Answered step by step

Verified Expert Solution

Question

1 Approved Answer

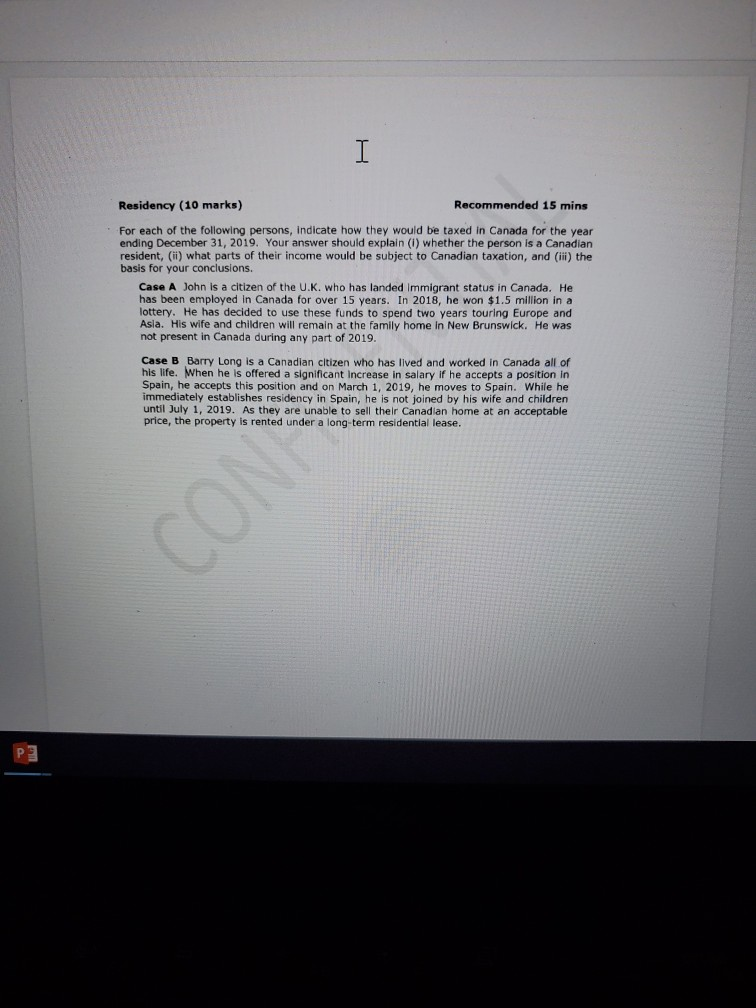

I Residency (10 marks) Recommended 15 mins For each of the following persons, indicate how they would be taxed in Canada for the year ending

I Residency (10 marks) Recommended 15 mins For each of the following persons, indicate how they would be taxed in Canada for the year ending December 31, 2019. Your answer should explain (1) whether the person is a Canadian resident, (ii) what parts of their income would be subject to Canadian taxation, and (iii) the basis for your conclusions. Case A John is a citizen of the U.K. who has landed Immigrant status in Canada. He has been employed in Canada for over 15 years. In 2018, he won $1.5 million in a lottery. He has decided to use these funds to spend two years touring Europe and Asia. His wife and children will remain at the family home in New Brunswick. He was not present in Canada during any part of 2019. Case B Barry Long is a Canadian citizen who has lived and worked in Canada all of his life. When he is offered a significant increase in salary if he accepts a position in Spain, he accepts this position and on March 1, 2019, he moves to Spain. While he immediately establishes residency in Spain, he is not joined by his wife and children until July 1, 2019. As they are unable to sell their Canadian home at an acceptable price, the property is rented under a long-term residential lease. CON I Residency (10 marks) Recommended 15 mins For each of the following persons, indicate how they would be taxed in Canada for the year ending December 31, 2019. Your answer should explain (1) whether the person is a Canadian resident, (ii) what parts of their income would be subject to Canadian taxation, and (iii) the basis for your conclusions. Case A John is a citizen of the U.K. who has landed Immigrant status in Canada. He has been employed in Canada for over 15 years. In 2018, he won $1.5 million in a lottery. He has decided to use these funds to spend two years touring Europe and Asia. His wife and children will remain at the family home in New Brunswick. He was not present in Canada during any part of 2019. Case B Barry Long is a Canadian citizen who has lived and worked in Canada all of his life. When he is offered a significant increase in salary if he accepts a position in Spain, he accepts this position and on March 1, 2019, he moves to Spain. While he immediately establishes residency in Spain, he is not joined by his wife and children until July 1, 2019. As they are unable to sell their Canadian home at an acceptable price, the property is rented under a long-term residential lease. CON

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started