Answered step by step

Verified Expert Solution

Question

1 Approved Answer

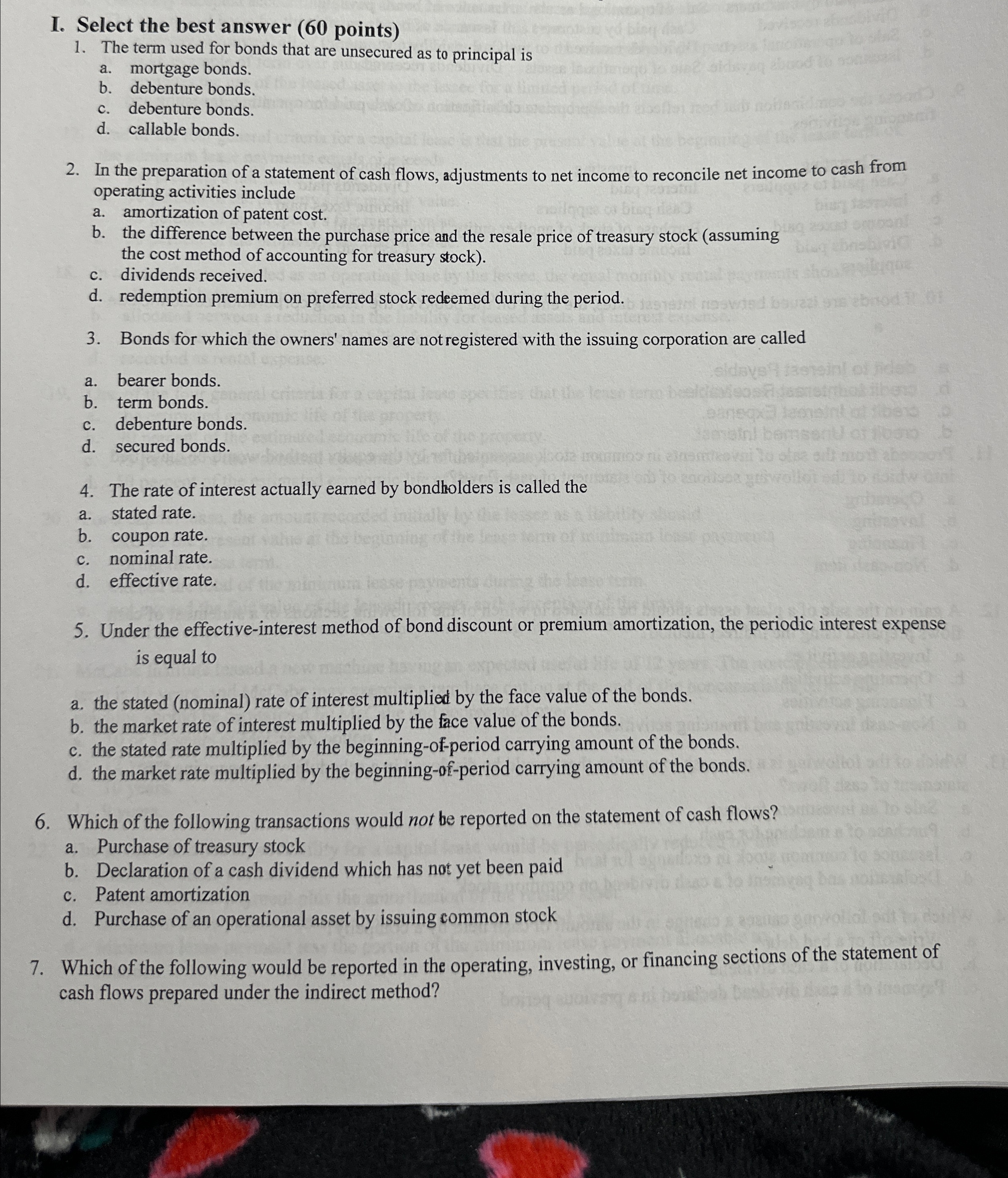

I. Select the best answer ( 6 0 points ) The term used for bonds that are unsecured as to principal is a . mortgage

I. Select the best answer points

The term used for bonds that are unsecured as to principal is

a mortgage bonds.

b debenture bonds.

c debenture bonds.

d callable bonds.

In the preparation of a statement of cash flows, adjustments to net income to reconcile net income to cash from operating activities include

a amortization of patent cost.

b the difference between the purchase price and the resale price of treasury stock assuming the cost method of accounting for treasury stock

c dividends received.

d redemption premium on preferred stock redeemed during the period.

Bonds for which the owners' names are not registered with the issuing corporation are called

a bearer bonds.

b term bonds.

c debenture bonds.

d secured bonds.

The rate of interest actually earned by bondholders is called the

a stated rate.

b coupon rate.

c nominal rate.

d effective rate.

Under the effectiveinterest method of bond discount or premium amortization, the periodic interest expense is equal to

a the stated nominal rate of interest multiplied by the face value of the bonds.

b the market rate of interest multiplied by the face value of the bonds.

c the stated rate multiplied by the beginningofperiod carrying amount of the bonds.

d the market rate multiplied by the beginningofperiod carrying amount of the bonds.

Which of the following transactions would not be reported on the statement of cash flows?

a Purchase of treasury stock

b Declaration of a cash dividend which has not yet been paid

c Patent amortization

d Purchase of an operational asset by issuing common stock

Which of the following would be reported in the operating, investing, or financing sections of the statement of cash flows prepared under the indirect method?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started