Question

I request please answer to this question with proper explanation: (earlier someone answered to this question but it was wrong since he/she wrote 9% preference

I request please answer to this question with proper explanation:

(earlier someone answered to this question but it was wrong since he/she wrote 9% preference share capital but in real it is 8% preference share capital) please give a correct answer. I request please give a proper explanation)

The present capital structure of a company is as follows

Rs. Lakhs

Equity share capital (face value per share Rs.10) 10000

8% Preference Share Capital 5000

9% Non convertible Debentures 5000

11% Term loans 10000

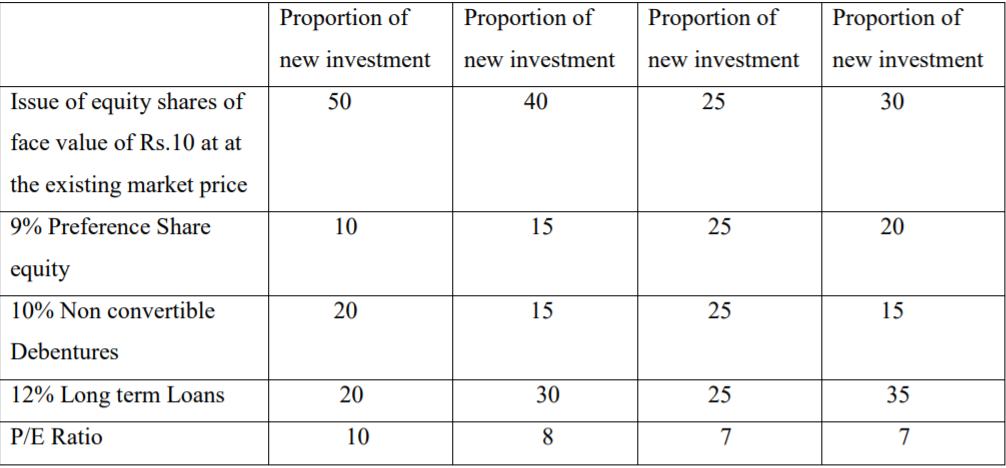

Its present return on capital employed is 25% The present market price per share is Rs.100 The rate of corporate tax is 25% It has a proposal under consideration which require additional financing to the extent of 50% of its existing capital employed. An investment in this proposal is expected to increase the return on capital employed to 35% of the total capital employed. The following alternative modes of investment are under consideration.

The management would like to adopt the alternative which will maximize the wealth of the shareholders. Keeping this objective in mind decide the best alternative.

\begin{tabular}{|l|c|c|c|c|} \hline & Proportion of new investment & Proportion of new investment & Proportion of new investment & Proportion of new investment \\ \hline Issue of equity shares of face value of Rs.10 at at the existing market price & 50 & 40 & 25 & 30 \\ \hline 9% Preference Share equity & 10 & 15 & 25 & 20 \\ \hline 10% Non convertible Debentures & 20 & 15 & 25 & 15 \\ \hline 12% Long term Loans & 20 & 30 & 25 & 35 \\ \hline P/E Ratio & 10 & 8 & & 7 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started