Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I really need help checking my answers on these. This is my last test and I can't post my questions separately! Any help at all

I really need help checking my answers on these.

This is my last test and I can't post my questions separately! Any help at all would be greatly appreciated.

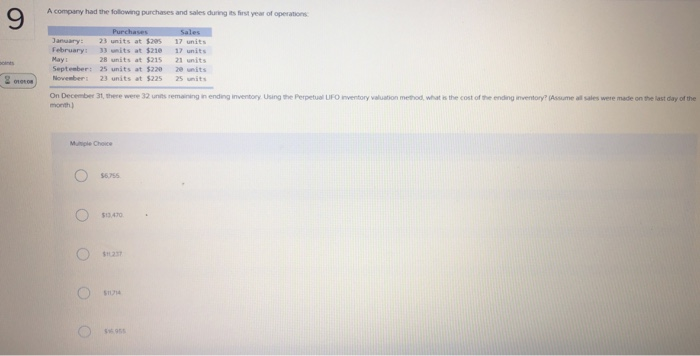

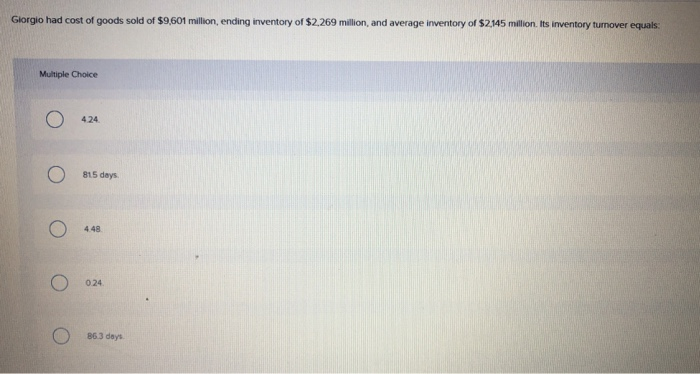

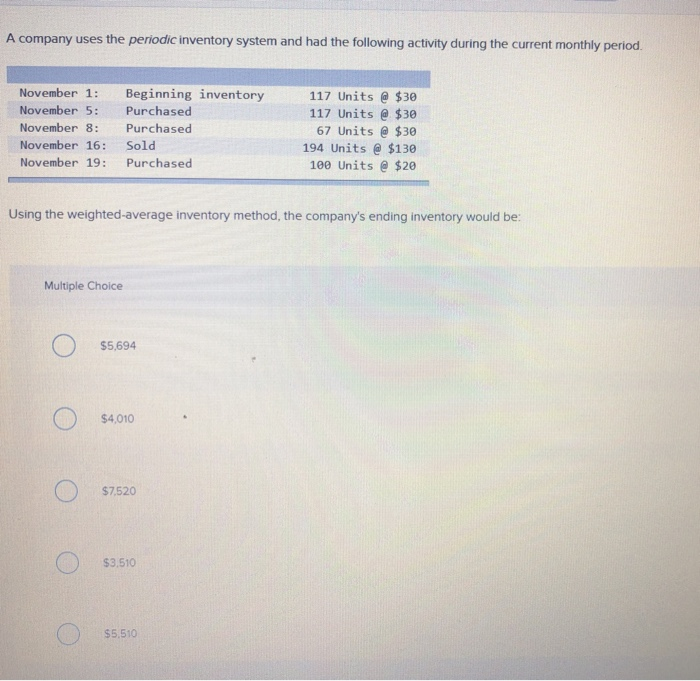

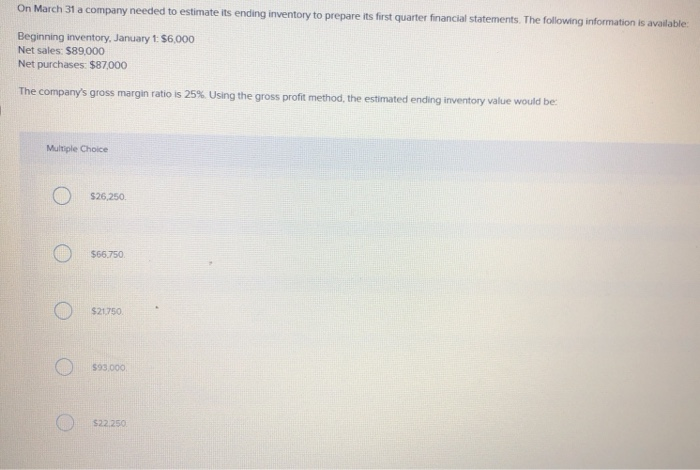

A company had the following purchases and sales during its first year of operations January 23 units at $20517 units February: 33 units at $210 17 units May 28 units at $215 21 units September: 25 units at $220 20 units November 23 units at $225 25 units On December 3, there were 32 units remaining in ending inventory Using Giorgio had cost of goods sold of $9,601 million, ending inventory of $2,269 million, and average inventory of $2,145 million. Its inventory turnover equals Multiple Choice 424. O 815 days 024. 863 A company uses the periodic inventory system and had the following activity during the current monthly period. November 1: November 5: November 8: November 16: November 19: Beginning inventory Purchased Purchased Sold Purchased 117 Units @ $30 117 Units @ $30 67 Units @ $30 194 Units @ $130 100 Units @ $20 Using the weighted average inventory method, the company's ending inventory would be: Multiple Choice $5,694 O $4,010 O O $3.510 O $5.510 O On March 31 a company needed to estimate its ending inventory to prepare its first quarter financial statements. The following information is available Beginning inventory, January 1: $6,000 Net sales: $89.000 Net purchases $87,000 The company's gross margin ratio is 25%. Using the gross profit method, the estimated ending inventory value would be Multiple Choice o O s26,250. o O S66,750. o $21,750. o O s93. , o 220Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started