I

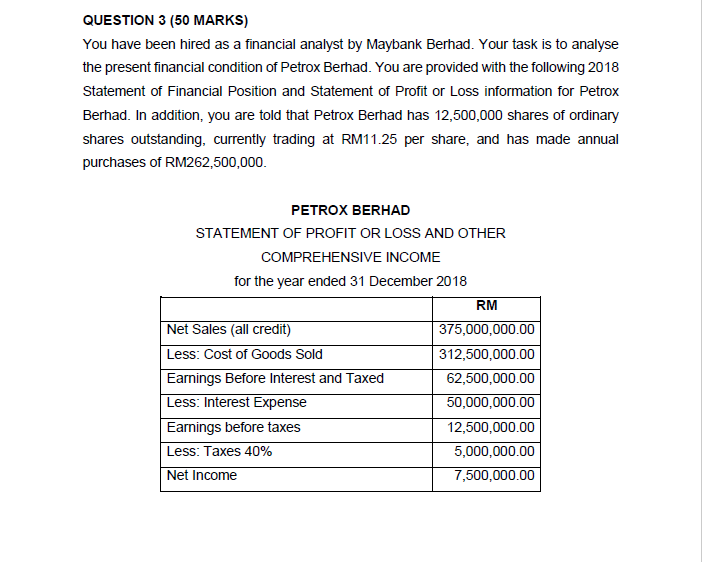

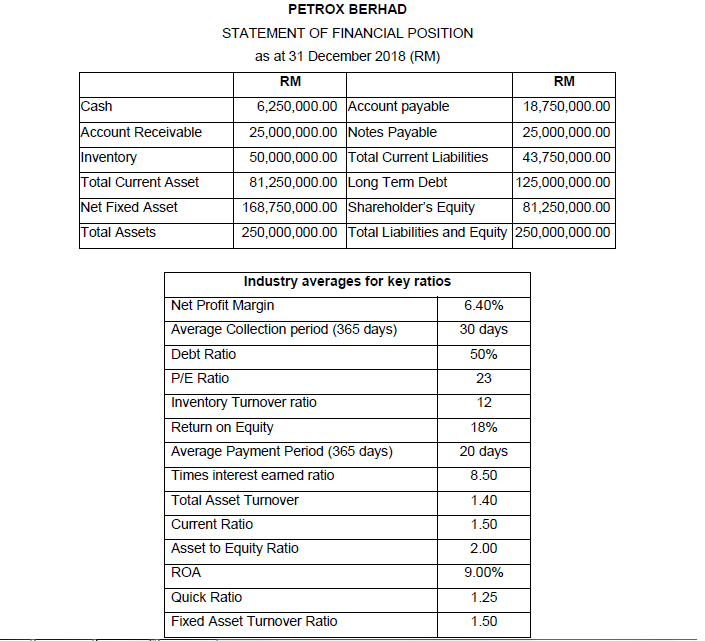

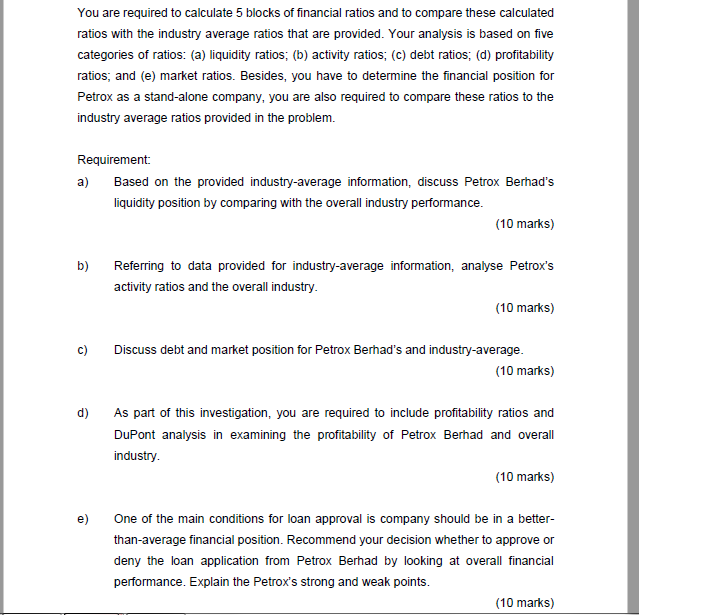

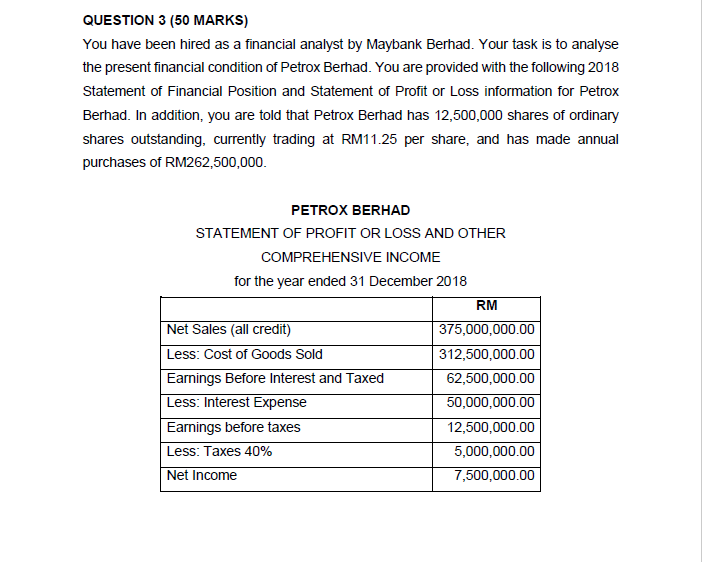

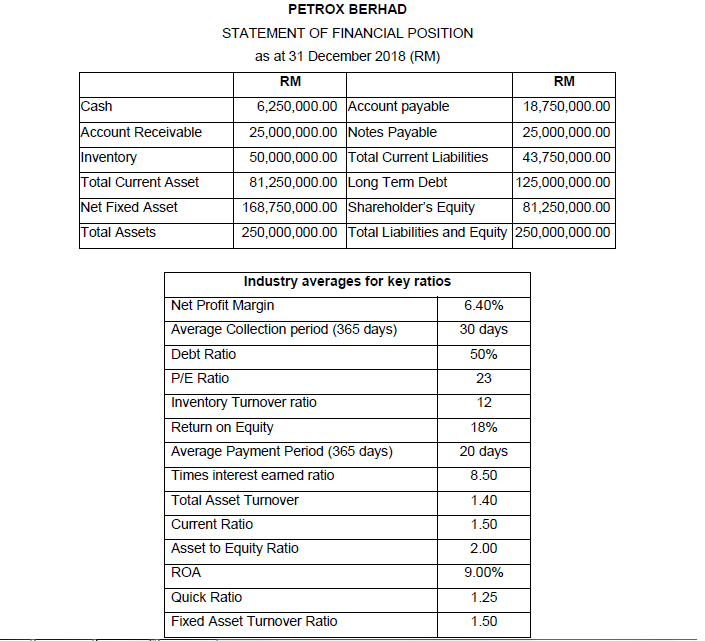

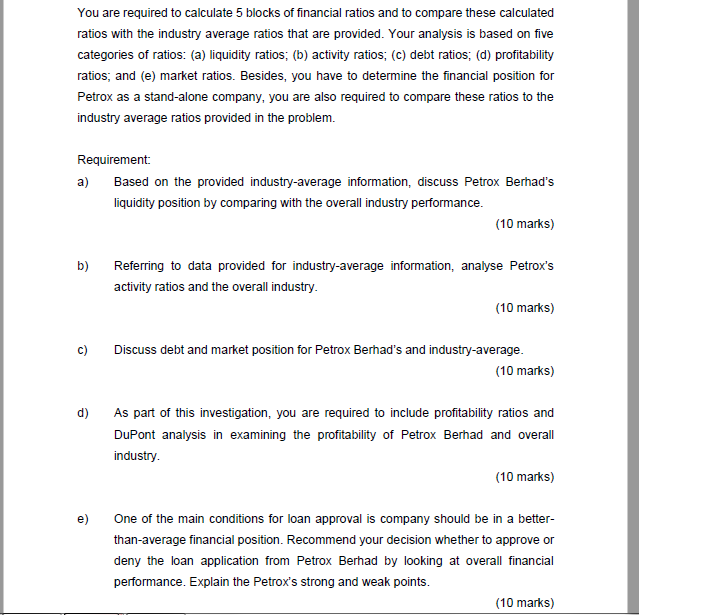

QUESTION 3 (50 MARKS) You have been hired as a financial analyst by Maybank Berhad. Your task is to analyse the present financial condition of Petrox Bernad. You are provided with the following 2018 Statement of Financial Position and Statement of Profit or Loss information for Petrox Berhad. In addition, you are told that Petrox Berhad has 12,500,000 shares of ordinary shares outstanding, currently trading at RM11.25 per share, and has made annual purchases of RM262,500,000. PETROX BERHAD STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME for the year ended 31 December 2018 RM Net Sales (all credit) 375,000,000.00 Less: Cost of Goods Sold 312,500,000.00 Earnings Before Interest and Taxed 62,500,000.00 Less: Interest Expense 50,000,000.00 Earnings before taxes 12,500,000.00 Less: Taxes 40% 5,000,000.00 Net Income 7,500,000.00 Cash Account Receivable Inventory Total Current Asset Net Fixed Asset Total Assets PETROX BERHAD STATEMENT OF FINANCIAL POSITION as at 31 December 2018 (RM) RM RM 6,250,000.00 Account payable 18,750,000.00 25,000,000.00 Notes Payable 25,000,000.00 50,000,000.00 Total Current Liabilities 43,750,000.00 81,250,000.00 Long Term Debt 125,000,000.00 168,750,000.00 Shareholder's Equity 81,250,000.00 250,000,000.00 Total Liabilities and Equity 250,000,000.00 Industry averages for key ratios Net Profit Margin 6.40% Average Collection period (365 days) 30 days Debt Ratio 50% P/E Ratio 23 Inventory Turnover ratio 12 Return on Equity 18% Average Payment Period (365 days) 20 days Times interest earned ratio 8.50 Total Asset Turnover 1.40 Current Ratio 1.50 Asset to Equity Ratio 2.00 ROA 9.00% Quick Ratio 1.25 Fixed Asset Turnover Ratio 1.50 You are required to calculate 5 blocks of financial ratios and to compare these calculated ratios with the industry average ratios that are provided. Your analysis is based on five categories of ratios: (a) liquidity ratios; (b) activity ratios; (c) debt ratios; (d) profitability ratios; and (e) market ratios. Besides, you have to determine the financial position for Petrox as a stand-alone company, you are also required to compare these ratios to the industry average ratios provided in the problem. Requirement: a) Based on the provided industry-average information, discuss Petrox Berhad's liquidity position by comparing with the overall industry performance. (10 marks) b) Referring to data provided for industry-average information, analyse Petrox's activity ratios and the overall industry. (10 marks) c) Discuss debt and market position for Petrox Berhad's and industry-average. (10 marks) d) As part of this investigation, you are required to include profitability ratios and DuPont analysis in examining the profitability of Petrox Berhad and overall industry. (10 marks) e) One of the main conditions for loan approval is company should be in a better- than-average financial position. Recommend your decision whether to approve or deny the loan application from Petrox Berhad by looking at overall financial performance. Explain the Petrox's strong and weak points. (10 marks) QUESTION 3 (50 MARKS) You have been hired as a financial analyst by Maybank Berhad. Your task is to analyse the present financial condition of Petrox Bernad. You are provided with the following 2018 Statement of Financial Position and Statement of Profit or Loss information for Petrox Berhad. In addition, you are told that Petrox Berhad has 12,500,000 shares of ordinary shares outstanding, currently trading at RM11.25 per share, and has made annual purchases of RM262,500,000. PETROX BERHAD STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME for the year ended 31 December 2018 RM Net Sales (all credit) 375,000,000.00 Less: Cost of Goods Sold 312,500,000.00 Earnings Before Interest and Taxed 62,500,000.00 Less: Interest Expense 50,000,000.00 Earnings before taxes 12,500,000.00 Less: Taxes 40% 5,000,000.00 Net Income 7,500,000.00 Cash Account Receivable Inventory Total Current Asset Net Fixed Asset Total Assets PETROX BERHAD STATEMENT OF FINANCIAL POSITION as at 31 December 2018 (RM) RM RM 6,250,000.00 Account payable 18,750,000.00 25,000,000.00 Notes Payable 25,000,000.00 50,000,000.00 Total Current Liabilities 43,750,000.00 81,250,000.00 Long Term Debt 125,000,000.00 168,750,000.00 Shareholder's Equity 81,250,000.00 250,000,000.00 Total Liabilities and Equity 250,000,000.00 Industry averages for key ratios Net Profit Margin 6.40% Average Collection period (365 days) 30 days Debt Ratio 50% P/E Ratio 23 Inventory Turnover ratio 12 Return on Equity 18% Average Payment Period (365 days) 20 days Times interest earned ratio 8.50 Total Asset Turnover 1.40 Current Ratio 1.50 Asset to Equity Ratio 2.00 ROA 9.00% Quick Ratio 1.25 Fixed Asset Turnover Ratio 1.50 You are required to calculate 5 blocks of financial ratios and to compare these calculated ratios with the industry average ratios that are provided. Your analysis is based on five categories of ratios: (a) liquidity ratios; (b) activity ratios; (c) debt ratios; (d) profitability ratios; and (e) market ratios. Besides, you have to determine the financial position for Petrox as a stand-alone company, you are also required to compare these ratios to the industry average ratios provided in the problem. Requirement: a) Based on the provided industry-average information, discuss Petrox Berhad's liquidity position by comparing with the overall industry performance. (10 marks) b) Referring to data provided for industry-average information, analyse Petrox's activity ratios and the overall industry. (10 marks) c) Discuss debt and market position for Petrox Berhad's and industry-average. (10 marks) d) As part of this investigation, you are required to include profitability ratios and DuPont analysis in examining the profitability of Petrox Berhad and overall industry. (10 marks) e) One of the main conditions for loan approval is company should be in a better- than-average financial position. Recommend your decision whether to approve or deny the loan application from Petrox Berhad by looking at overall financial performance. Explain the Petrox's strong and weak points. (10 marks)