I seriously dont get it. please help :(

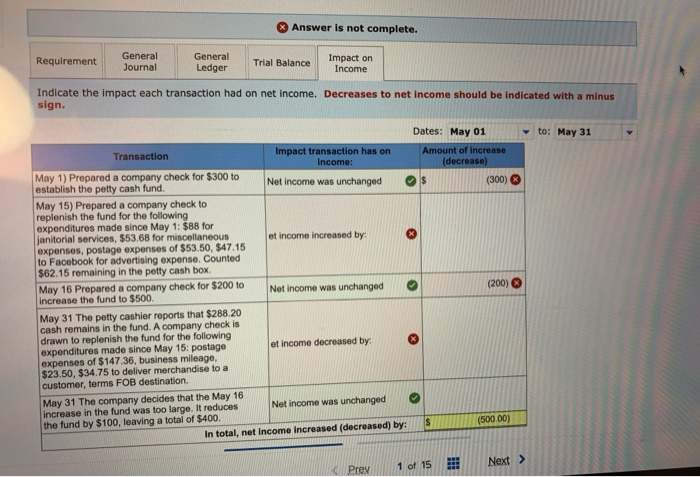

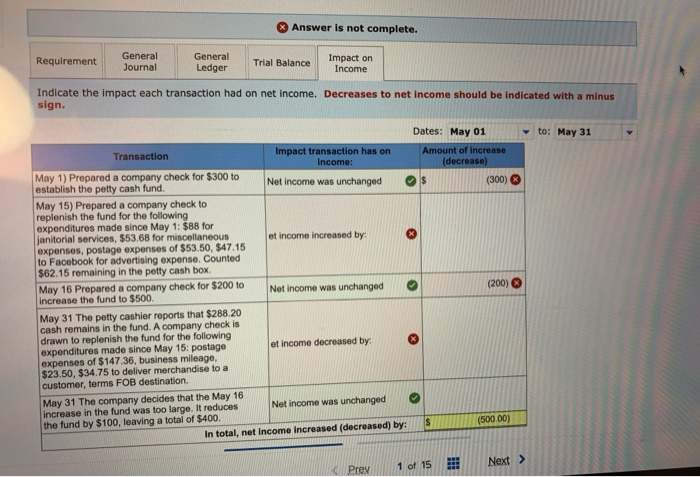

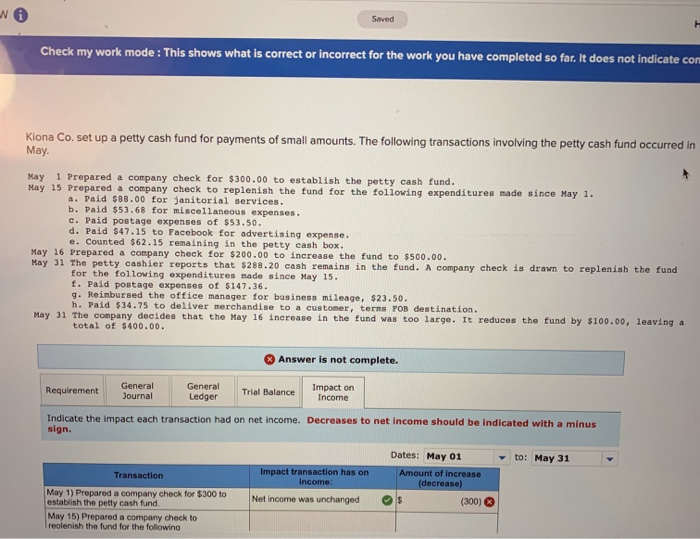

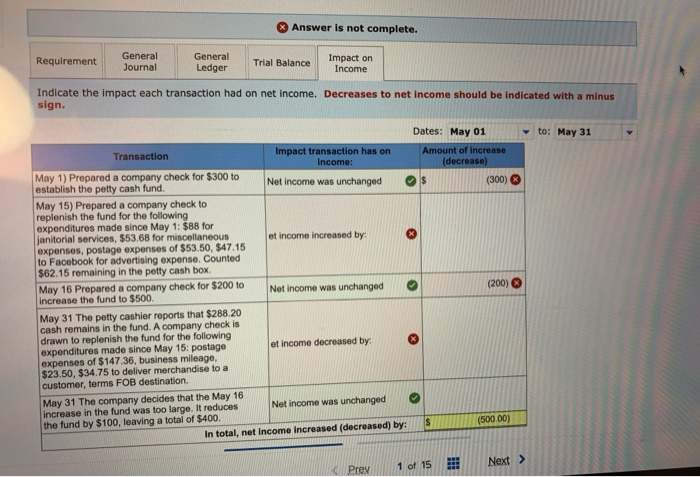

Answer is not complete. Requirement General Journal General Ledger Trial Balance Impact on Income Indicate the impact each transaction had on net income. Decreases to net income should be indicated with a minus sign. to: May 31 Dates: May 01 Amount of increase (decrease) $ (300) (200) Transaction Impact transaction has on Income: May 1) Prepared a company check for $300 to Net Income was unchanged establish the petty cash fund. May 15) Prepared a company check to replenish the fund for the following expenditures made since May 1: $88 for janitorial services, $53.68 for miscellaneous et income increased by: expenses, postage expenses of $53.50, $47.15 to Facebook for advertising expense. Counted $62.15 remaining in the petty cash box May 16 Prepared a company check for $200 to Not income was unchanged increase the fund to $500 May 31 The petty cashier reports that $288.20 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15: postage et income decreased by: expenses of $147.36, business mileage, $23.50, $34.75 to deliver merchandise to a customer, terms FOB destination. May 31 The company decides that the May 16 increase in the fund was too large. It reduces Net income was unchanged the fund by $100, leaving a total of $400. In total, net income increased (decreased) by: $ (500.00) Prey 1 of 15 Next > VA Saved Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate con Kiona Co. set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May. May 1 Prepared a company check for $300.00 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1. a. Paid $80.00 for janitorial services. b. Paid $53.68 for miscellaneous expenses. c. Paid postage expenses of $53.50. d. Paid $47.15 to Facebook for advertising expense. e. Counted $62.15 remaining in the petty cash box. May 16 Prepared a company check for $200.00 to increase the fund to $500.00. May 31 The petty cashier reports that $288.20 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures nade since May 15. 1. Paid postage expenses of $147.36. g. Reimbursed the office manager for business mileage, $23.50. h. Paid $34.75 to deliver merchandise to a customer, terms FOB destination. May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $100.00, leaving a total of $400.00. Answer is not complete. Requirement General Journal General Ledger Trial Balance Impact on Income Indicate the impact each transaction had on net income. Decreases to net income should be indicated with a minus sign. Dates: May 01 to: May 31 Impact transaction has on Amount of increase Transaction Income: (decrease) May 1) Prepared a company check for $300 to Net Income was unchanged (300) establish the petty cash fund May 15) Prepared a company check to replenish the fund for the following