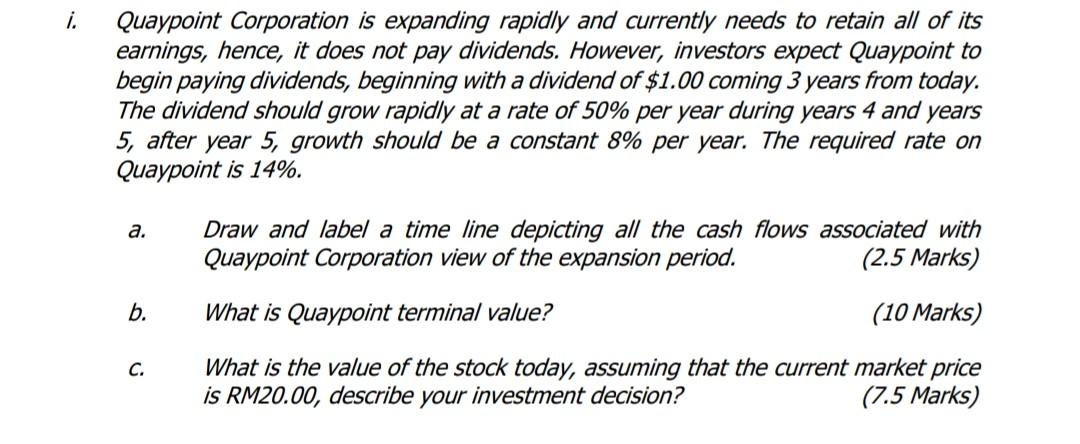

i. Quaypoint Corporation is expanding rapidly and currently needs to retain all of its earnings, hence, it does not pay dividends. However, investors expect Quaypoint to begin paying dividends, beginning with a dividend of $1.00 coming 3 years from today. The dividend should grow rapidly at a rate of 50% per year during years 4 and years 5, after year 5, growth should be a constant 8% per year. The required rate on Quaypoint is 14%. a. Draw and label a time line depicting all the cash flows associated with Quaypoint Corporation view of the expansion period. (2.5 Marks) b. What is Quaypoint terminal value? (10 Marks) C. What is the value of the stock today, assuming that the current market price is RM20.00, describe your investment decision? (7.5 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started