Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I rate good! 3) 4) Shankar Company uses a perpetual system to record inventory trarisactions. The company purchases 1.000 units of inventiory on account on

I rate good!

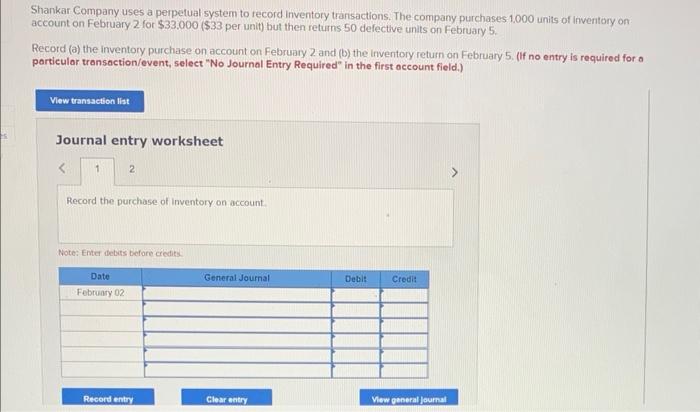

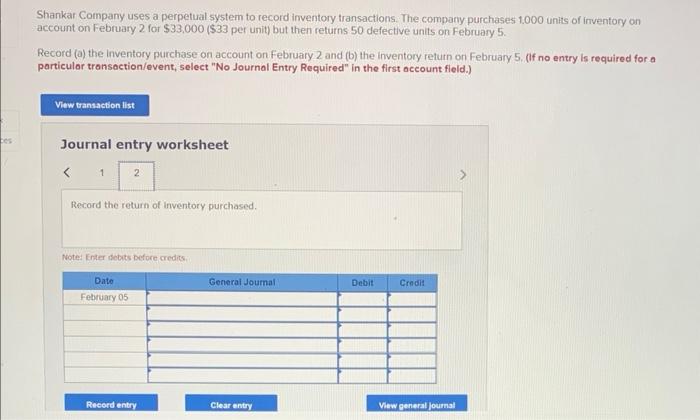

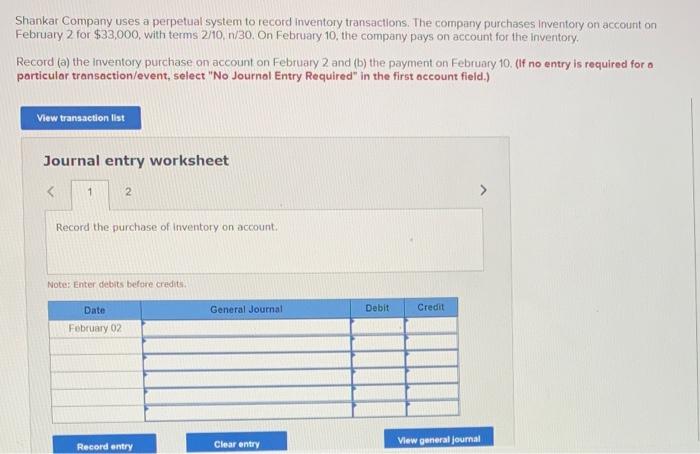

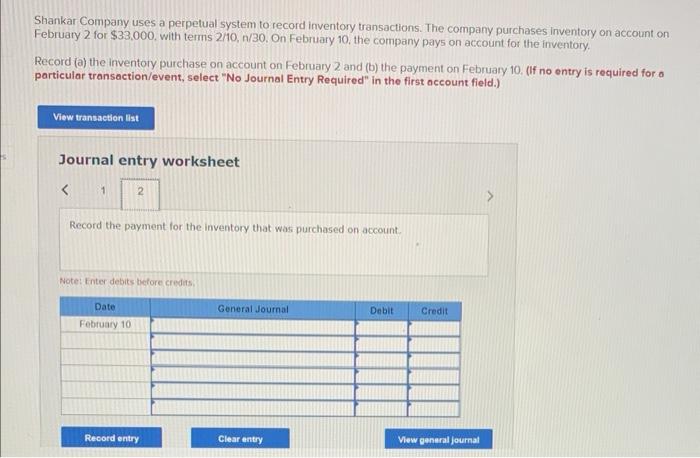

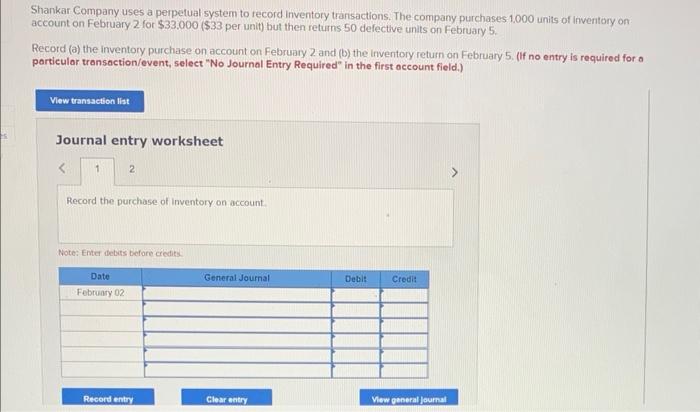

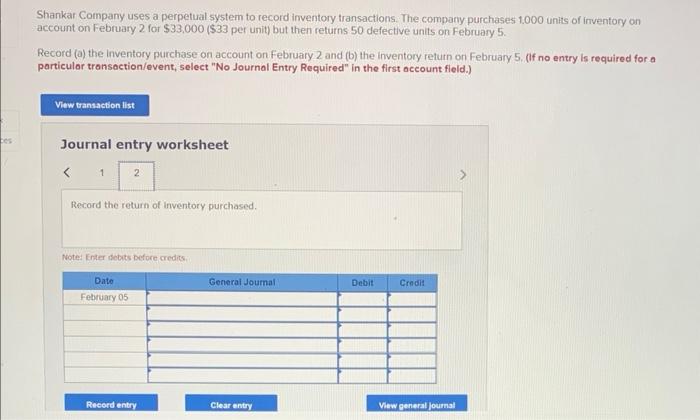

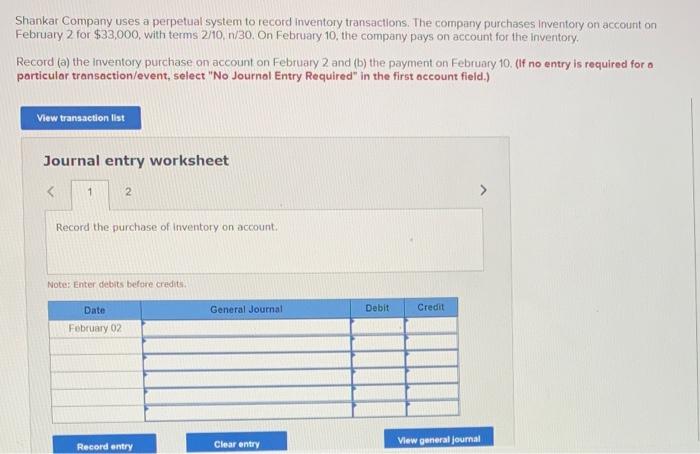

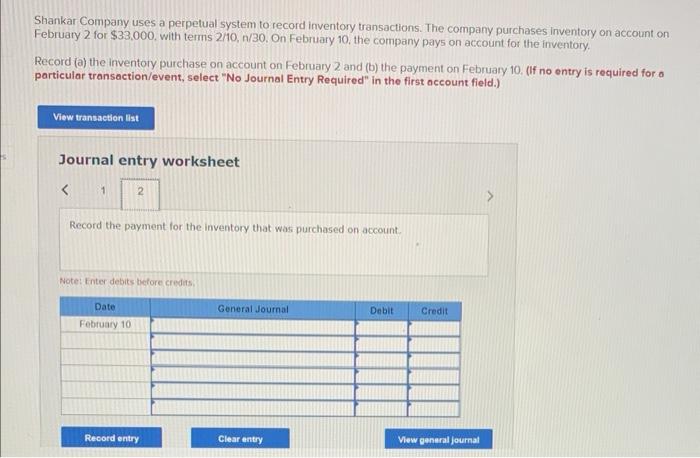

Shankar Company uses a perpetual system to record inventory trarisactions. The company purchases 1.000 units of inventiory on account on February 2 for $33.000 (\$33 per unit) but then returns 50 defective units on February 5. Record (a) the inventory purchase on account on February 2 and (b) the inventory return on February 5 . (If no entry is required for a particular transoction/event, select "No Journal Entry Required" in the first occount field.) Journal entry worksheet 2 Record the purchase of inventory on account. Note: Enter debits before credies: Shankar Company uses a perpetual system to record inventory transactions. The company purchases 1.000 units of inventory on account on February 2 for $33,000 (\$33 per unit) but then returns 50 defective units on February 5. Record (a) the inventory purchase on account on February 2 and (b) the inventory return on February 5 . (if no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account fleld.) Journal entry worksheet Shankar Company uses a perpetual system to record inventory transactions. The company purchases inventory on account on February 2 for $33,000, with terms 2/10,n/30. On February 10, the company pays on account for the inventory. Record (a) the inventory purchase on account on February 2 and (b) the payment on February 10. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first occount field.) Journal entry worksheet Record the purchase of inventory on account. Note: Enter debits before credits. Shankar Company uses a perpetual system to record inventory transactions. The company purchases inventory on account on February 2 for $33,000, with terms 2/10,n/30. On February 10, the company pays on account for the inventory. Record (a) the inventory purchase on account on February 2 and (b) the payment on February 10, (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the payment for the inventory that was purchased on account. Note: tinter debits betore credits 3)

4)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started