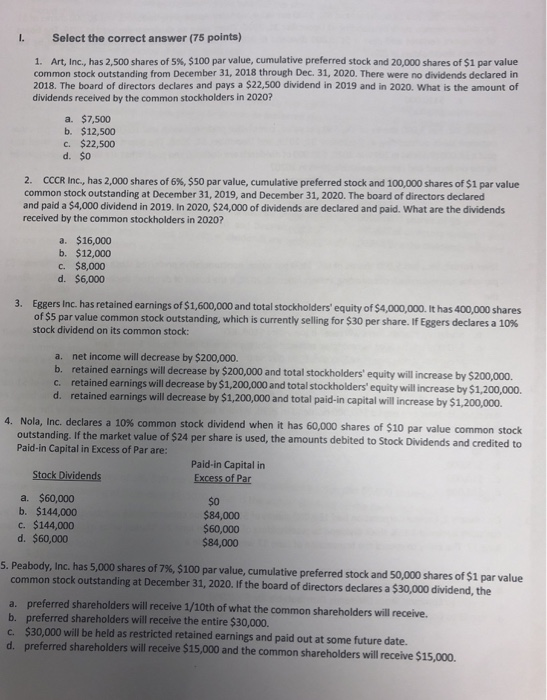

I. Select the correct answer (75 points) 1, Art, Inc., has 2,500 shares of 5%, $100 par value, cumulative preferred stock and 20,000 shares of $1 par value common stock outstanding from December 31, 2018 through Dec. 31, 2020. There were no dividends declared in 2018. The board of directors declares and pays a $22,500 dividend in 2019 and in 2020. What is the amount of dividends received by the common stockholders in 2020? a. $7,500 b. $12,500 c. $22,500 d. $0 2. CCCR Inc., has 2,000 shares of 6%, $50 par value, cumulative preferred stock and 100,000 shares of $1 par value common stock outstanding at December 31, 2019, and December 31, 2020. The board of directors declared and paid a $4,000 dividend in 2019. In 2020, $24,000 of dividends are declared and paid. What are the dividends received by the common stockholders in 2020? a. $16,000 b. $12,000 c. $8,000 d. $6,000 3. Eggers Inc. has retained earnings of $1,600,000 and total stockholders' equity of $4,000,000. lt has 400,000 shares of $5 par value common stock outstanding, which is currently selling for S30 per share. If Eggers declares a 0% stock dividend on its common stock net income will decrease by $200,000. retained earnings will decrease by $200,000 and total stockholders' equity will increase by $200,000. retained earnings will decrease by $1,200,000 and total stockholders' equity will increase by $1,200,000. retained earnings will decrease by $1,200,000 and total paid-in capital will increase by $1,200,000. a. b. c. d. 4, Nola, Inc. declares a 10% common stock dividend when it has 60,000 shares of SO par value common stock outstanding. If the market value of $24 per share is used, the amounts debited to Stock Dividends and credited to Paid-in Capital in Excess of Par are: Paid-in Capital in Excess of Par Stock Dividends a. $60,000 $o $84,000 $60,000 $84,000 b. $144,000 c. $144,000 d. $60,000 , Peabody, Inc. has 5,000 shares of 7%, $100 par value, cumulative preferred stock and 5000 shares of S1 par value common stock outstanding at December 31, 2020. If the board of directors declares a $30,000 dividend, the a. preferred shareholders will receive 1/10th of what the common shareholders will receive. b. preferred shareholders will receive the entire $30,000. c. $30,000 will be held as restricted retained earnings and paid out at some future date. d. preferred shareholders will receive $15,000 and the common shareholders will receive $15,000