Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I really do not like Mondays, Kathy Ayers, Vice President of Marketing and Communications for Land and Nature (L&N) Jerky Company, thought as she

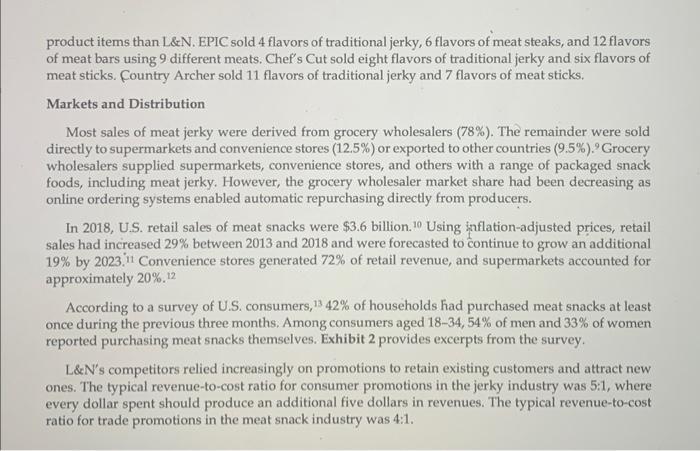

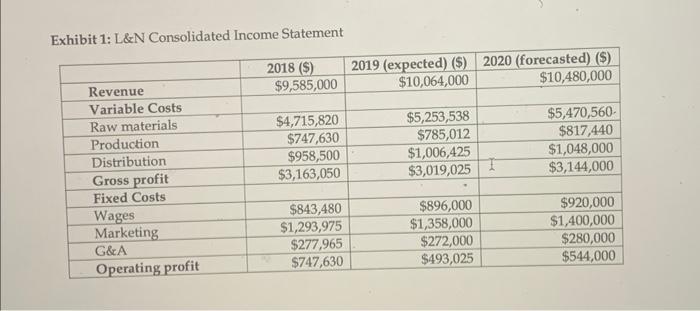

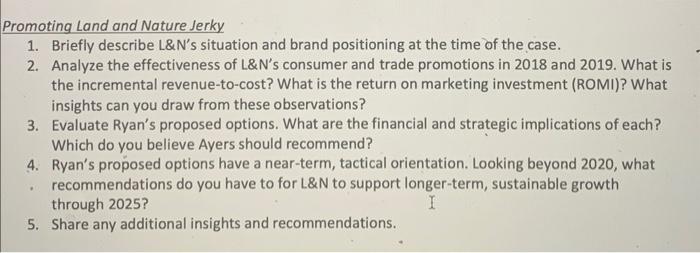

"I really do not like Mondays," Kathy Ayers, Vice President of Marketing and Communications for Land and Nature (L&N) Jerky Company, thought as she reflected on her afternoon meeting with L&N's CEO, Tim Ryan. During the meeting, Ayers and Ryan had reviewed L&N's actual, expected, and forecasted income statements from 2018 through 2020 (Exhibit 1). Ryan explained, "For 2020, we hope to run at 80% capacity. That will lead to 4% growth in revenue, assuming the same variable cost percentages that we have now, and a 3% increase in fixed costs. Our forecast operating profit for 2020 is currently 5.2% of sales, well short of the 7% target headquarters has for the company." Startled, Ayers looked at Ryan, who stated, "I want your team to help me achieve this goal. By next week's leadership meeting, I need you to analyze the effectiveness of our consumer and trade promotions and make recommendations for the 2020 budget to ensure we use our resources wisely." Although relieved her budget was not being cut again, Ayers needed to ensure Ryan understood the importance of promotions. She said, "We cannot increase sales, stimulate demand, and encourage trial without consumer promotions, Trade promotions are less essential, but they have helped us secure new accounts, encouraged our partners to stock more inventory, and generated point-of-purchase discounts passed along from our partners to consumers." Ryan paused briefly before responding. "I think you're right, but we must have some numbers to support that hypothesis," he said. "Corporate wants us to justify our position that promotions expense translates to revenue because if it does not, why should we spend it?" After meeting Ryan, Ayers called Steve Ham, L&N's Chief Financial Officer. "Steve, can you get some numbers together for me?" she asked. "I need to first calculate return-on-marketing-investment (ROMI) for both consumer and trade promotions and then consider how to adjust the budget to maximize ROMI." Ayers's surprise, Ham replied, "I have been working on that for the past week. Give me an hour to finish it." Now, Ayers was on her way to Ham's office with her notes and planned budget. Meat Jerky Industry in the United States The meat jerky industry included companies that dehydrate (or cure), season, and package meat into meat jerky products. In 2018, estimated sales were $1.3 billion ($67.3 million in profit) with projected annual growth of 2.7%. On average, operating profit margins were approximately 5%. Products Meat jerky was a nutrient-dense, shelf-stable meat that was made lightweight by drying; a pound of meat or poultry weighed about four ounces after being made into jerky. It was made from lean cuts of whole muscle. Meat was sliced into thin strips or restructured muscle by grinding and processing whole muscle to form a more uniform shape. Most jerky was sold in plastic, multi-serve bags. In 2018, beef had 79% of total U.S. jerky sales. Less than 20% of jerky sales came from other meats such as turkey, chicken, pork, and game such as deer, elk, salmon, and buffalo. Analysts predicted beef jerky revenue would decline and sales of innovative flavors and healthier meats would increase.5 Meat snacks were made from processed meats, including both muscle anli fat, typically formed into sticks that were encased like sausage, and often sold in single-serving packages. The nutritional contents of jerky and meat snacks differed considerably. For example, in 2019, a one-ounce serving of Oberto's All-Natural Original Beef Jerky was 70 calories with 0.5g of fat and 10g of protein, while a one-ounce serving of Slim Jim's Original Beef Stick was 140 calories with 11g of fat and 6g of protein. Competitive Landscape In 2018, the top three competitors accounted for 60% of total sales in the U.S. market. The largest was Link Snacks, Inc. (26%), which produced beef jerky, turkey jerky, beef sticks, and meat and cheese packs under the brand name Jack Link's. The Oberto Sausage Company was the second-largest competitor (19%). It produced and sold beef jerky, salami, pepperoni, and other snack sausages under the brand name Oh Boy! Oberto. Slim Jim, produced by a division of Conagra Brands Inc., was the third-largest competitor (15%). It offered a wide variety of meat sticks, meat snacks, and dried sausages. Competitive Landscape In 2018, the top three competitors accounted for 60% of total sales in the U.S. market. The largest was Link Snacks, Inc. (26%), which produced beef jerky, turkey jerky, beef sticks, and meat and cheese packs under the brand name Jack Link's. The Oberto Sausage Company was the second-largest competitor (19%). It produced and sold beef jerky, salami, pepperoni, and other snack sausages under the brand name 'Oh Boy! Oberto. Slim Jim, produced by a division of Conagra Brands Inc., was the third-largest competitor (15%). It offered a wide variety of meat sticks, meat snacks, and dried sausages. The remaining industry revenue included numerous smaller companies and hundreds of single- person operations. Many of them offered premium-quality products. For example, Chef's Cut Real Jerky offered protein-rich jerky targeted to golfers, and Country Archer Jerky Co. produced gourmet jerky, sticks, and bars made with "premium and clean" ingredients." Rapid revenue growth had also spurred industry consolidation, with global food companies acquiring small jerky producers. As examples, Hershey's purchased KRAVE in 2015, General Mills acquired EPIC Provisions in 2016, and Premium Brands Holding Corporation purchased Oberto in 2018. These companies used their power to secure limited shelf space. The bases of competition were product price-quality, channel relationships, and innovation- differentiation. Most consumers were price sensitive, yet those concerned with quality were loyal to competitively priced brands. Producers needed relationships with meat producers to ensure steady access to inputs as well as distributors to secure shelf space in stores. Innovation and differentiation helped earn consumer interest, command higher prices, and secure product placement. These efforts included new flavor profiles, all-natural or organic variations, and artisanal (small batch) handcrafted product lines that were targeted at athletes, hikers, and campers. L&N considered KRAVE, EPIC, Chef's Cut, and Country Archer as its direct competitors. L&N had. products that were similarly priced (per ounce) to their competitors', but the other companies had more product items than L&N. EPIC sold 4 flavors of traditional jerky, 6 flavors of meat steaks, and 12 flavors of meat bars using 9 different meats. Chef's Cut sold eight flavors of traditional jerky and six flavors of meat sticks. Country Archer sold 11 flavors of traditional jerky and 7 flavors of meat sticks. Markets and Distribution Most sales of meat jerky were derived from grocery wholesalers (78%). The remainder were sold directly to supermarkets and convenience stores (12.5%) or exported to other countries (9.5%). Grocery wholesalers supplied supermarkets, convenience stores, and others with a range of packaged snack foods, including meat jerky. However, the grocery wholesaler market share had been decreasing as online ordering systems enabled automatic repurchasing directly from producers. In 2018, U.S. retail sales of meat snacks were $3.6 billion. 10 Using inflation-adjusted prices, retail sales had increased 29% between 2013 and 2018 and were forecasted to continue to grow an additional 19% by 2023,11 Convenience stores generated 72% of retail revenue, and supermarkets accounted for approximately 20%, 12 According to a survey of U.S. consumers, 13 42% of households had purchased meat snacks at least once during the previous three months. Among consumers aged 18-34, 54% of men and 33% of women reported purchasing meat snacks themselves. Exhibit 2 provides excerpts from the survey. L&N's competitors relied increasingly on promotions to retain existing customers and attract new ones. The typical revenue-to-cost ratio for consumer promotions in the jerky industry was 5:1, where every dollar spent should produce an additional five dollars in revenues. The typical revenue-to-cost ratio for trade promotions in the meat snack industry was 4:1. Land and Nature (L&N) Jerky Company Located in Nebraska, L&N was an independent subsidiary owned by KB Holdings, a global food company. Until 2014, L&N had slowly expanded its product lines to include a variety of premium- quality, all-natural jerky that was available in stores throughout the Great Plains. In 2014, KB Holdings purchased L&N to build its portfolio of all-natural, eco-friendly products by expanding L&N's distribution nationwide. Surveys suggested that jerky consumers considered L&N one of the top five brands among all-natural artisan jerky and meat snacks. Philosophy & Production Ayers had joined L&N because she believed in its focus on sustainability; L&N sourced its products from sustainable farms and produced products using eco-friendly practices. It processed only traditional meats (beef, turkey, and pork) to scale production responsibly and efficiently. The company also supported conservation efforts and nonprofit organizations. Unlike competitors that used co-packers, L&N processed purchased meat in its own production facility. It employed 20 workers and used USDA Food Safety and Inspection Service (FSIS) guidelines for jerky processing: strip preparation, marination, antimicrobial interventions, surface preparation and lethality (i.e., the process for destroying pathogenic microorganisms), drying, and post-drying heating. 14 Managing its own facilities improved quality control and lowered production costs. In 2019, L&N's product mix included two lines: traditional beef jerky and meat strips. L&N's jerky was made from whole muscle beef and came in four flavors: regular, teriyaki, barbeque, and habanero. Strips were introduced as an extension to L&N's product mix in 2013. They were made from beef, turkey, and pork using restructured muscle. Strips were offered in three unique flavor combinations: chipotle-lime turkey, apple-walnut pork, and dark chocolate, and blackberry beef. In 2016, L&N's chipotle-lime turkey strip won a national award from the American Cured Meat Championships. In 2018, jerky accounted for 42% of L&N's revenue, strips for 58%. Since 2015, L&N wholesale prices for jerky and strips were $3 and $1, respectively. In 2017, L&N reduced its jerky, package size from 2.2 to 2.0 ounces and its strip package size from 0.8 to 0.7 ounces to address rising material costs while maintaining prices. In 2019, jerky was sold in resealable pouches for $5.49 MSRP. Retailers frequently discounted jerky; the average retail price in 2019 was $4.99. Strips were sold in individual, vacuum-sealed packages for $1.99 MSRP. They offered fewer price discounts on strips; the average retail price in 2019 was $1.89. Although products were competitively priced against premium national brands, L&N had one of the highest price-per-ounce MSRP. Positioning and Customers In 2016, Ayers had convinced Ryan to reposition L&N's products. L&N situated itself as an artisanal heritage brand that made hand-crafted, better-for-you products, and it began promoting its products as high-quality, protein-rich, and all-natural. Its packaging emphasized grams of protein per serving, all-natural ingredients, and minimal processing. L&N's products were labeled as certified paleo, gluten-free, and grain-free. Its practices for meat sourcing practices allowed L&N to be the only national meat jerky producer permitted to label its products using three AGW (A Greener World) certifications: Certified Grassfed, Certified Non-GMO, and Animal Welfare Approved. Rather than using a Wild West theme to differentiate its products, L&N used bold graphics and vibrant colors. The primary colors of its meat steak strip packaging varied by flavor: apple red (apple- walnut pork); lime green (chipotle-lime turkey); and blackberry purple (dark chocolate and blackberry beef). In addition, L&N differentiated itself from other artisanal jerky brands-which usually used sophisticated, artistically rendered images-by using cartoon-rendered food icons. Branding choices positioned L&N products as offbeat and quirky. T The market study that Ayers had commissioned showed that L&N had strong brand awareness among meat snack consumers (75% aided recall), which was comparable to competitors such as KRAVE, EPIC, Country Archer, and Chef's Cut. According to the study, 12% of consumers surveyed had purchased an L&N product at least once in the previous three months; 40% of those surveyed had purchased any meat snack during that period. Consumers who had purchased L&N's products tended to be college-educated, working adults with household incomes of $75,000-$99,999. Compared to the average meat snack consumer, L&N customers were more likely to look at ingredients before buying snack foods (42% vs. 28 %) and less likely to idenlify low price as important to their purchase decision (16% vs. 39%). The study also suggested that L&N's customers were far more likely to look for labels like L&N's AGW certifications than the average jerky buyer was (39% vs. 27%). Exhibit 3 compares L&N customers to all customers who purchased meat snacks. As a subsidiary of KB Holdings, L&N enjoyed strong distribution. In the United States, 70% of supermarket chains, 44% of convenience stores, and 36% of independent grocers stocked at least one L&N product. KB Holdings managed reordering, restocking, and delivery for all retail accounts in exchange for 10% of L&N's revenue; typical grocery wholesaler distribution fees ran from 15% to 30%. L&N also considered its relationship with KB Holdings to be a major competitive advantage. Unlike independent, wholesale distributors that often represented several jerky brands, KB Holdings had a vested interest in L&N's long-term revenue and profit growth. L&N's jerky pouches were offered near other jerky products on hanger shelves. Strips were sold from L&N display boxes located near nutrition bars. Independent of KB Holdings, L&N managed its own advertising, consumer promotions, and trade promotions through a three-person sales and marketing team, which had developed successful point-of-purchase displays in convenience stores that increased impulse purchases. L&N's annual survey of distributors indicated strong satisfaction with product quality (95%), inventory turn (91%), relationship (88%), and trade promotions (81%). L&N's Integrated Marketing Communications Ayers arrived at Ham's office and sat down. She gave him a copy of her notes and budget and began to explain. "As you know, we conceptualize L&N's marketing communications strategy using three components: (1) strategic intent, including the communication goals arid target audience; (2) strategic execution, including message/story and media; and (3) strategic impact, including budget and effectiveness metrics. In 2019, our goal was to build a preference for our products and increase the likelihood of purchase. We targeted mainly existing customers, but we also targeted consumers who expressed interest in jerky or meat snacks online. We shared our message primarily through paid and owned online media. We also used onsumer and trade promotions to build demand." L&N's paid media included social media ads, search ads, and image-rich display ads. Its owned media included a mobile-friendly website and company-sponsored social media content that used a combination of humor and emotional (feel-good) appeals. For example, the L&N website shared information about sustainability practices as well as funny animal pictures and videos. L&N had recently finished negotiations with a company to outsource a portion of paid and owned media. The company specialized in targeting and delivering marketing content using marketing automation, artificial intelligence, and machine learning. By outsourcing, L&N estimated it would reduce its 2020 paid and owned media budget from $700,000 to $500,000. L&N invested heavily in consumer promotions, which were pull marketing communications intended to induce end users to purchase L&N's products at the point of sale. Consumer promotions also encouraged trial among new customers; L&N commonly used digital coupons (e.g., buy-one-get- one and cents-off) and instant savings stickers on packages. L&N also invested in social media contests in which participants earned money to be donated to a sustainable nonprofit organization. For example, L&N invited participants to share pictures of nature via social media. It then selected five entries as finalists and asked followers to vote for their favorite. L&N donated $50,000 to the preferred nonprofit of the winning photographer and $10,000 to the nonprofit of the runner-up. L&N alternated promotions monthly so that it offered consumer promotions during even months (February, April, June, August, October, and December). Ayers explained, "Consumer promotions will drive most of our revenue generation. We get a lot of positive feedback on social media when we offer promotions that consumers like. Our customers especially love to re-share contests and promotions that benefit social and environmental causes they support. Our loyal customers are one of our greatest assets." L&N also invested in trade promotions, which were push marketing communications designed to motivate retailers to sell products to consumers and to maintain distributor relationships and loyalty. L&N's trade promotions included discounts off invoice prices, free cases with minimum orders, shelf talkers (i.e., signs attached to a shelf that were designed to attract a customer's attention, and performance discount incentives for verifiable merchandising/advertising support). L&N regarded this effort as key for getting retailers to carry L&N products; it estimated that half its accounts would discontinue carrying L&N's products without them. L&N alternated promotions monthly; it offered trade promotions during odd months (January, March, May, July, September, and November). Ayers explained: "I am not sure about the effectiveness of our trade promotions. Our trade partners tell us that our timing, duration, and frequency of trade promotions are very effective and that our shelf talkers and.vibrant packaging are distinct visuals. In addition, thanks to KB holdings, we have fewer out-of-stock issues and higher inventory turn-over rates than our competitors do. However, although our goal is for retailers to pass along discounts to stimulate demand rather than build their own inventory, we cannot control how our partners manage their inventory or stock our products." Ham told Ayers. "I just finished these estimates. Using historical sales records, expected organic growth, and the 2018 and 2019 monthly marketing expenses (Exhibit 4), I estimated incremental revenue for trade and consumer promotions (Exhibit 5). I think this information will help you estimate ROMI for promotions for the 2020 budget, which includes $700,000 for owned and paid media, $400,000 for consumer promotions, and $300,000 for trade promotions. Unfortunately, I do not have the data to calculate incremental revenue for media spending." Ayers thanked Ham for the information. Decision As Ayers walked back to her office, she reflected on Ryan's request during their earlier meeting: I want you to estimate L&N forecasted 2020 operating profit (Exhibit 1) using three options: reduce L&N's total promotion budget by 30%, increase L&N's consumer promotions by $200,000, or increase L&N's trade promotions by $200,000. Because we can reduce our paid and owned media budget by 30%, the first option explores whether we can achieve our profit goal by reducing promotion spending. Options two and three, increasing consumer promotions and increasing trade promotions, respectively, would reallocate the savings from the paid and owned media budget to promotions. I want to invest all the savings into one category, to maintain existing programs while increasing investments in new programs. I do not want to invest more money into both consumer and trade promotions because it will split the focus of your team. Ayers replied, "Beyond these calculations, we must consider both strategic and financial issues. L&N must differentiate our products from those of our competitors. Our positioning and emphasis on better-for-you ingredients have been effective, but the competitive landscape is changing." Ryan said, "I might agree, but remember that you have under a week to do your analyses and make your recommendation. I look forward to hearing what your data suggest." I Or Exhibit 1: L&N Consolidated Income Statement 2018 ($) $9,585,000 Revenue Variable Costs Raw materials Production Distribution Gross profit Fixed Costs Wages Marketing G&A Operating profit M $4,715,820 $747,630 $958,500 $3,163,050 $843,480 $1,293,975 $277,965 $747,630 2019 (expected) ($) 2020 (forecasted) ($) $10,064,000 $10,480,000 $5,253,538 $785,012 $1,006,425 $3,019,025 $896,000 $1,358,000 $272,000 $493,025 T $5,470,560- $817,440 $1,048,000 $3,144,000 $920,000 $1,400,000 $280,000 $544,000 Promoting Land and Nature Jerky 1. Briefly describe L&N's situation and brand positioning at the time of the case. 2. Analyze the effectiveness of L&N's consumer and trade promotions in 2018 and 2019. What is the incremental revenue-to-cost? What is the return on marketing investment (ROMI)? What insights can you draw from these observations? 3. Evaluate Ryan's proposed options. What are the financial and strategic implications of each? Which do you believe Ayers should recommend? 4. Ryan's proposed options have a near-term, tactical orientation. Looking beyond 2020, what recommendations do you have to for L&N to support longer-term, sustainable growth through 2025? I 5. Share any additional insights and recommendations. .

Step by Step Solution

★★★★★

3.59 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Please like my answer as it would motivate me to provide more quality answers to all the students and I would be able to help all of you in your study Answer 1 Marketing Effectiveness is the pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started