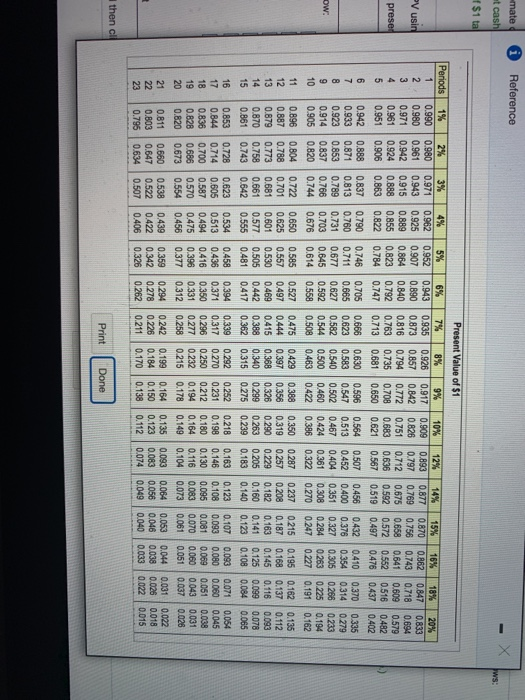

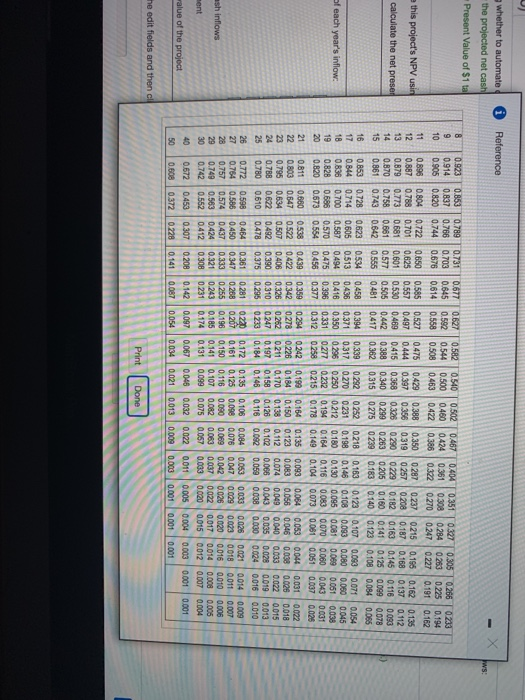

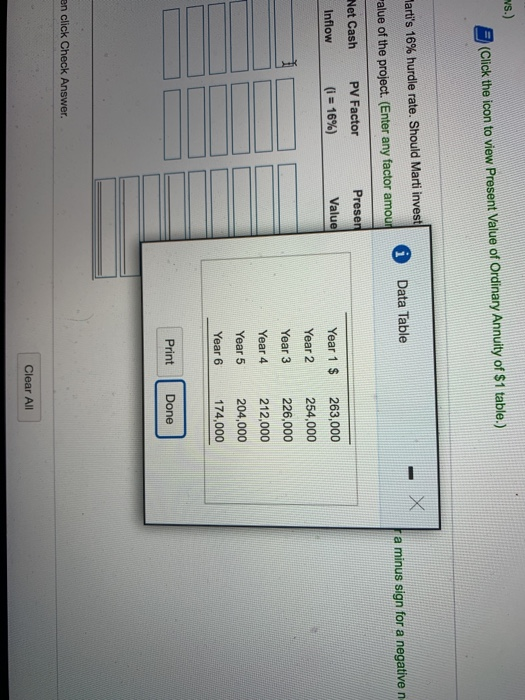

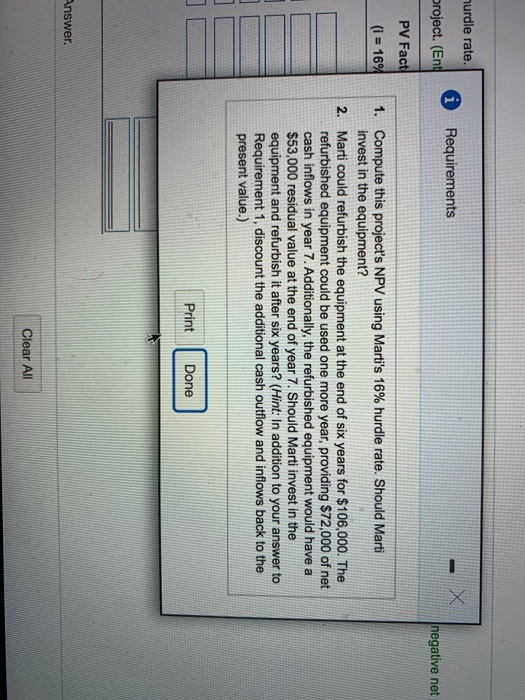

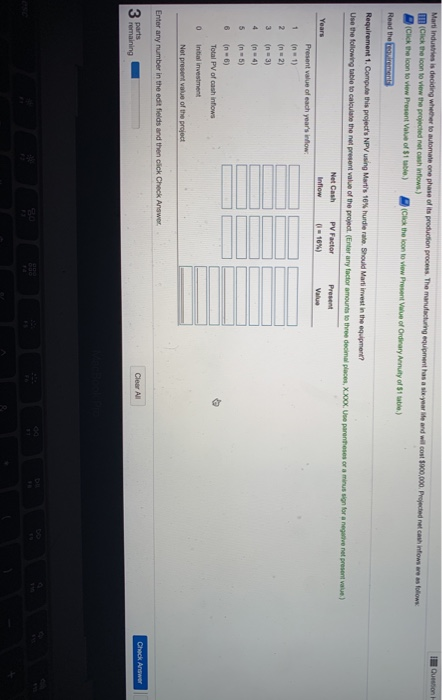

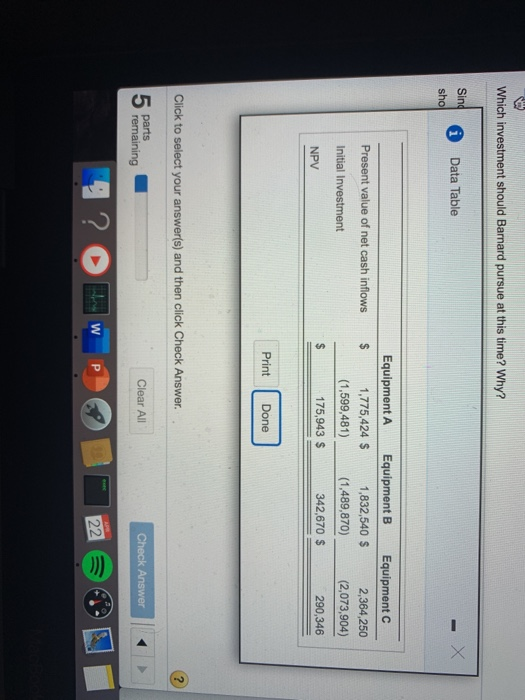

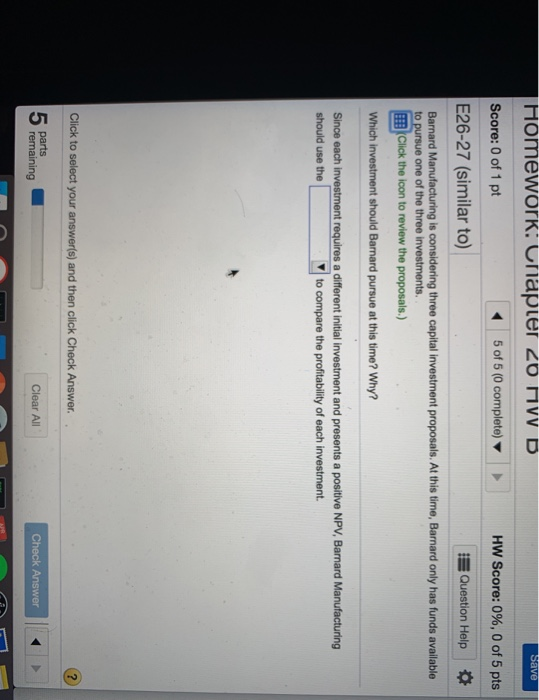

i Reference mate et cash of $1 ta Periods V usin 1% 0.990 0.980 0.971 0.961 0.951 0.942 2% 0.980 0.961 0.942 0.924 0.906 0.888 3% 0.971 0.943 0.915 0.888 0.863 0.837 20% 0.833 Present Value of $1 7% 8% 9% 0.935 0.926 0.917 0.873 0.857 0.842 0.816 0.794 0.772 0.763 0.735 0.708 0.713 0.681 5% 0.952 0.907 0.864 0.823 0.784 0.746 0.711 6% 0.943 0.890 0.840 0.792 0.747 4% 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 10% 0.909 0.826 0.751 0.683 12% 0.893 0.797 0.712 0.636 15% 0.870 0.756 0.658 14% 0.877 0.769 0.675 0.592 16% 0.862 0.743 0.641 18% 0.847 0.718 0.609 prese ow: 0.184 0.170 0.138 then cl Print Done i Reference whether to automate the projected net cash Present Value of $1 ta this project's NPV usin calculate the net preser EN P of each year's inflow: 0.043 0.038 ANSON&AR & 8 0.053 0.047 0.042 ash inflows 0.069 0.06 0.020 0.017 0.016 0.014 0.014 0.009 0.0110.007 0.000 0.005 0.008 0.005 0.007 0.004 0.001 0.001 ent walue of the project 0.004 0.001 0.005 0.001 0.003 0.001 the edit fields and then cl wys.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Data Table a minus sign for a negativen Tarti's 16% hurdle rate. Should Marti invest Falue of the project. (Enter any factor amour Net Cash PV Factor Preser Inflow (i = 16%) Value Year 1 $ Year 2 Year 3 Year 4 263,000 254,000 226,000 212,000 204,000 174,000 Year 6 Print Done en click Check Answer. Clear All hurdle rate. i Requirements broject. (Ent negative net PV Fact (i = 16% 1. Compute this project's NPV using Marti's 16% hurdle rate. Should Marti invest in the equipment? Marti could refurbish the equipment at the end of six years for $106,000. The refurbished equipment could be used one more year, providing $72,000 of net cash inflows in year 7. Additionally, the refurbished equipment would have a $53,000 residual value at the end of year 7. Should Marti invest in the equipment and refurbish it after six years? (Hint: In addition to your answer to Requirement 1, discount the additional cash outflow and inflows back to the present value.) Print Done Answer. Clear All Que sont Marti Industries is deciding whether to automate one phase of its production process. The manufacturing woment has a Click the icon to view the projected net cash flows) Click the loon to view Present Value of Sw e ) Click the icon to view Present of Ordinary Annuity of year and cost 900.000 Projected net cashows w o w Read the avements Requirement 1. Compute this project's NPV using Martis 10% hurdlereShould Marti invest in the equipment? Use the following table to calculate the net present value of the project(Enter any factor amounts to three decimal places, XXOO. Years Net Cash Inflow PV Factor ( 16%) 1 2 3 Present value of each year's now (n = 1) n=2) (n = 3) in-4) (n = 5) in = 6) Total PV of cash infows initial investment O Not present value of the project Enter any number in the edit fields and then click Check Answer 3 remaining parts Clear All Check Answer Which investment should Barnard pursue at this time? Why? Sing sho Data Table Present value of net cash inflows Equipment A Equipment B $ 1,775,424 $ 1,832,540 $ (1,599,481) (1,489,870) 175,943 $ 342,670 $ Equipment C 2,364,250 (2,073,904) 290,346 Initial Investment NPV Print Done Click to select your answer(s) and then click Check Answer. 5 parts remaining Clear All Check Answer ? O p 22 Save Homework: Chapter 20 MVD Score: 0 of 1 pt 5 of 5 (0 complete) E26-27 (similar to) HW Score: 0%, 0 of 5 pts Question Help Barnard Manufacturing is considering three capital investment proposals. At this time, Barnard only has funds available to pursue one of the three investments. Click the icon to review the proposals.) Which investment should Barnard pursue at this time? Why? Since each investment requires a different initial investment and presents a positive NPV, Barnard Manufacturing should use the V to compare the profitability of each investment. Click to select your answer(s) and then click Check Answer. 5 remaining 5 parts Clear All Check Answer CA G the last two pictures were by accident sorry a the last two pictures were by accident sorry - Google S Gmail Google