Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I reposted the questions clearly my apologies FIN 470 - Assignment 815 1 MNO, Inc., a publicly traded manufacturing firm in the United States, has

I reposted the questions clearly my apologies

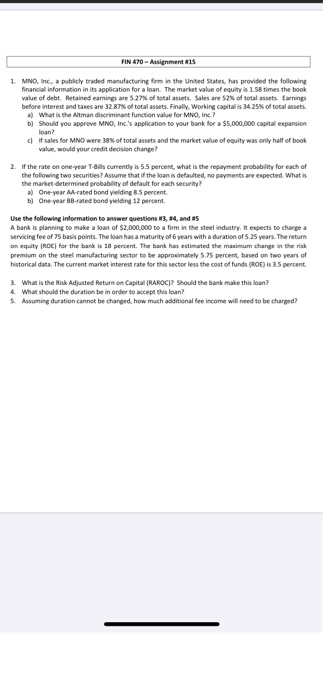

FIN 470 - Assignment 815 1 MNO, Inc., a publicly traded manufacturing firm in the United States, has provided the following financial information in its application for a loan. The market value of times the book value of debt Retained earnings are 5.27% of total Sales are 52% of total aring before interest and taxes are 327 of total l y working capital 3425 of total What is the Altmandiriant action value for MNO, Inc.? Should you prove MNO, Inc.'s application to your bank for a $.000.000 capital expansion on? sales for MNO were 38% of total assets and the market value of guy was only half of book w would your credit decision change? 2 m the one year 55 percent, the t e ach of the following two ? Assume that the development expected What the o od for each security? OneA bondang percent One d bonding 12 percent Use the following m ontow estions, and A bank is planning to make a loan of $2.000.000 a m the steel industry expect to charge vicing fee of this points. The banhaa maturity of an with a duration of 25 years. The return onuity for the bank 8 percent. The band has estimated the maximum change in the premium on the steel manufacturing sector to be approximately 5.75 percent based on two years of historical data. The current market interest rate for this sector less the cost of funds (ROE) is 35 percent What is the Risk Adjusted Return on Capital RAROCI? Should the bank make this loan? What should the duration be in order to accept this loan? Assuming duration cannot be changed, how much additional fee income will need to be charged Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started