Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i send this quation again Question 3: The Muscat Electric Company ventures to a new project in the eastern part of the capital city which

i send this quation again

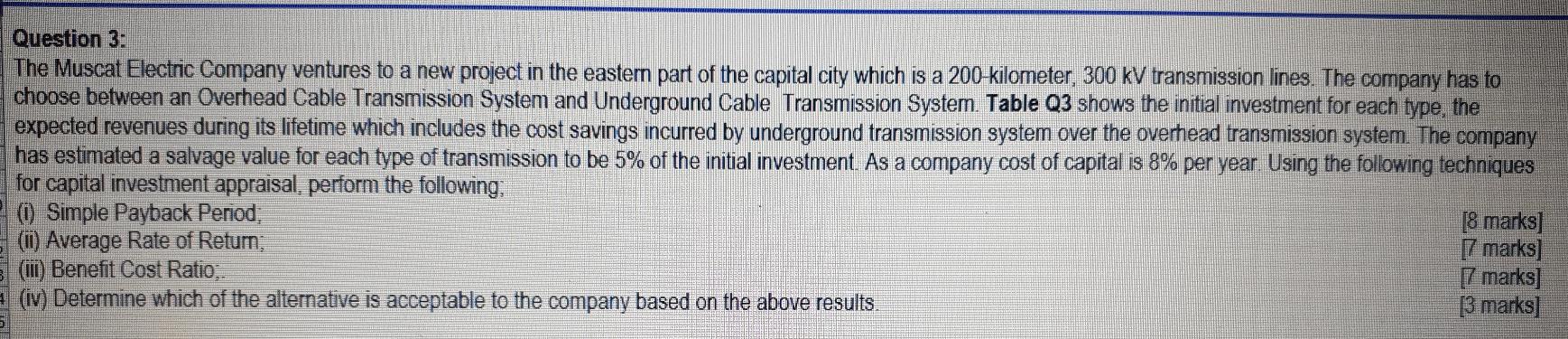

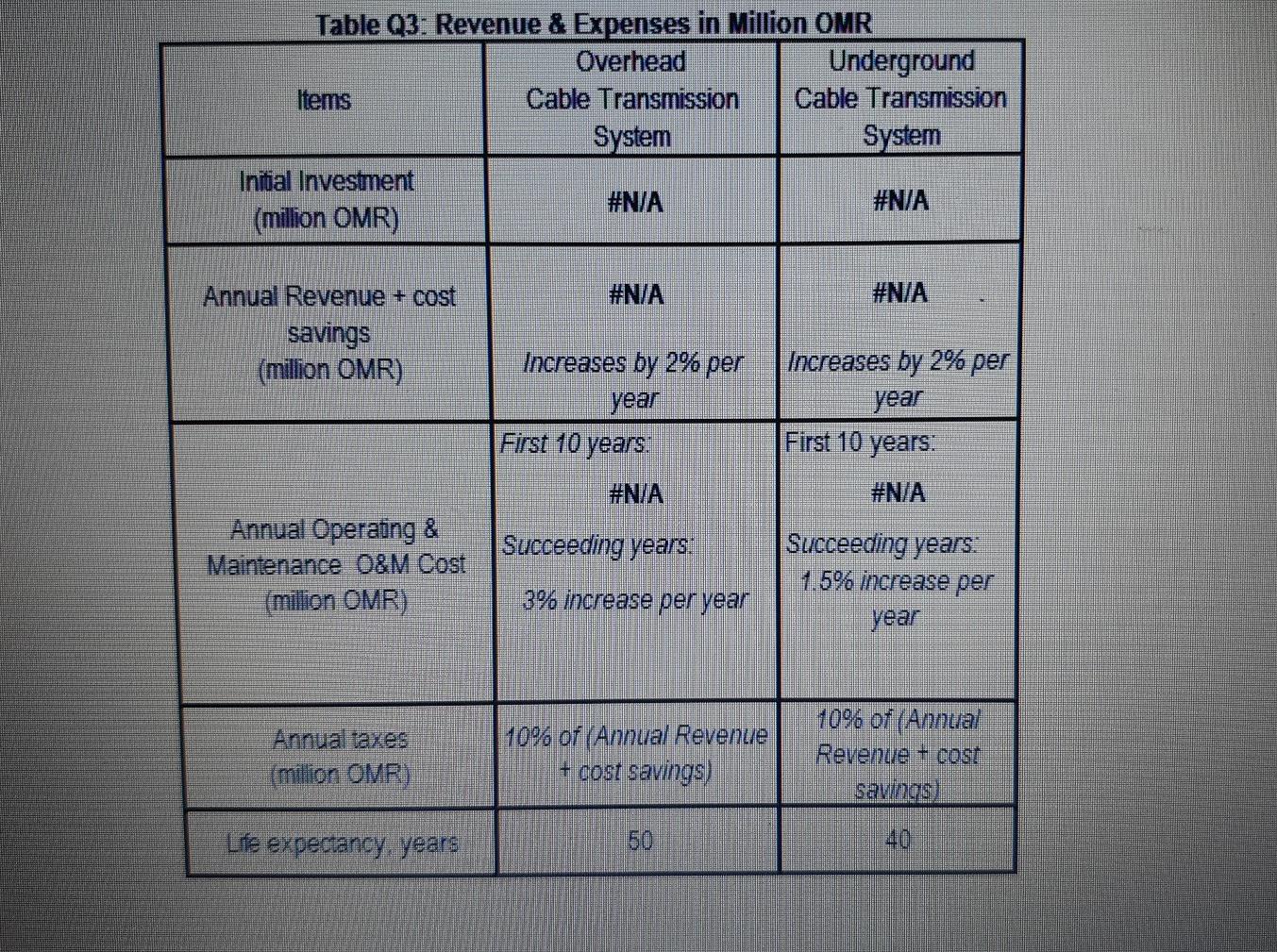

Question 3: The Muscat Electric Company ventures to a new project in the eastern part of the capital city which is a 200 kilometer, 300 kV transmission lines. The company has to choose between an Overhead Cable Transmission System and Underground Cable Transmission System. Table Q3 shows the initial investment for each type, the expected revenues during its lifetime which includes the cost savings incurred by underground transmission system over the overhead transmission system. The company has estimated a salvage value for each type of transmission to be 5% of the initial investment. As a company cost of capital is 8% per year. Using the following techniques for capital investment appraisal, perform the following, (0) Simple Payback Period: [8 marks] (1) Average Rate of Return, [7 marks] (iii) Benefit Cost Ratio;. [7 marks] (iv) Determine which of the alternative is acceptable to the company based on the above results. [3 marks] Table Q3: Revenue & Expenses in Million OMR Overhead Underground Items Cable Transmission Cable Transmission System System Initial Investment #N/A #N/A (million OMR) #N/A #N/A Annual Revenue + cost savings (million OMR) Increases by 2% per Increases by 2% per year First 10 years year First 10 years: #N/A #N/A Succeeding years: Annual Operating & Maintenance O&M Cost (million OMR) Succeeding years. 1.5% increase per year 3% increase per year Annual taxes (million OMR) 10% of (Annual Revenue + cost savings) 10% of (Annual Revenue + cost savings) Life expectancy, years Question 3: The Muscat Electric Company ventures to a new project in the eastern part of the capital city which is a 200 kilometer, 300 kV transmission lines. The company has to choose between an Overhead Cable Transmission System and Underground Cable Transmission System. Table Q3 shows the initial investment for each type, the expected revenues during its lifetime which includes the cost savings incurred by underground transmission system over the overhead transmission system. The company has estimated a salvage value for each type of transmission to be 5% of the initial investment. As a company cost of capital is 8% per year. Using the following techniques for capital investment appraisal, perform the following, (0) Simple Payback Period: [8 marks] (1) Average Rate of Return, [7 marks] (iii) Benefit Cost Ratio;. [7 marks] (iv) Determine which of the alternative is acceptable to the company based on the above results. [3 marks] Table Q3: Revenue & Expenses in Million OMR Overhead Underground Items Cable Transmission Cable Transmission System System Initial Investment #N/A #N/A (million OMR) #N/A #N/A Annual Revenue + cost savings (million OMR) Increases by 2% per Increases by 2% per year First 10 years year First 10 years: #N/A #N/A Succeeding years: Annual Operating & Maintenance O&M Cost (million OMR) Succeeding years. 1.5% increase per year 3% increase per year Annual taxes (million OMR) 10% of (Annual Revenue + cost savings) 10% of (Annual Revenue + cost savings) Life expectancy, yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started