I really just need help making the closing entries. And Im not sure if the general ledger is completely right either. Thanks

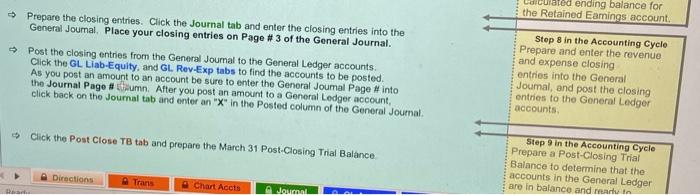

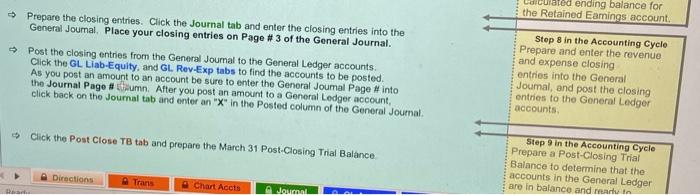

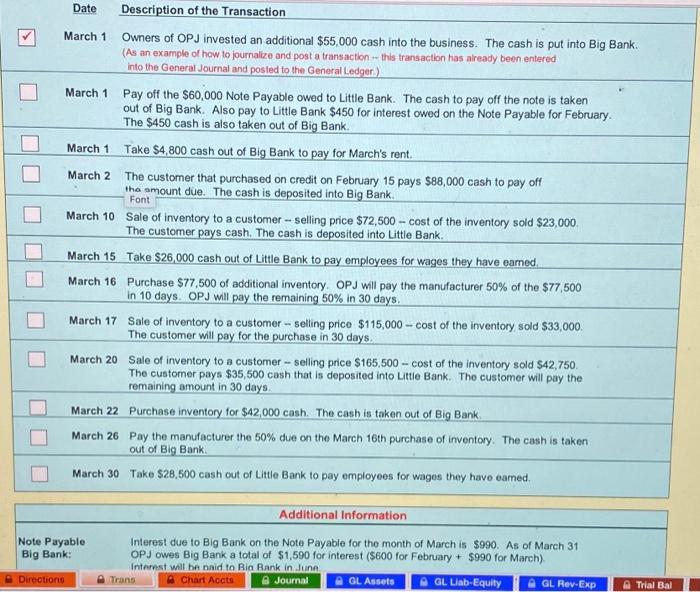

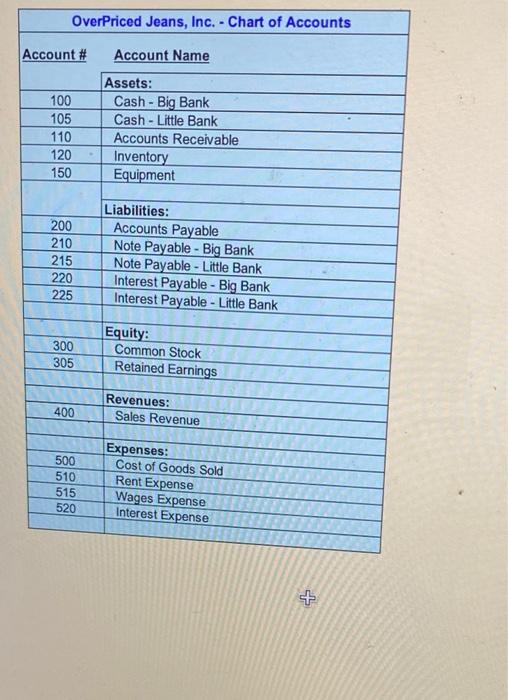

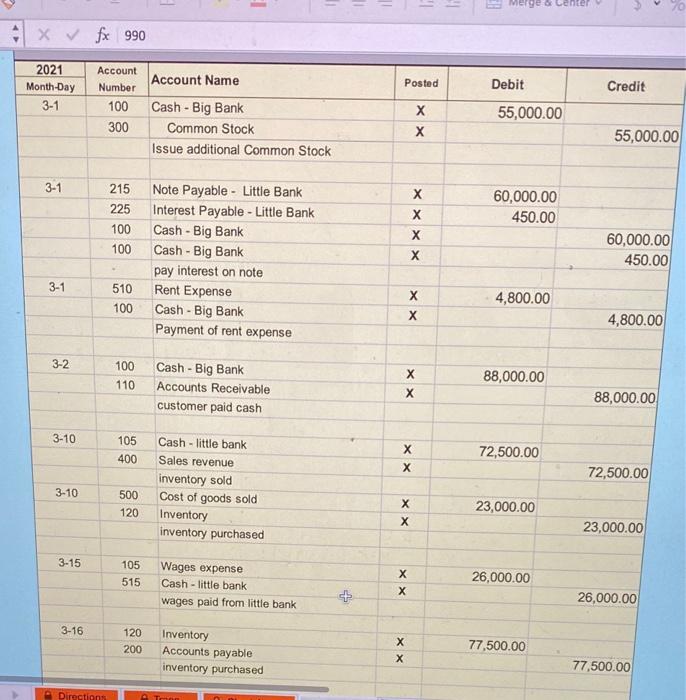

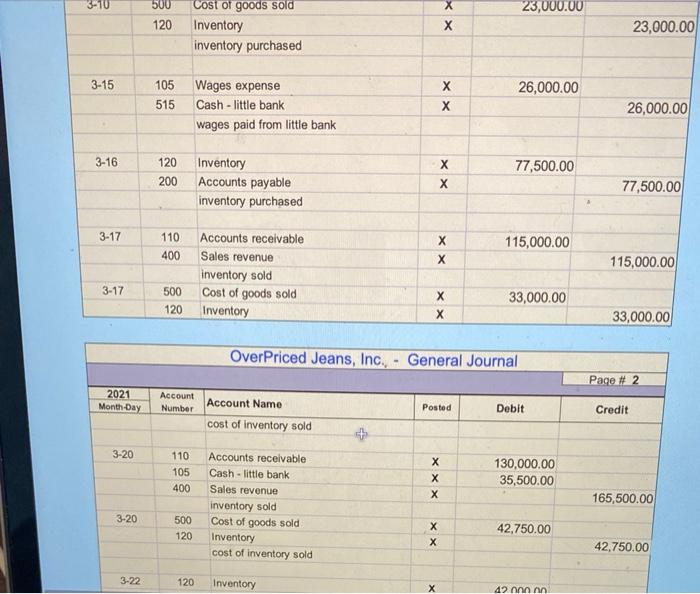

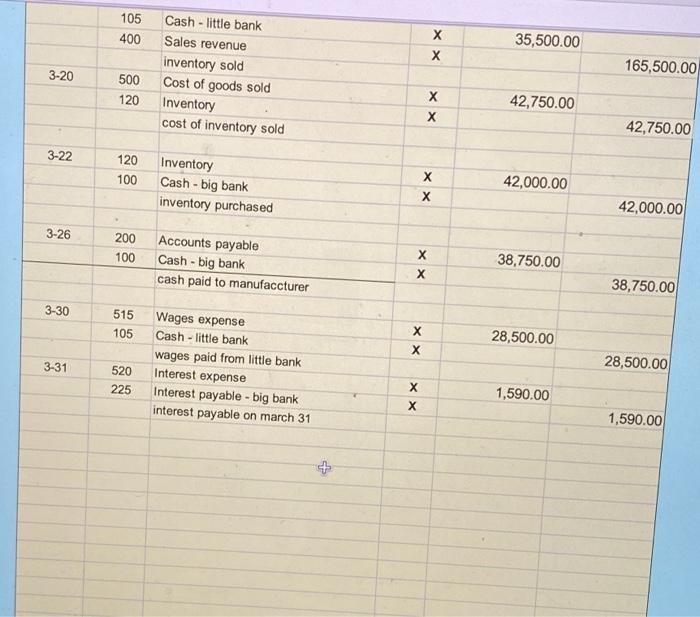

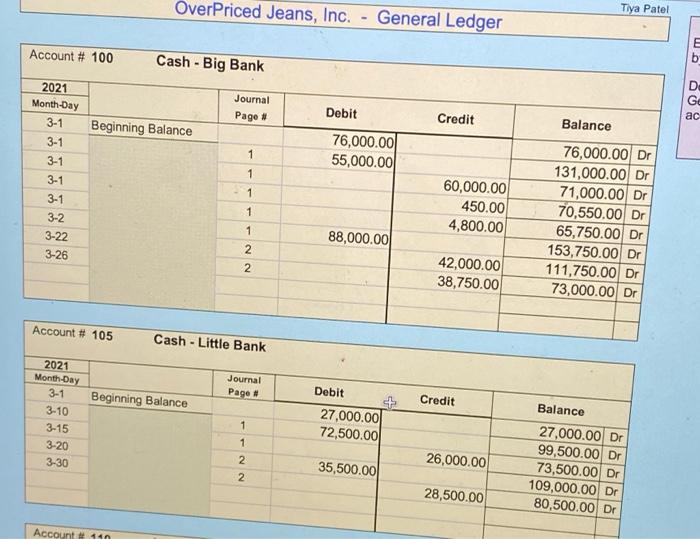

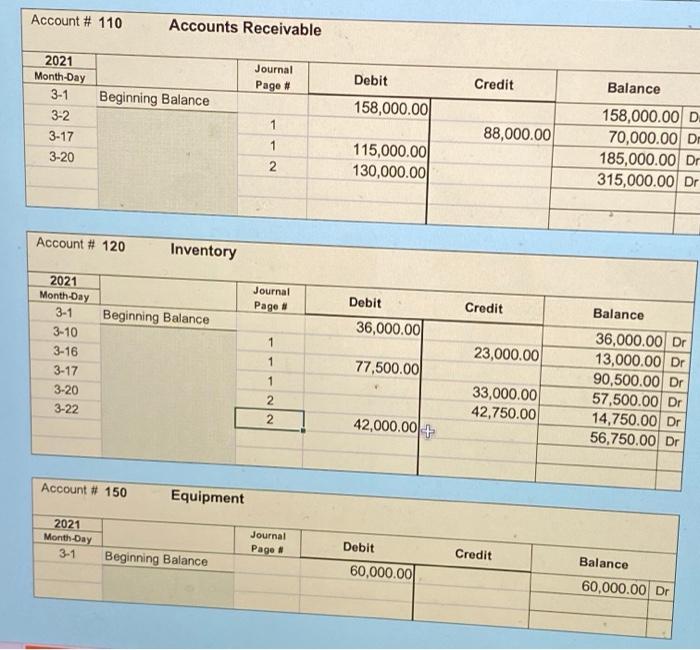

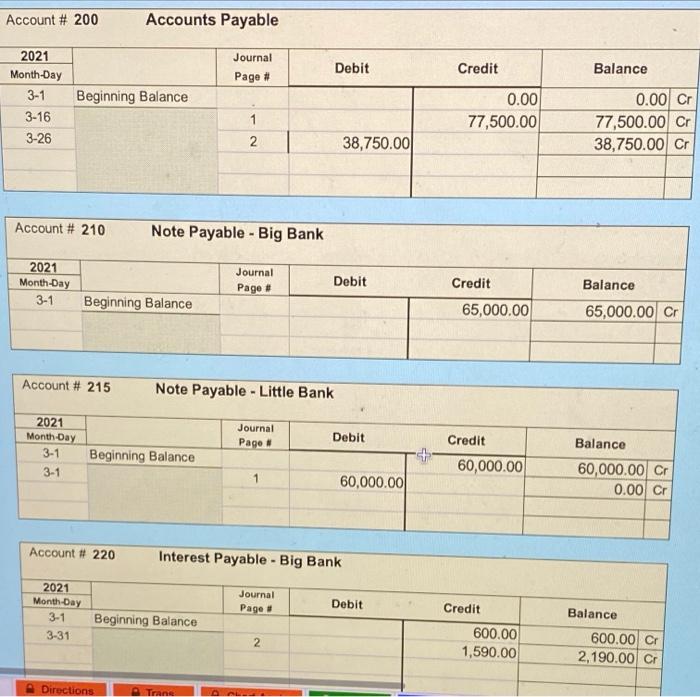

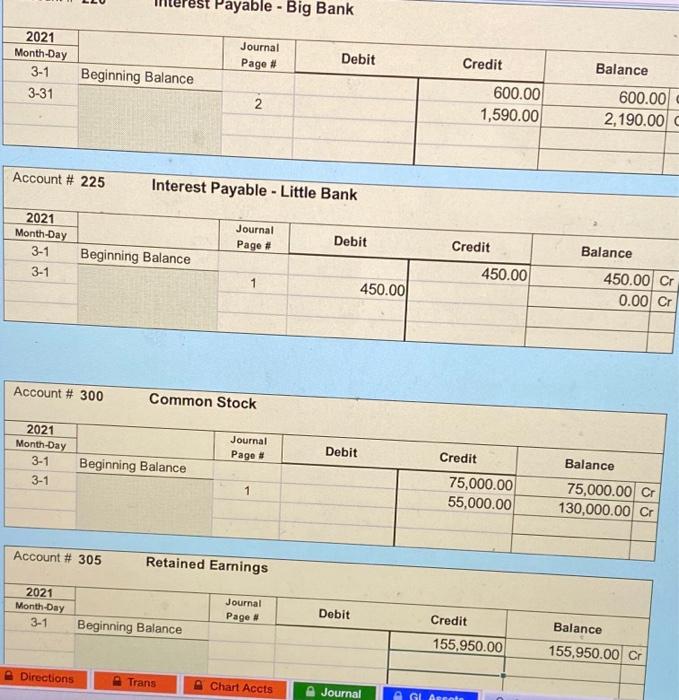

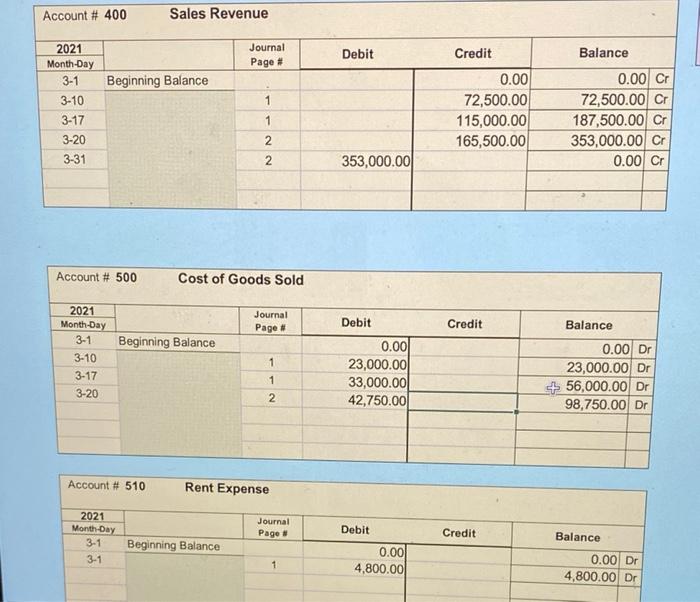

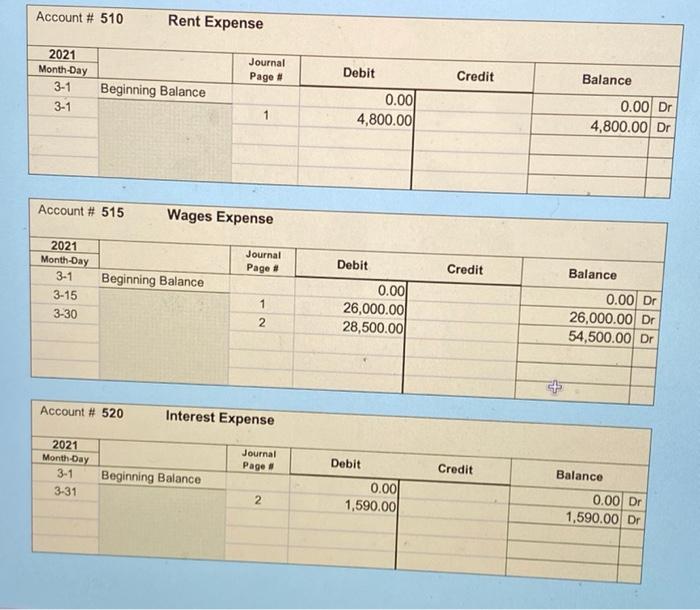

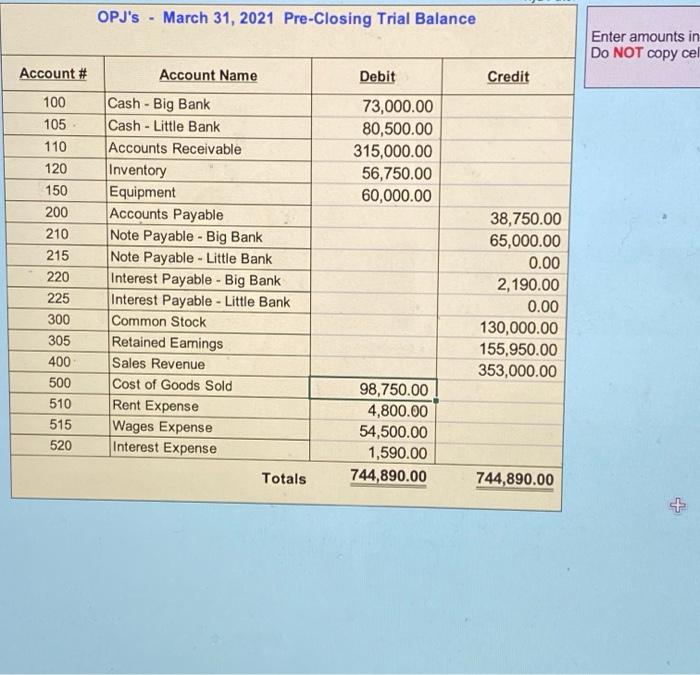

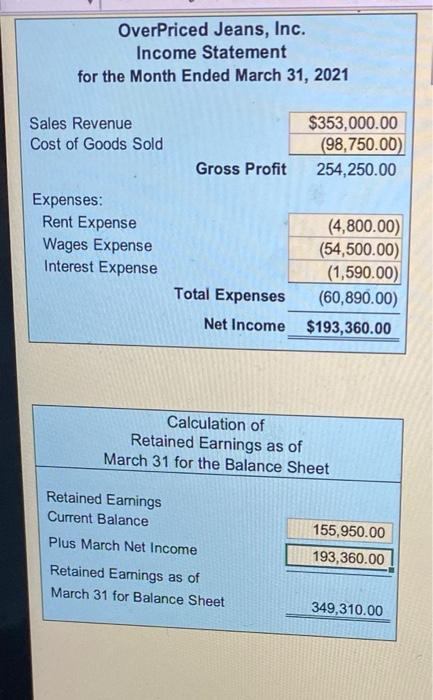

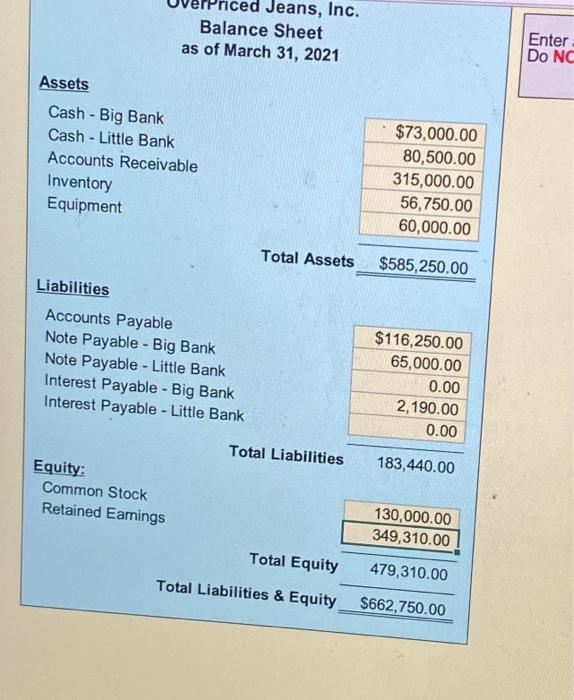

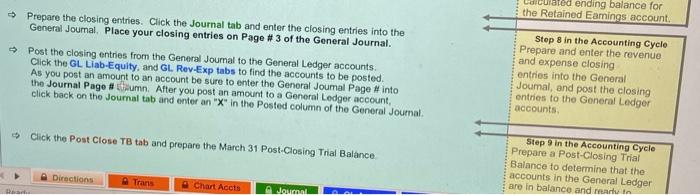

ated ending balance for the Retained Eamings account. Prepare the closing entries. Click the Journal tab and enter the closing entries into the General Joumal Place your closing entries on Page #3 of the General Journal. > Post the closing entries from the General Journal to the General Ledger accounts Click the GL Liab-Equity, and GL Rev-Exp tabs to find the accounts to be posted. As you post an amount to an account be sure to enter the General Joumal Page #into the Journal Page #umn. After you post an amount to a General Ledger account, click back on the Joumal tab and enter an "Xin the Posted column of the General Journal Step 8 in the Accounting Cycle Prepare and enter the revenue and expense closing entries into the General Joumal, and post the closing entries to the General Ledger accounts Click the Post Close TB tab and prepare the March 31 Post-Closing Trial Balance Step in the Accounting Cycle Prepare a Post-Closing Trial Balance to determine that the accounts in the General Ledger are in balance and matu to Directions Trans Chart Accts Journal U Font Date Description of the Transaction March 1 Owners of OPJ invested an additional $55,000 cash into the business. The cash is put into Big Bank. (As an example of how to journalize and post a transaction - this transaction has already been entered into the General Journal and posted to the General Ledger.) March 1 Pay off the $60,000 Note Payable owed to Little Bank. The cash to pay off the note is taken out of Big Bank. Also pay to Little Bank $450 for interest owed on the Note Payable for February The $450 cash is also taken out of Big Bank. March 1 Take $4,800 cash out of Big Bank to pay for March's rent. March 2 The customer that purchased on credit on February 15 pays $88,000 cash to pay off the amount due. The cash is deposited into Big Bank. March 10 Sale of inventory to a customer-selling price $72,500 - cost of the inventory sold $23,000 The customer pays cash. The cash is deposited into Little Bank March 15 Take $26,000 cash out of Little Bank to pay employees for wages they have eamed March 16 Purchase $77,500 of additional inventory. OPJ will pay the manufacturer 50% of the $77,500 in 10 days. OPJ will pay the remaining 50% in 30 days. March 17 Sale of inventory to a customer-selling price $115,000 - cost of the inventory sold $33,000 The customer will pay for the purchase in 30 days. March 20 Sale of inventory to a customer - selling price $165,500 - cost of the inventory sold 542,750 The customer pays $35,500 cash that is deposited into Little Bank. The customer will pay the remaining amount in 30 days March 22 Purchase inventory for $42,000 cash. The cash is taken out of Big Bank March 26 Pay the manufacturer the 50% due on the March 16th purchase of inventory. The cash is taken out of Big Bank March 30 Take $28,500 cash out of Little Bank to pay employees for wages they have oamed. Additional Information Note Payable Big Bank: Interest due to Big Bank on the Note Payable for the month of March is $990. As of March 31 OPJ owes Big Bank a total of $1,590 for interest ($600 for February $990 for March) Interest will be naid to Ria Rank in June Trans Chart Accts Journal GL Assets GL Liab-Equity GL Rev-Exp Directions A Trial Bal Overpriced Jeans, Inc. - Chart of Accounts Account # Account Name 100 105 110 120 150 Assets: Cash - Big Bank Cash - Little Bank Accounts Receivable Inventory Equipment 200 210 215 220 225 Liabilities: Accounts Payable Note Payable - Big Bank Note Payable - Little Bank Interest Payable - Big Bank Interest Payable - Little Bank 300 Equity: Common Stock Retained Earnings 305 Revenues: Sales Revenue 400 500 510 515 520 Expenses: Cost of Goods Sold Rent Expense Wages Expense Interest Expense + E1 - 11 1 11 merge & Center Xfx 990 Account Name Posted 2021 Month-Day 3-1 Debit Credit Account Number 100 300 55,000.00 Cash - Big Bank Common Stock Issue additional Common Stock X X 55,000.00 3-1 215 225 100 100 60,000.00 450.00 Note Payable - Little Bank Interest Payable - Little Bank Cash - Big Bank Cash - Big Bank pay interest on note Rent Expense Cash - Big Bank Payment of rent expense X X X X 60,000.00 450.00 3-1 510 100 4,800.00 4,800.00 3-2 100 110 88,000.00 Cash - Big Bank Accounts Receivable customer paid cash xx 88,000.00 3-10 105 400 XX 72,500.00 72,500.00 3-10 Cash - little bank Sales revenue inventory sold Cost of goods sold Inventory inventory purchased 500 120 X X 23,000.00 23,000.00 3-15 105 515 Wages expense Cash - little bank wages paid from little bank 26,000.00 X X 26,000.00 3-16 120 200 Inventory Accounts payable inventory purchased 77,500.00 77,500.00 Directions 3-10 500 120 23,000.00 Cost of goods sold Inventory inventory purchased XX 23,000.00 3-15 105 515 26,000.00 Wages expense Cash - little bank wages paid from little bank 26,000.00 3-16 120 77,500.00 Inventory Accounts payable inventory purchased 200 X X 77,500.00 3-17 110 400 xx 115,000.00 115,000.00 Accounts receivable Sales revenue inventory sold Cost of goods sold Inventory 3-17 500 120 X 33,000.00 33,000.00 OverPriced Jeans, Inc. - General Journal Page # 2 2021 Month-Day Account Number Posted Debit Account Name cost of inventory sold Credit 3-20 110 105 400 X X X 130,000.00 35,500.00 Accounts receivable Cash - little bank Sales revenue inventory sold Cost of goods sold Inventory cost of inventory sold 165,500.00 3-20 500 120 42,750.00 42,750.00 3-22 120 Inventory 42 nnnnn 105 400 x x 35,500.00 165,500.00 3-20 Cash - little bank Sales revenue inventory sold Cost of goods sold Inventory cost of inventory sold 500 120 XX 42,750.00 42,750.00 3-22 120 100 Inventory Cash - big bank inventory purchased XX 42,000.00 42,000.00 3-26 200 100 Accounts payable Cash - big bank cash paid to manufaccturer XX 38,750.00 38,750.00 3-30 515 105 x x 28,500.00 3-31 Wages expense Cash - little bank wages paid from little bank Interest expense Interest payable - big bank interest payable on march 31 28,500.00 520 225 1,590.00 1,590.00 OverPriced Jeans, Inc. Tiya Patel General Ledger Account # 100 Cash - Big Bank b 2021 Month-Day De Gc Journal Page # Debit Credit ac Beginning Balance Balance 3-1 3-1 3-1 1 76,000.00 55,000.00 3-1 1 - 1 60,000.00 450.00 4,800.00 3-1 3-2. 3-22 3-26 1 76,000.00 Dr 131,000.00 Dr 71,000.00 Dr 70,550.00 Dr 65,750.00 Dr 153,750.00 Dr 111,750.00 Dr 73,000.00 Dr 1 88,000.00 2 2 42,000.00 38,750.00 Account # 105 Cash - Little Bank Journal Page Debit Beginning Balance Credit 2021 Month-Day 3-1 3-10 3-15 3-20 3-30 Balance 1 1 27,000.00 72,500.00 26,000.00 NN 35,500.00 27,000.00 Dr 99,500.00 Dr 73,500.00 Dr 109,000.00 Dr 80,500.00 Dr 28,500.00 Account # 110 Account # 110 Accounts Receivable Journal Page # Debit Credit Beginning Balance 2021 Month-Day 3-1 3-2 3-17 3-20 158,000.00 1 88,000.00 Balance 158,000.00 D 70,000.00 DO 185,000.00 DO 315,000.00 Dr 1 115,000.00 130,000.00 N Account # 120 Inventory Journal Page # Credit Beginning Balance Debit 36,000.00 2021 Month-Day 3-1 3-10 3-16 3-17 3-20 3-22 1 1 1 23,000.00 77,500.00 Balance 36,000.00 Dr 13,000.00 Dr 90,500.00 Dr 57,500.00 Dr 14,750.00 Dr 56,750.00 Dr 2 2 33,000.00 42,750.00 42,000.00+ Account # 150 Equipment 2021 Month Day 3-1 Journal Page # Beginning Balance Credit Debit 60,000.00 Balance 60,000.00 Dr Account # 200 Accounts Payable Journal Debit Credit Balance Page # 2021 Month-Day 3-1 3-16 3-26 Beginning Balance 0.00 77,500.00 1 2 0.00 Cr 77,500.00 Cr 38,750.00 Cr 38,750.00 Account # 210 Note Payable - Big Bank 2021 Month-Day 3-1 Journal Page # Debit Credit Balance Beginning Balance 65,000.00 65,000.00 Cr Account # 215 Note Payable - Little Bank 2021 Month-Day 3-1 Journal Page 1 Beginning Balance Debit - 60,000.00 Credit 60,000.00 3-1 Balance 60,000.00 C 0.00 Cr 1 Account # 220 Interest Payable - Big Bank 2021 Month-Day 3-1 3-31 Journal Page 1 Debit Balance Beginning Balance Credit 600.00 1,590.00 2 600.00 Cr 2,190.00 C Directions | ranh Payable - Big Bank 2021 Month-Day 3-1 3-31 Journal Page # Debit Credit Beginning Balance Balance 2. 600.00 1,590.00 600.00 2,190.00 Account # 225 Interest Payable - Little Bank 2021 Month-Day 3-1 3-1 Journal Page # Debit Credit Beginning Balance Balance 450.00 1 450.00 450.00 Cr 0.00 Cr Account # 300 Common Stock 2021 Month-Day 3-1 3-1 Journal Page # Debit Credit Beginning Balance Balance 1 75,000.00 55,000.00 75,000.00 CT 130,000.00 C Account # 305 Retained Earnings 2021 Month-Day 3-1 Journal Page # Debit Beginning Balance Credit 155,950.00 Balance 155,950.00 C Directions Trans Chart Accts Journal GIAset Account # 400 Sales Revenue Journal Page # Debit Credit Balance Beginning Balance 2021 Month-Day 3-1 3-10 3-17 3-20 3-31 1 1 0.00 72,500.00 115,000.00 165,500.00 0.00 Cr 72,500.00 Cr 187,500.00 Cr 353,000.00 Cr 0.00 Cr N N 353,000.00 Account # 500 Cost of Goods Sold 2021 Month-Day 3-1 Journal Page # Debit Credit Balance Beginning Balance 1 3-10 3-17 3-20 0.00 23,000.00 33,000.00 42,750.00 1 0.00 Dr 23,000.00 Dr +56,000.00 Dr 98,750.00 Dr 2 Account # 510 Rent Expense 2021 Month-Day 3-1 3-1 Journal Page 8 Credit Beginning Balance Debit 0.00 4,800.00 Balance 0.00 Dr 4,800.00 Dr 1 Account # 510 Rent Expense 2021 Month-Day 3-1 3-1 Journal Page# Debit Credit Balance Beginning Balance 1 0.001 4,800.00 0.00 Dr 4,800.00 Dr Account # 515 Wages Expense 2021 Month-Day 3-1 Journal Page# Debit Credit Beginning Balance Balance 3-15 3-30 1 2 0.00 26,000.00 28,500.00 0.00 Dr 26,000.00 Dr 54,500.00 Dr Account # 520 Interest Expense 2021 Month Day 3-1 3-31 Journal Page Debit Credit Beginning Balance 2 0.00 1,590.00 Balance 0.00 Dr 1,590.00 Dr OPJ's - March 31, 2021 Pre-Closing Trial Balance Enter amounts in Do NOT copy cel Account # Account Name Debit Credit 73,000.00 80,500.00 315,000.00 56,750.00 60,000.00 100 105 110 120 150 200 210 215 220 225 300 305 400 500 510 515 520 Cash - Big Bank Cash - Little Bank Accounts Receivable Inventory Equipment Accounts Payable Note Payable - Big Bank Note Payable - Little Bank Interest Payable - Big Bank Interest Payable - Little Bank Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Rent Expense Wages Expense Interest Expense 38,750.00 65,000.00 0.00 2,190.00 0.00 130,000.00 155,950.00 353,000.00 98,750.00 4,800.00 54,500.00 1,590.00 744,890.00 Totals 744,890.00 + Overpriced Jeans, Inc. Income Statement for the Month Ended March 31, 2021 Sales Revenue Cost of Goods Sold $353,000.00 (98,750.00) 254,250.00 Gross Profit Expenses: Rent Expense Wages Expense Interest Expense (4,800.00) (54,500.00) (1,590.00) (60,890.00) $193,360.00 Total Expenses Net Income Calculation of Retained Earnings as of March 31 for the Balance Sheet Retained Eamings Current Balance Plus March Net Income 155,950.00 193,360.00 Retained Eamings as of March 31 for Balance Sheet 349,310.00 Jeans, Inc. Balance Sheet as of March 31, 2021 Enter Do NC Assets Cash - Big Bank Cash - Little Bank Accounts Receivable Inventory Equipment $73,000.00 80,500.00 315,000.00 56,750.00 60,000.00 Total Assets $585,250.00 Liabilities Accounts Payable Note Payable - Big Bank Note Payable - Little Bank Interest Payable - Big Bank Interest Payable - Little Bank $116,250.00 65,000.00 0.00 2,190.00 0.00 Total Liabilities 183,440.00 Equity: Common Stock Retained Eamings 130,000.00 349,310.00 Total Equity 479,310.00 Total Liabilities & Equity $662,750.00