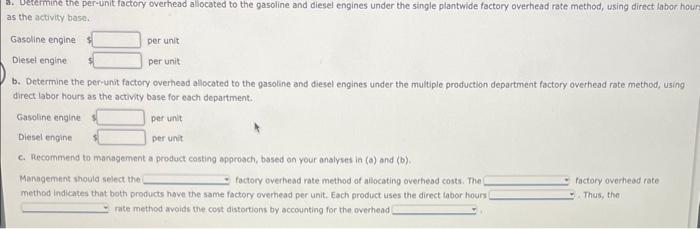

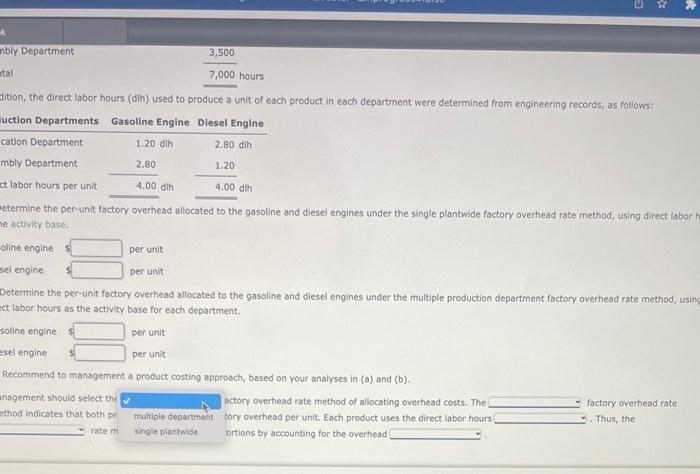

I show all options for part c of question, please help

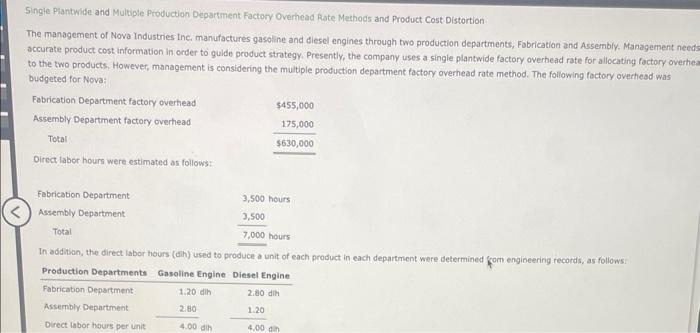

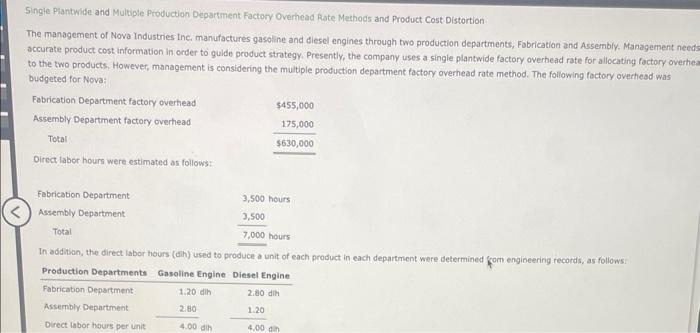

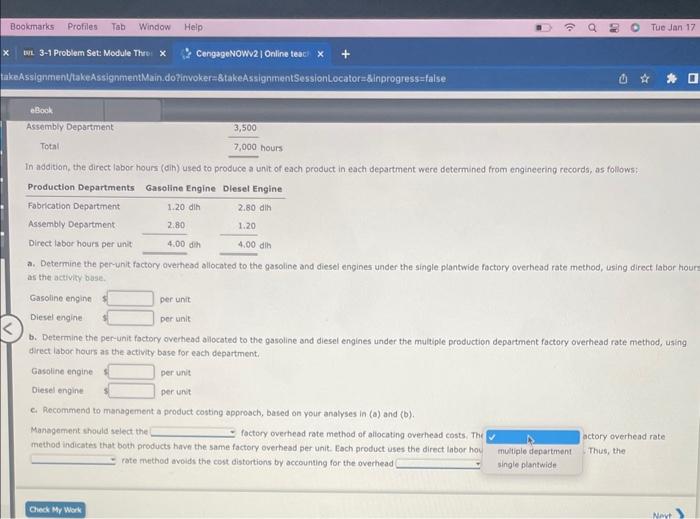

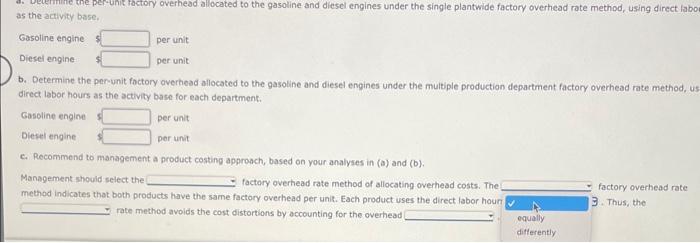

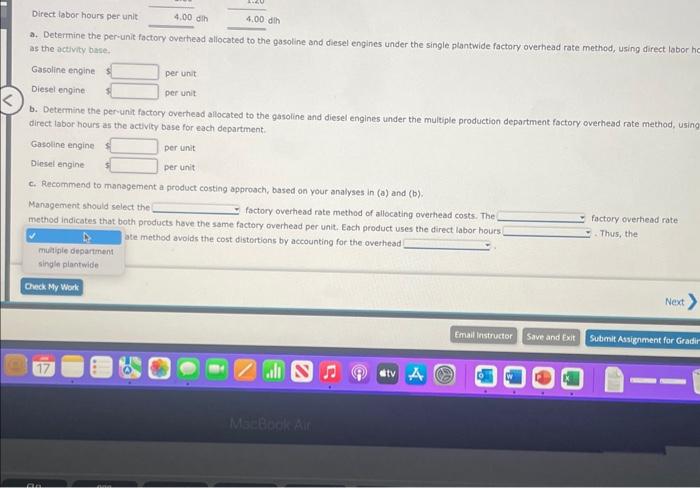

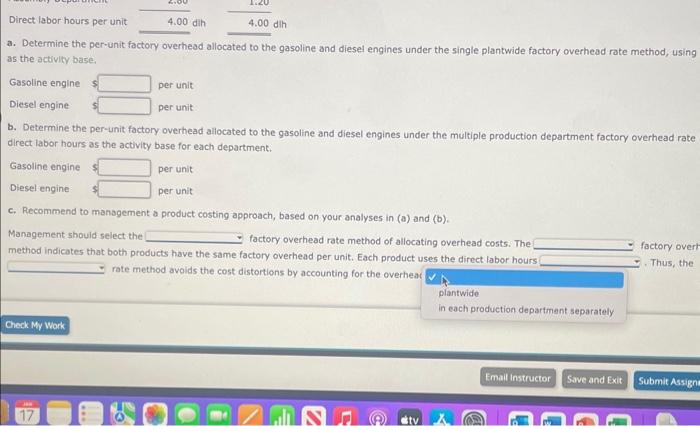

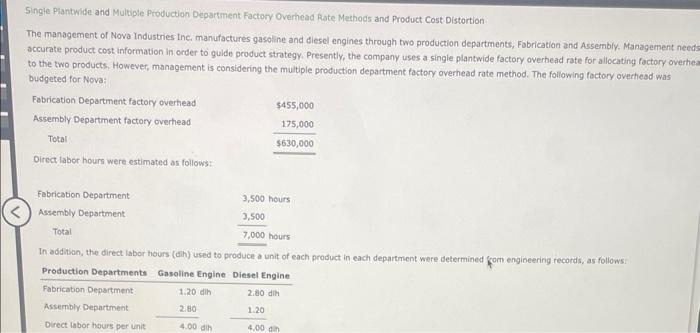

Single Plantwide and Multiple Production Department Factory Overhead Rate Methods and Product Cost Distortion The management of Nova Industries Inci manufactures gasoline and diesel engines through two prodoction departments, Fobrication and Assembly. Management need: accurate product cost information in order to gulde product strategy. Presently, the company uses a single plantwide factory overhead rate for allocating foctory overhe. to the two products. However, management is considering the multiple production department foctory averhead rate method. The following foctory overhead was budgeted for Nova: a. Decemine the per-unit factory overhead allocated to the gasoline and diesel engines under the single plantwide factory overhead rate method, using direct labor hou as the activity base. b. Determine the per-unit factory overhead allocated to the gasoline and diesel engines under the multiple production department factory overhead rate method; using direct labor hours as the activity base for each department. Gasolineengine1Dieselengineperunitperunit c. Recommend to management a product costing approach, bosed on your analyses in (a) and (b). Management should select the factory overhead rate method of allocating overhead costs. The factory overhead rate method indicates that both products have the same factory overhead per unit. Each product uses the direct labor hours Thus, the rate method avoids the cost distortions by accounting for the overhead dition, the direct labor hours (dih) used to produce a unit of each product in each department were determined from engineering records, as follows: fetermine the per-unit factory overhead allocated to the gasoline and diesel engines under the single plantwide factory overhead rate method, using direct labor h le activity base. olineengine$selengineperunit Determine the per-unit factory overhead allocated to the gasoline and diesel engines under the multiple production department factory overhead rate method, usin ict iabor hours as the activity base for each department. sotine engine 5 per unit asel engine $ per unit Recommend to management a product costing approoch, based on your analyses in (a) and (b). inagement should select thy sctory overhead rate method of allocating overhead costs. The factory overhead rate ory overhead per unit. Each product uses the direct labor hours Thus, the ortions by accounting for the overhead Total 7,000 hours In addition, the direct labor hours (dih) used to produce a unit of each product in each department were determined from engineering records, as follows: a. Determine the per-unit factory averhead allocated to the gasoline and diesel engines under the single plantwide factory overhead rate method, using direct fabor hou as the activicy buse. Gasoline engine s per unit Diesel engine 1 per unit b. Determine the per-unit factory overhead allocated to the gasoline and diesel engines under the multiple production department factory overhead rate method, using direct labochours as the activity base for each department. Gasoline engine per unit Diesel engine per unit c. Recommend to management a product costing approsch, baced on your analyses in (a) and (b). Management should select the foctory overhead rate method of allocating overhead costs. The method indicates that both products have the same factory overhesd per unit. Each product uses the direct labor hou rate muthod avoids the cost distortions by accounting for the overhead as the activity base, Gasoline engine 5 per unit Diesel engine per unit b. Determine the perunit foctory overhead allocated to the gasoline and diesel engines under the multiple production department factory overhead rate method, us direct labor hours as the activity base for each department. Gasoline engine per unit Diesel engine por unit c. Recommend to management a product costing approach, based on your analyses in (a) and (b). Management should select the factory overhead rate method of allocating overhead costs. The factory overhead rate method indicates that both products have the same factory overhead per unit. Each product uses the direct labor hour rate method avoids the cost distortions by accounting for the overhead a. Determine the per-unit factory overhead allocated to the gasoline and diesel engines under the single plantwide factory overhead rate method, using direct labor ho as the activity base. b. Determine the per-unit factocy overhead allocated to the gasoline and diesel engines under the multiple production department factory overhead rate method, using direct labor hours as the activity base for each department. Gasoline engine 1 per unit Dirsel engine per unit. c. Recommend to management a product costing approsch, based on your analyses in (a) and (b). Management should select the factory overhead rate method of allocating overhead costs. The method indicates that both products have the same factory overhead per unit. Each product uses the direct labor hours. ate method avolds the cost distortions by accounting for the overhead a. Determine the per-unit factory overhead allocated to the gasoline and diesel engines under the single plantwide factory overhead rate method, using as the activity base. Gasoline engine per unit Diesel engine per unit b. Determine the per-unit factory overhead ailocated to the gasoline and diesel engines under the multiple production department factory overhead rate direct labor hours as the activity base for each department. Gasoline engine per unit Diesel engine per unit c. Recommend to management a product costing approach, based on your analyses in (a) and (b). Management shouid select the factory overhead rate method of allocating overhead costs. The method indicates that both products have the same factory overhead per unit. Each product uses the direct labor hours rate method avoids the cost distortions by accounting for the overheat