I really need help with this problem. Please if someone could answer it.

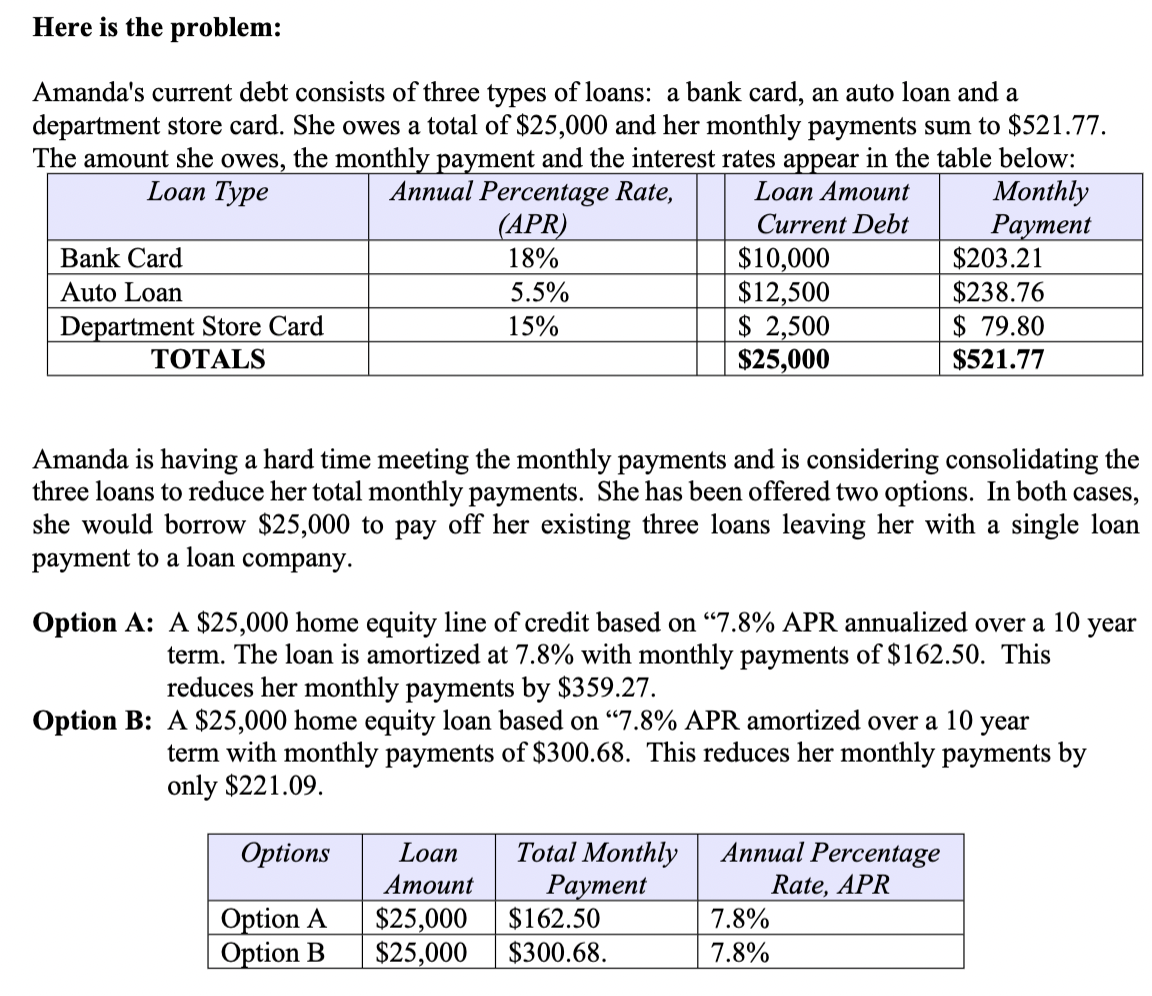

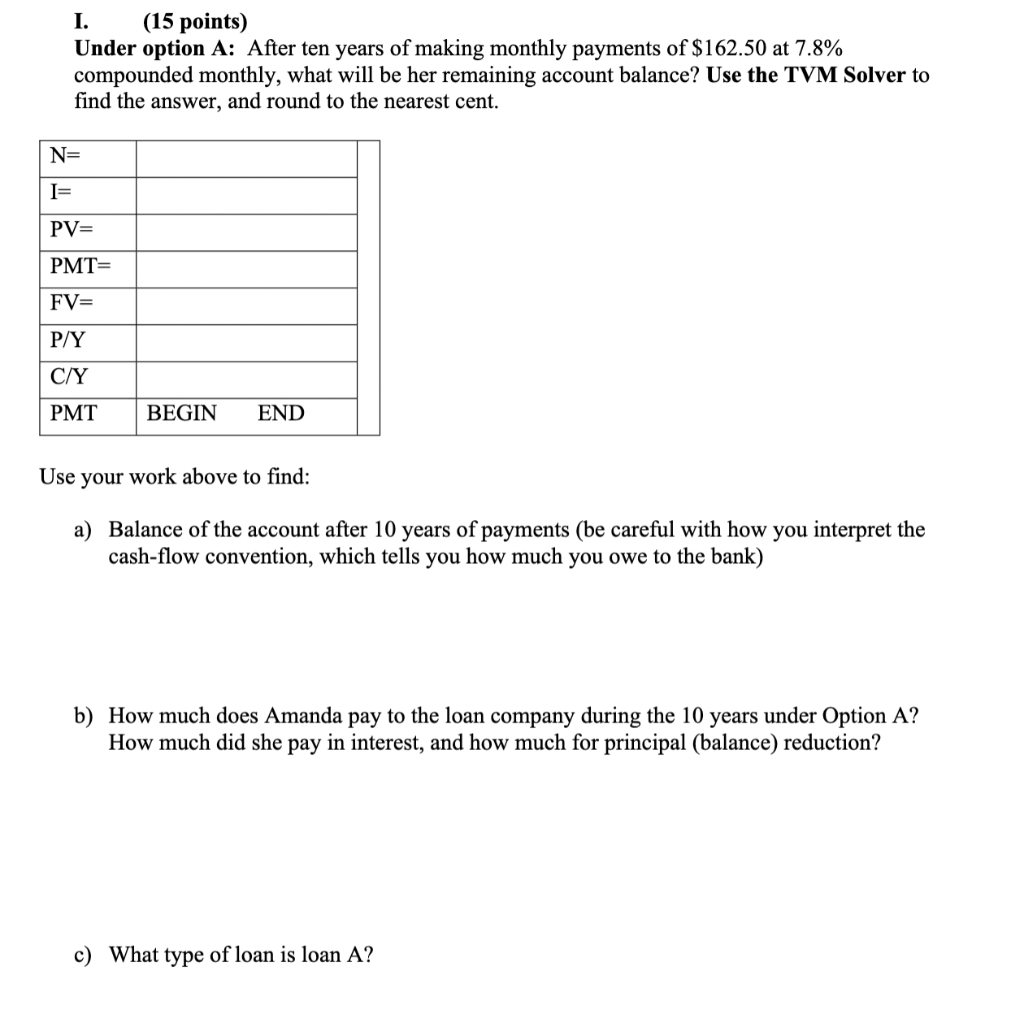

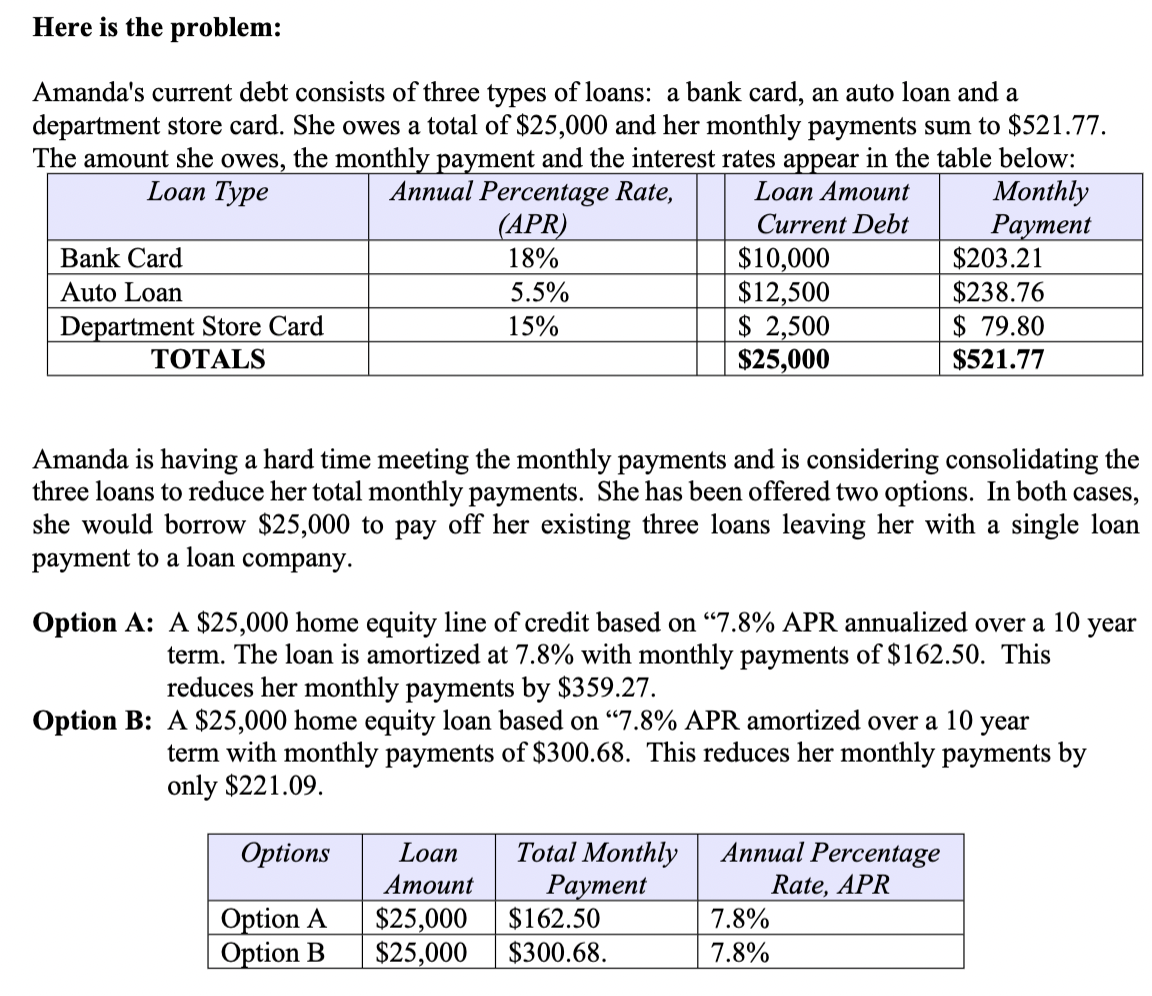

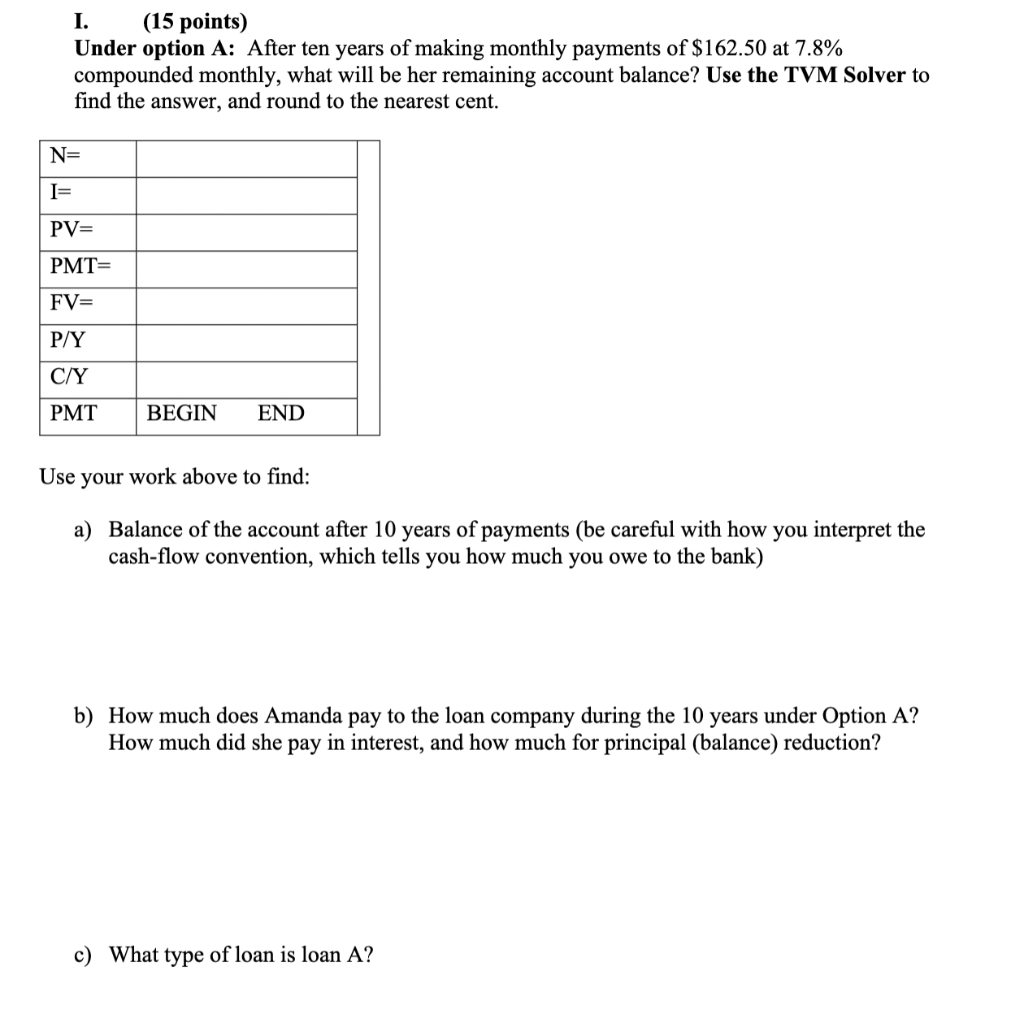

Here is the problem: Amanda's current debt consists of three types of loans: a bank card, an auto loan and a department store card. She owes a total of $25,000 and her monthly payments sum to $521.77. The amount she owes, the monthly payment and the interest rates appear in the table below: Amanda is having a hard time meeting the monthly payments and is considering consolidating the three loans to reduce her total monthly payments. She has been offered two options. In both cases, she would borrow $25,000 to pay off her existing three loans leaving her with a single loan payment to a loan company. Option A: A $25,000 home equity line of credit based on " 7.8% APR annualized over a 10 year term. The loan is amortized at 7.8% with monthly payments of $162.50. This reduces her monthly payments by $359.27. Option B: A $25,000 home equity loan based on "7.8\% APR amortized over a 10 year term with monthly payments of $300.68. This reduces her monthly payments by only $221.09. I. (15 points) Under option A: After ten years of making monthly payments of $162.50 at 7.8% compounded monthly, what will be her remaining account balance? Use the TVM Solver to find the answer, and round to the nearest cent. Use your work above to find: a) Balance of the account after 10 years of payments (be careful with how you interpret the cash-flow convention, which tells you how much you owe to the bank) b) How much does Amanda pay to the loan company during the 10 years under Option A? How much did she pay in interest, and how much for principal (balance) reduction? c) What type of loan is loan A ? Here is the problem: Amanda's current debt consists of three types of loans: a bank card, an auto loan and a department store card. She owes a total of $25,000 and her monthly payments sum to $521.77. The amount she owes, the monthly payment and the interest rates appear in the table below: Amanda is having a hard time meeting the monthly payments and is considering consolidating the three loans to reduce her total monthly payments. She has been offered two options. In both cases, she would borrow $25,000 to pay off her existing three loans leaving her with a single loan payment to a loan company. Option A: A $25,000 home equity line of credit based on " 7.8% APR annualized over a 10 year term. The loan is amortized at 7.8% with monthly payments of $162.50. This reduces her monthly payments by $359.27. Option B: A $25,000 home equity loan based on "7.8\% APR amortized over a 10 year term with monthly payments of $300.68. This reduces her monthly payments by only $221.09. I. (15 points) Under option A: After ten years of making monthly payments of $162.50 at 7.8% compounded monthly, what will be her remaining account balance? Use the TVM Solver to find the answer, and round to the nearest cent. Use your work above to find: a) Balance of the account after 10 years of payments (be careful with how you interpret the cash-flow convention, which tells you how much you owe to the bank) b) How much does Amanda pay to the loan company during the 10 years under Option A? How much did she pay in interest, and how much for principal (balance) reduction? c) What type of loan is loan A