i really need the t accounts and the table.

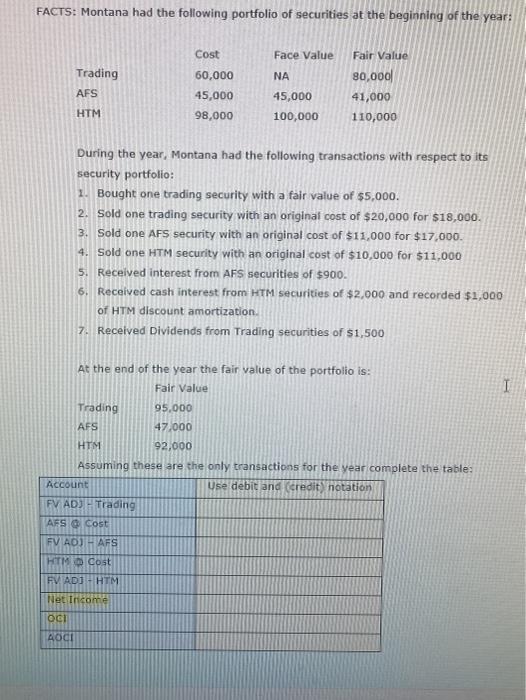

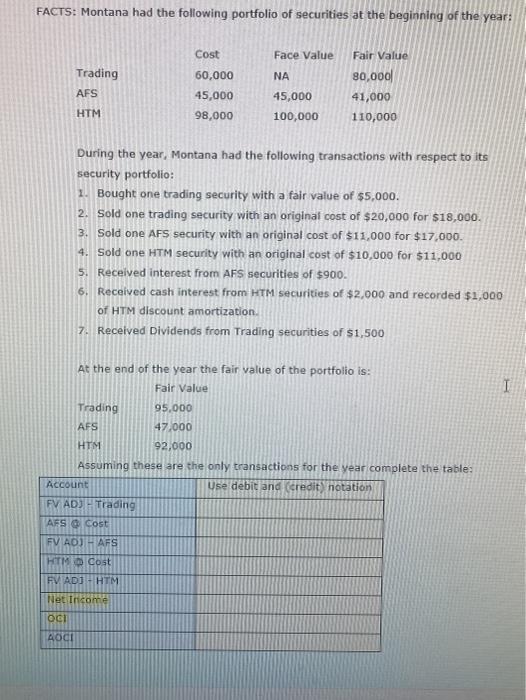

FACTS: Montana had the following portfolio of securities at the beginning of the year: Cost Face Value 60,000 NA Trading AFS Fair Value 80,000 41,000 110,000 45,000 98,000 45,000 100,000 HTM During the year, Montana had the following transactions with respect to its security portfolio: 1. Bought one trading security with a fair value of $5,000. 2. Sold one trading security with an original cost of $20,000 for $18,000. 3. Sold one AFS security with an original cost of $11,000 for $17,000. 4. Sold one HTM security with an original cost of $10,000 for $11,000 5. Received interest from AFS securities of $900. 6. Received cash interest from HTM securities of $2,000 and recorded $1,000 of HTM discount amortization. 7. Received Dividends from Trading securities of $1,500 I At the end of the year the fair value of the portfolio is: Fair Value Trading 95.000 AFS 47.000 HTM 92,000 Assuming these are the only transactions for the year complete the table: Account Use debit and credit notation FV ADJH Trading AFS O cost FV ADI HAFS HTM Cost FVADO HTM Net Income OGI AOCI FACTS: Montana had the following portfolio of securities at the beginning of the year: Cost Face Value 60,000 NA Trading AFS Fair Value 80,000 41,000 110,000 45,000 98,000 45,000 100,000 HTM During the year, Montana had the following transactions with respect to its security portfolio: 1. Bought one trading security with a fair value of $5,000. 2. Sold one trading security with an original cost of $20,000 for $18,000. 3. Sold one AFS security with an original cost of $11,000 for $17,000. 4. Sold one HTM security with an original cost of $10,000 for $11,000 5. Received interest from AFS securities of $900. 6. Received cash interest from HTM securities of $2,000 and recorded $1,000 of HTM discount amortization. 7. Received Dividends from Trading securities of $1,500 I At the end of the year the fair value of the portfolio is: Fair Value Trading 95.000 AFS 47.000 HTM 92,000 Assuming these are the only transactions for the year complete the table: Account Use debit and credit notation FV ADJH Trading AFS O cost FV ADI HAFS HTM Cost FVADO HTM Net Income OGI AOCI

i really need the t accounts and the table.

i really need the t accounts and the table.