Answered step by step

Verified Expert Solution

Question

1 Approved Answer

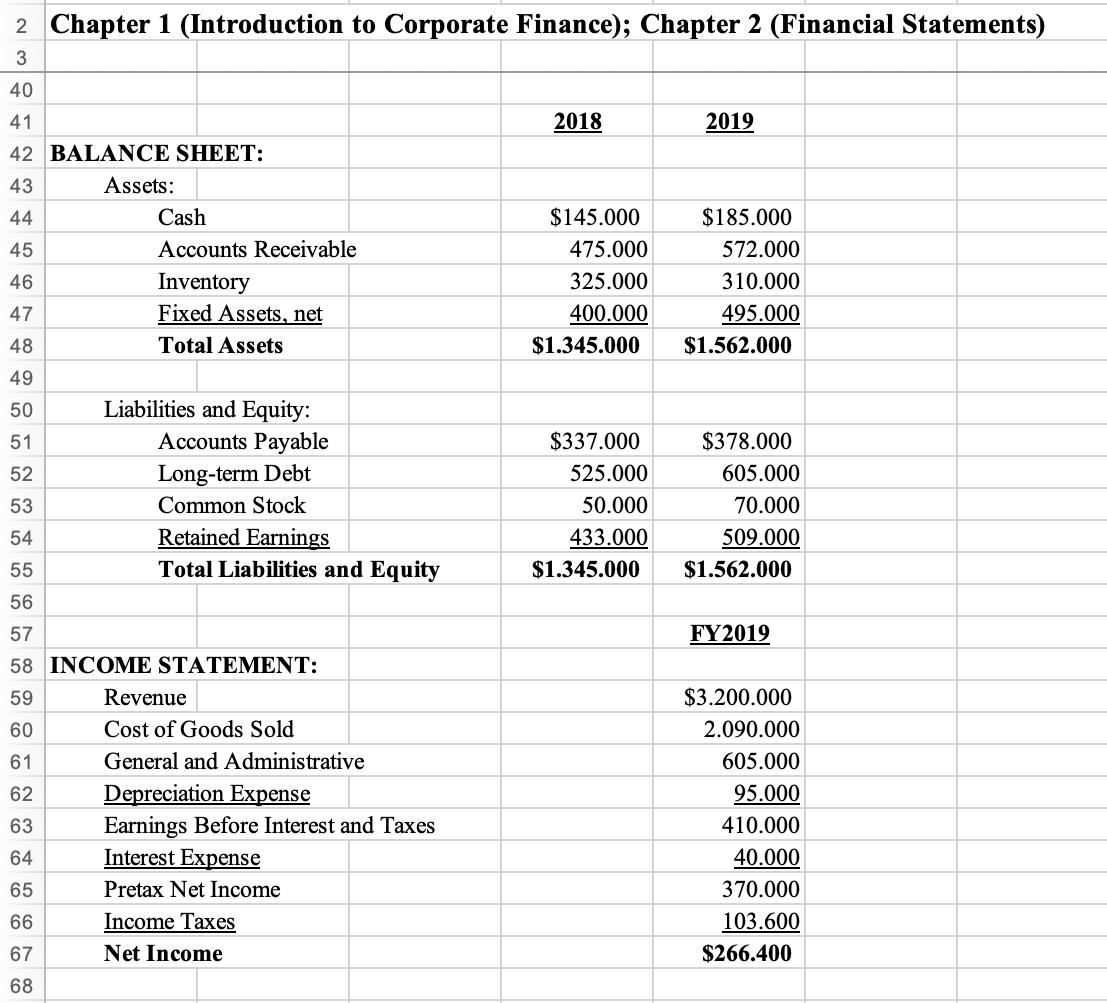

I really need help with these questions, can anyone help me, please? Chapter 1 (Introduction to Corporate Finance); Chapter 2 (Financial Statements) Chapter 1 (Introduction

I really need help with these questions, can anyone help me, please?

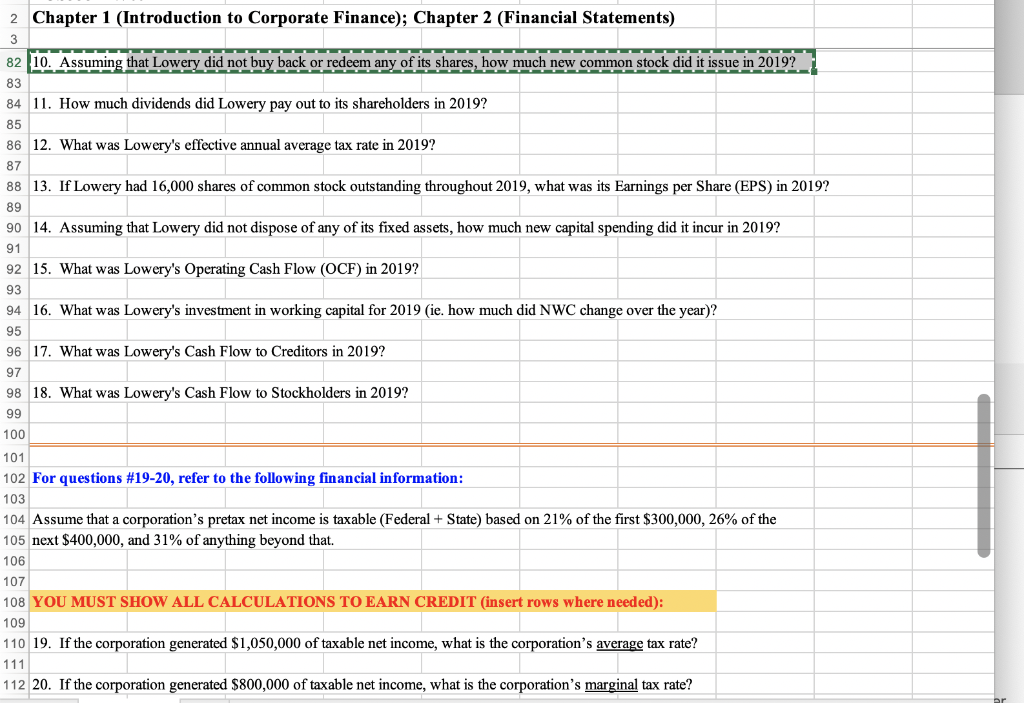

Chapter 1 (Introduction to Corporate Finance); Chapter 2 (Financial Statements) Chapter 1 (Introduction to Corporate Finance); Chapter 2 (Financial Statements) 10. Assuming that Lowery did not buy back or redeem any of its shares, how much new common stock did it issue in 2019 ? 11. How much dividends did Lowery pay out to its shareholders in 2019 ? 12. What was Lowery's effective annual average tax rate in 2019? 13. If Lowery had 16,000 shares of common stock outstanding throughout 2019, what was its Earnings per Share (EPS) in 2019? 14. Assuming that Lowery did not dispose of any of its fixed assets, how much new capital spending did it incur in 2019 ? 15. What was Lowery's Operating Cash Flow (OCF) in 2019? 16. What was Lowery's investment in working capital for 2019 (ie. how much did NWC change over the year)? 17. What was Lowery's Cash Flow to Creditors in 2019? 18. What was Lowery's Cash Flow to Stockholders in 2019 ? For questions #19-20, refer to the following financial information: Assume that a corporation's pretax net income is taxable (Federal + State) based on 21% of the first $300,000,26% of the 105 next $400,000, and 31% of anything beyond that. 106 107 108 YOU MUST SHOW ALL CALCULATIONS TO EARN CREDIT (insert rows where needed): 109 110 19. If the corporation generated $1,050,000 of taxable net income, what is the corporation's average tax rate? 111 112 20. If the corporation generated $800,000 of taxable net income, what is the corporation's marginal tax rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started