Answered step by step

Verified Expert Solution

Question

1 Approved Answer

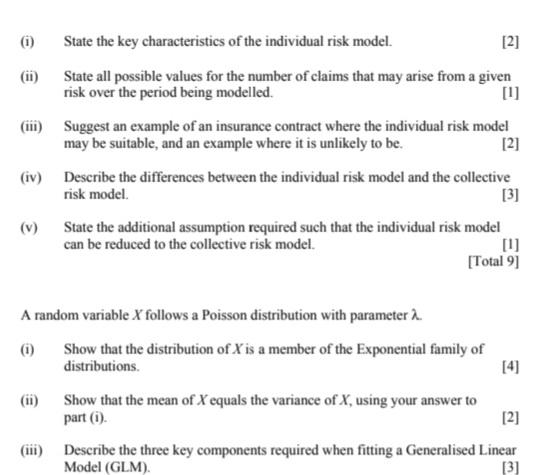

(i) State the key characteristics of the individual risk model. [2] (ii) State all possible values for the number of claims that may arise

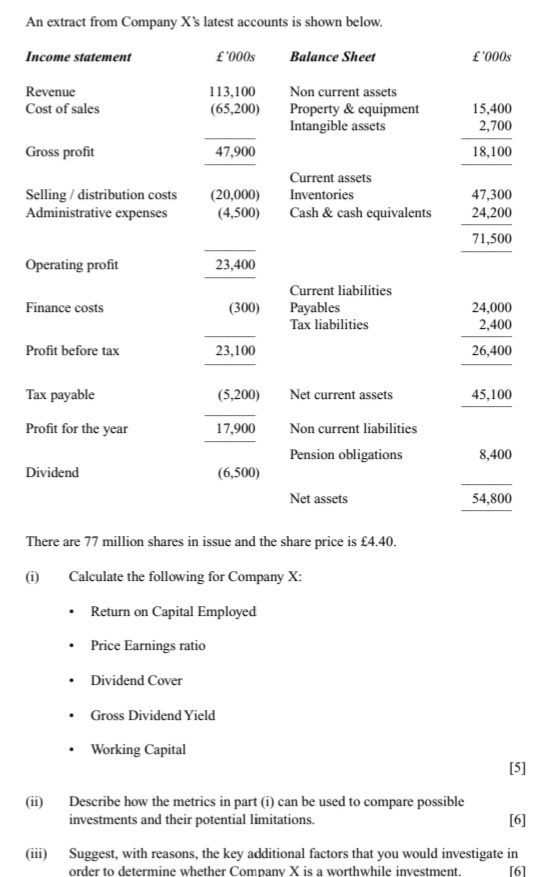

(i) State the key characteristics of the individual risk model. [2] (ii) State all possible values for the number of claims that may arise from a given risk over the period being modelled. [1] (iii) Suggest an example of an insurance contract where the individual risk model may be suitable, and an example where it is unlikely to be. [2] (iv) Describe the differences between the individual risk model and the collective risk model. [3] (v) State the additional assumption required such that the individual risk model can be reduced to the collective risk model. [1] [Total 9] A random variable X follows a Poisson distribution with parameter A. (i) Show that the distribution of X is a member of the Exponential family of distributions. [4] (ii) Show that the mean of X equals the variance of X, using your answer to part (i). [2] (iii) Describe the three key components required when fitting a Generalised Linear Model (GLM). [3] An extract from Company X's latest accounts is shown below. Income statement '000s Balance Sheet '000s Revenue 113,100 Non current assets Cost of sales (65,200) Property & equipment 15,400 Intangible assets 2,700 Gross profit 47,900 18,100 Current assets Selling/distribution costs (20,000) Inventories 47,300 Administrative expenses (4,500) Cash & cash equivalents 24,200 71,500 Operating profit 23,400 Current liabilities Finance costs (300) Payables 24,000 Tax liabilities 2,400 Profit before tax 23,100 26,400 Tax payable (5,200) Net current assets 45,100 Profit for the year 17,900 Non current liabilities Pension obligations 8,400 Dividend (6,500) Net assets 54,800 There are 77 million shares in issue and the share price is 4.40. (i) Calculate the following for Company X: . Return on Capital Employed Price Earnings ratio Dividend Cover . Gross Dividend Yield Working Capital [5] (ii) Describe how the metrics in part (i) can be used to compare possible investments and their potential limitations. [6] (iii) Suggest, with reasons, the key additional factors that you would investigate in order to determine whether Company X is a worthwhile investment. [6]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started