I really need help and I was wondering if you could help me with my my accounting exercise? Its from the book Learning Sage 50 Accounting 2018 A Modular Approach.

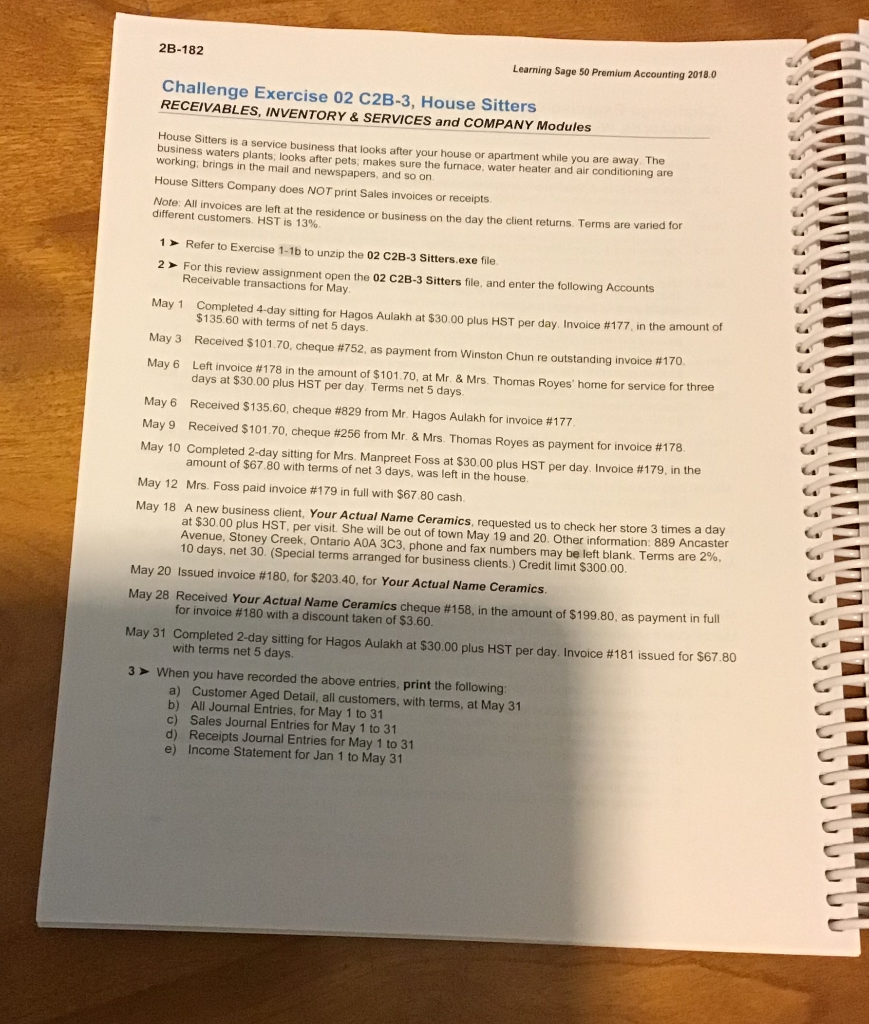

2B-182 Learning Sage 50 Premium Accounting 2018.0 Challenge Exercise 02 C2B-3, House Sitters RECEIVABLES, INVENTORY & SERVICES and COMPANY Modules House Sitters is a service business waters plants lok tt looks after your house working, brings in the mail and newspapers ure the furnace, water heater and air conditioning are apartment while you are away. The on House Sitters Company does NOT print Sales invoices or receipts Note: All invoices are let different customers. HST ic residence or business on the day the client returns. Terms are varied for Refer to Exercise 1-1b to unzip the 02 C2B-3 Sitters.exe file. For this review ass Receivable transactions o 2 the 02 C28-3 sitters file, and enter the following Accounts May May 1 pleted 4-day sitting for Hagos Aulakh at $30.00 plus HST per day. Invoice # 177 n the amount of $135.6 with terms of net 5 days May 3 Received $101.70, cheque #752, as payment from Winston Chun outstanding invoice #170 t$30.00 nlu amount of $101.70, at Mr. & Mrs. Thomas Royes' home for service for three days a Left invoice #178 May 6 HST per day. Terms net 5 days May 6 Received $135.60, cheque #829 from Mr. Hagos Aulakh for invoice #177 Received $101.70, cheque #256 from Mr. & Mrs. Thomas Royes as payment for invoice # 178 May 9 May 10 C mpleted 2-day sitting for Mrs. Manpreet Foss at $30.00 plus HST per day. Invoice #179, in the amount of $67.80 with terms of net 3 days, was left in the house May 12 Mrs. Foss paid invoice # 179 in full with $67.80 cash at $30 oo ess client, Your Actual Name Ceramics, requested us to Avenue, Stoney per visit. She will be out of town May 19 and 20 O ck her store 3 times a day 10 days, net 30. (Special terms arranged for business clients.) Credit limit $300.00. May 18 A new 889 Ancaster AOA 3C3, phone and fax numbers may be left blank. Terms are 2%, May 20 Issued invoice #180, for $203.40, for Your Actual Name Ceramics. May 28 Received Your Actual Name Ceramics cheque #158 , in the amount of $199.80, as payment in full for invoice #180 with a discount taken of $3.60. May 31 Completed 2-day sitting for Hagos Aulakh at $30.00 plus HST per day. Invoice #181 issued for $67.80 days with terms ne When you have recorded the above entries, print the following a) Customer Aged Detail, all customers, with terms, at May 31 b) All Journal Entries, for May 1 to 31 c) Sales Journal Entries for May 1 to 31 d) Receipts Journal Entries for May 1 to 31 e) Income Statement for Jan 1 to May 31 3 OOOOODDDD AA 2B-182 Learning Sage 50 Premium Accounting 2018.0 Challenge Exercise 02 C2B-3, House Sitters RECEIVABLES, INVENTORY & SERVICES and COMPANY Modules House Sitters is a service business waters plants lok tt looks after your house working, brings in the mail and newspapers ure the furnace, water heater and air conditioning are apartment while you are away. The on House Sitters Company does NOT print Sales invoices or receipts Note: All invoices are let different customers. HST ic residence or business on the day the client returns. Terms are varied for Refer to Exercise 1-1b to unzip the 02 C2B-3 Sitters.exe file. For this review ass Receivable transactions o 2 the 02 C28-3 sitters file, and enter the following Accounts May May 1 pleted 4-day sitting for Hagos Aulakh at $30.00 plus HST per day. Invoice # 177 n the amount of $135.6 with terms of net 5 days May 3 Received $101.70, cheque #752, as payment from Winston Chun outstanding invoice #170 t$30.00 nlu amount of $101.70, at Mr. & Mrs. Thomas Royes' home for service for three days a Left invoice #178 May 6 HST per day. Terms net 5 days May 6 Received $135.60, cheque #829 from Mr. Hagos Aulakh for invoice #177 Received $101.70, cheque #256 from Mr. & Mrs. Thomas Royes as payment for invoice # 178 May 9 May 10 C mpleted 2-day sitting for Mrs. Manpreet Foss at $30.00 plus HST per day. Invoice #179, in the amount of $67.80 with terms of net 3 days, was left in the house May 12 Mrs. Foss paid invoice # 179 in full with $67.80 cash at $30 oo ess client, Your Actual Name Ceramics, requested us to Avenue, Stoney per visit. She will be out of town May 19 and 20 O ck her store 3 times a day 10 days, net 30. (Special terms arranged for business clients.) Credit limit $300.00. May 18 A new 889 Ancaster AOA 3C3, phone and fax numbers may be left blank. Terms are 2%, May 20 Issued invoice #180, for $203.40, for Your Actual Name Ceramics. May 28 Received Your Actual Name Ceramics cheque #158 , in the amount of $199.80, as payment in full for invoice #180 with a discount taken of $3.60. May 31 Completed 2-day sitting for Hagos Aulakh at $30.00 plus HST per day. Invoice #181 issued for $67.80 days with terms ne When you have recorded the above entries, print the following a) Customer Aged Detail, all customers, with terms, at May 31 b) All Journal Entries, for May 1 to 31 c) Sales Journal Entries for May 1 to 31 d) Receipts Journal Entries for May 1 to 31 e) Income Statement for Jan 1 to May 31 3 OOOOODDDD AA