Question

I reaaaaally need help with this project below. I have no idea how to do any of these formulas. Please provide the formulas needed to

I reaaaaally need help with this project below. I have no idea how to do any of these formulas. Please provide the formulas needed to answer the questions below and the answer as well. This is my 4th time posting it on chegg and i have yet to recieve an expert to provide the fromulas for me.

Instructions:

For the purpose of grading the project you are required to perform the following tasks:

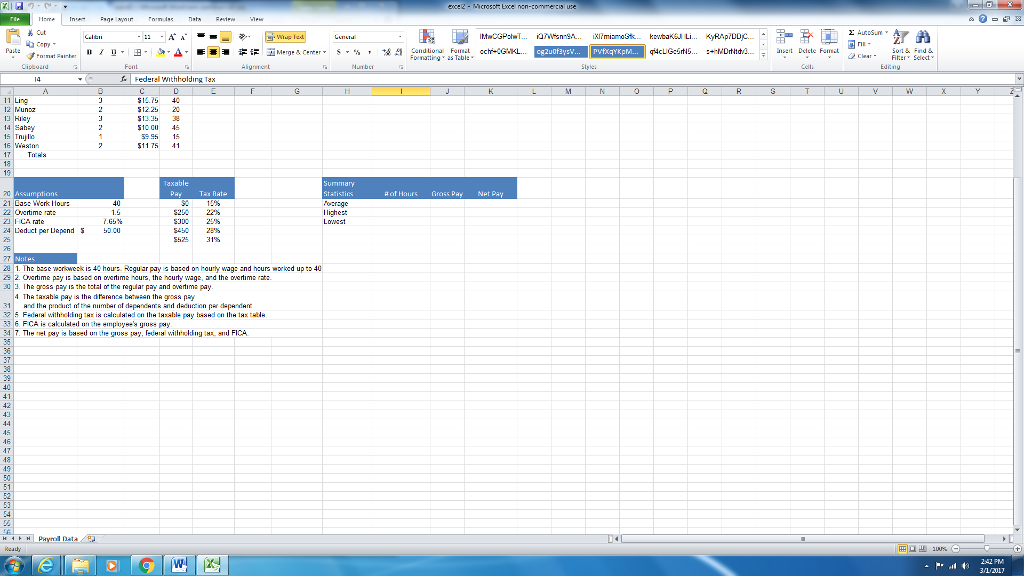

| Step | Instructions | Points Possible |

|---|---|---|

| 1 | Open the downloaded file exploring_e02_grader_h2.xlsx. | 0.000 |

| 2 | Use IF functions to calculate the regular pay and overtime pay based on a regular 40-hour workweek in cells E5 and F5. Pay overtime only for overtime hours. In cell G5, calculate the gross pay based on the regular and overtime pay. Abrams regular pay is $398. With 8 overtime hours, Abrams overtime pay is $119.40. | 20.000 |

| 3 | Create a formula in cell H5 to calculate the taxable pay. Multiply the number of dependents (column B) by the deduction per dependent (A24) and subtract that from the gross pay. With two dependents, Abrams taxable pay is $417.40. | 10.000 |

| 4 | Use a VLOOKUP function in cell I5 to identify and calculate the federal withholding tax. Use the tax rates from the range D21:E25. The VLOOKUP function returns the applicable tax rate, which you must then multiply by the taxable pay. | 20.000 |

| 5 | Calculate FICA in cell J5 based on gross pay and the FICA rate (cell B23), and calculate the net pay in cell K5. Copy all formulas down their respective columns to row 16. | 10.000 |

| 6 | With the range E5:K16 selected, use Quick Analysis tools to calculate the total regular pay, overtime pay, gross pay, taxable pay, withholding tax, FICA, and net pay on row 17. | 10.000 |

| 7 | Apply Accounting Number Format to the range C5:C16. Apply Accounting Number Format to the first row of monetary data and to the total row. Apply the Comma style to the monetary values for the other employees. Underline the last employees monetary values and use the Format Cells dialog box to apply Top and Double Bottom border for the totals. | 10.000 |

| 8 | Insert appropriate functions to calculate the average, highest, and lowest values in the Summary Statistics area (the range I21:K23) of the worksheet. Format the # of hours calculations as General number format with one decimal and the remaining calculations with Accounting number format. | 15.000 |

| 9 | Insert a footer with your name on the left side, the sheet name code in the center, and the file name code on the right side of the worksheet. | 5.000 |

| 10 | Save and close the workbook. Submit the file as directed. | 0.000 |

| Total Points | 100.000 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started