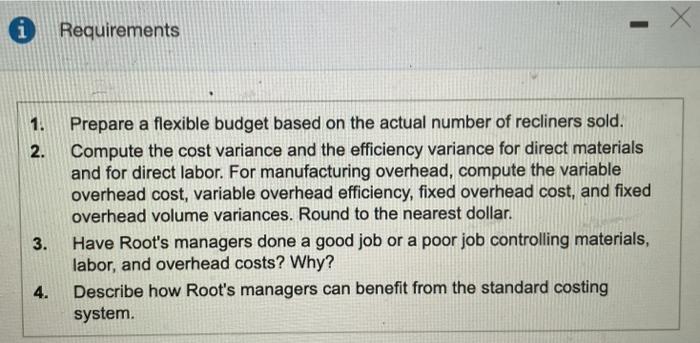

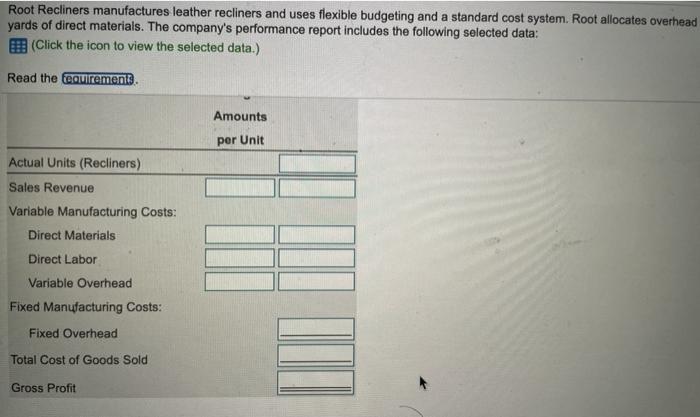

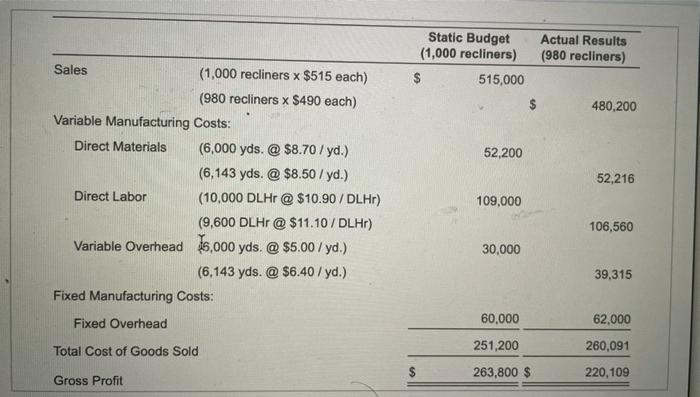

i Requirements 1. 2. Prepare a flexible budget based on the actual number of recliners sold. Compute the cost variance and the efficiency variance for direct materials and for direct labor. For manufacturing overhead, compute the variable overhead cost, variable overhead efficiency, fixed overhead cost, and fixed overhead volume variances. Round to the nearest dollar. Have Root's managers done a good job or a poor job controlling materials, labor, and overhead costs? Why? Describe how Root's managers can benefit from the standard costing system. 3. 4. Root Recliners manufactures leather recliners and uses flexible budgeting and a standard cost system. Root allocates overhead yards of direct materials. The company's performance report includes the following selected data: (Click the icon to view the selected data.) Read the fequirement Amounts per Unit Actual Units (Recliners) Sales Revenue Variable Manufacturing Costs: Direct Materials Direct Labor Variable Overhead Fixed Manufacturing Costs: Fixed Overhead Total Cost of Goods Sold HII Gross Profit Static Budget (1,000 recliners) $ 515,000 Actual Results (980 recliners) 480,200 52,200 Sales (1,000 recliners x $515 each) (980 recliners x $490 each) Variable Manufacturing Costs: Direct Materials (6,000 yds. @ $8.70 / yd.) (6,143 yds. @ $8.50 / yd.) Direct Labor (10,000 DLHr @ $10.90 / DLHr) (9,600 DLHr@ $11.10 / DLHr) Variable Overhead 16,000 yds @ $5.00 / yd.) (6,143 yds. @ $6.40 / yd.) Fixed Manufacturing Costs: 52,216 109,000 106,560 30,000 39,315 Fixed Overhead 60,000 62,000 Total Cost of Goods Sold 251,200 260,091 263,800 $ 220,109 Gross Profit i Requirements 1. 2. Prepare a flexible budget based on the actual number of recliners sold. Compute the cost variance and the efficiency variance for direct materials and for direct labor. For manufacturing overhead, compute the variable overhead cost, variable overhead efficiency, fixed overhead cost, and fixed overhead volume variances. Round to the nearest dollar. Have Root's managers done a good job or a poor job controlling materials, labor, and overhead costs? Why? Describe how Root's managers can benefit from the standard costing system. 3. 4. Root Recliners manufactures leather recliners and uses flexible budgeting and a standard cost system. Root allocates overhead yards of direct materials. The company's performance report includes the following selected data: (Click the icon to view the selected data.) Read the fequirement Amounts per Unit Actual Units (Recliners) Sales Revenue Variable Manufacturing Costs: Direct Materials Direct Labor Variable Overhead Fixed Manufacturing Costs: Fixed Overhead Total Cost of Goods Sold HII Gross Profit Static Budget (1,000 recliners) $ 515,000 Actual Results (980 recliners) 480,200 52,200 Sales (1,000 recliners x $515 each) (980 recliners x $490 each) Variable Manufacturing Costs: Direct Materials (6,000 yds. @ $8.70 / yd.) (6,143 yds. @ $8.50 / yd.) Direct Labor (10,000 DLHr @ $10.90 / DLHr) (9,600 DLHr@ $11.10 / DLHr) Variable Overhead 16,000 yds @ $5.00 / yd.) (6,143 yds. @ $6.40 / yd.) Fixed Manufacturing Costs: 52,216 109,000 106,560 30,000 39,315 Fixed Overhead 60,000 62,000 Total Cost of Goods Sold 251,200 260,091 263,800 $ 220,109 Gross Profit