Answered step by step

Verified Expert Solution

Question

1 Approved Answer

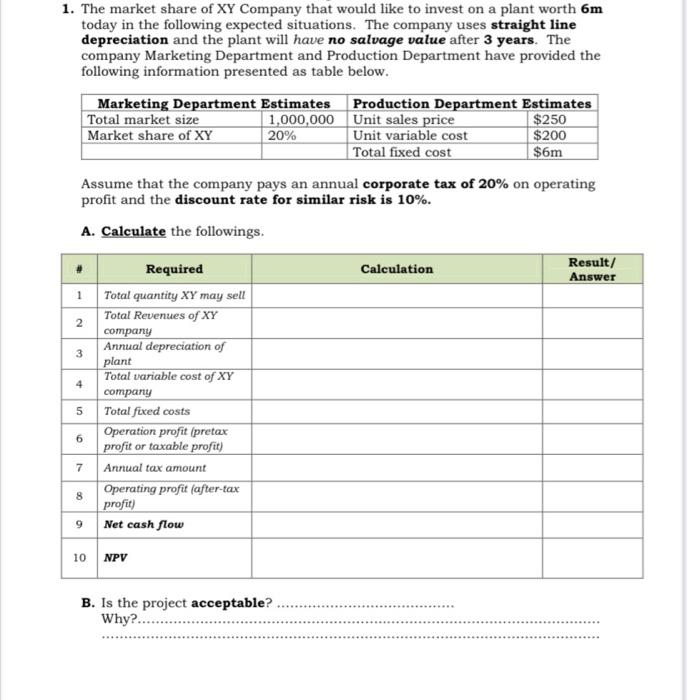

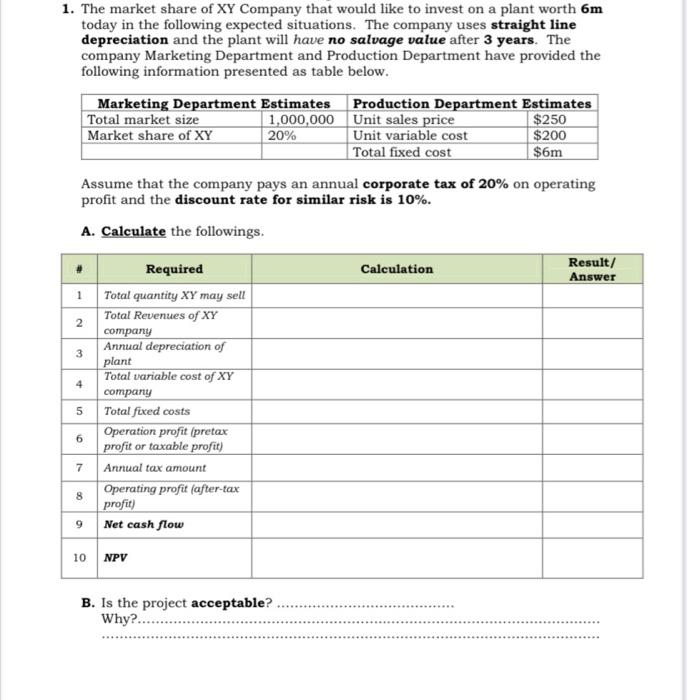

I really need help with this question 1. The market share of XY Company that would like to invest on a plant worth 6m today

I really need help with this question

1. The market share of XY Company that would like to invest on a plant worth 6m today in the following expected situations. The company uses straight line depreciation and the plant will have no salvage value after 3 years. The company Marketing Department and Production Department have provided the following information presented as table below. Marketing Department Estimates Production Department Estimates Total market size 1,000,000 Unit sales price $250 Market share of XY 20% Unit variable cost $200 Total fixed cost $6m Assume that the company pays an annual corporate tax of 20% on operating profit and the discount rate for similar risk is 10%. A. Calculate the followings. Calculation Result/ Answer 3 4 Required 1 Total quantity XY may sell Total Revenues of XY 2 company Annual depreciation of plant Total variable cost of XY company 5 Total fixed costs Operation profit (pretax profit or taxable profit) 7 Annual tax amount Operating profit (after-tax profit) 9 Net cash flow 6 10 NPV B. Is the project acceptable? Why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started