Question

i. The company paid down the above note by $500. j. the company paid $500 cash dividends (total) to its owners. k. The company recognised

i. The company paid down the above note by $500.

j. the company paid $500 cash dividends (total) to its owners.

k. The company recognised $1000 wear of all its net PPE during the month of June.

l. On the last day of the month, the company realised that $1000 worth of its net PPE, was left in the rain and damaged. The firm believes it can sell the damaged net PPE (as "Misc Asset, PPE") for $400.

Question:

i. Create a set of Journal Entries for the June Transactions, in journal form (dr, cr form).

ii. Create an Income Statement for June.

iii. Create a Balance Sheet for June.

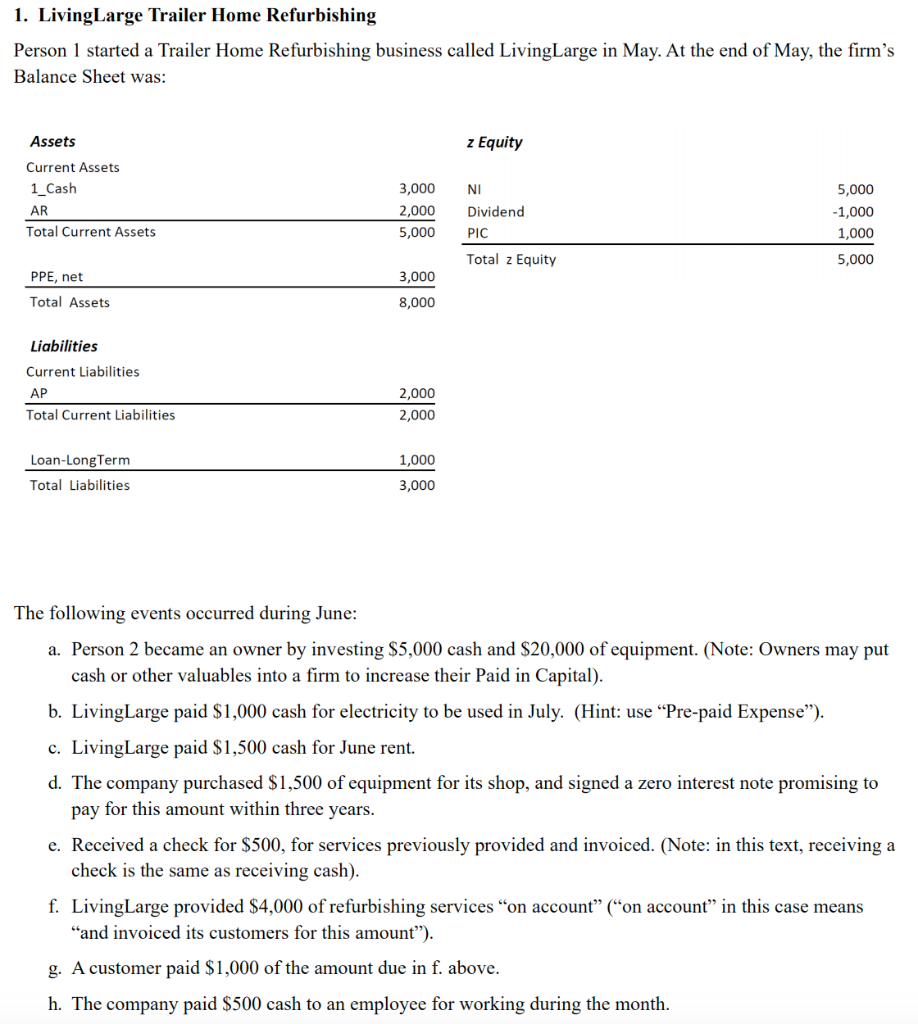

1. LivingLarge Trailer Hom ie Refurbishing Person 1 started a Trailer Home Refurbishing business called LivingLarge in May. At the end of May, the firm's Balance Sheet was: Assets Current Assets 1 Cash AR Total Current Assets z Equity 3,000 NI 2,000 Dividend 5,000 PIC 5,000 1,000 1,000 5,000 Total z Equity PPE, net 3,000 Total Assets 8,000 Liabilities Current Liabilities AP Total Current Liabilities 2,000 2,000 1,000 Loan-LongTerm Total Liabilities 3,000 The following events occurred during June: a. Person 2 became an owner by investing S5,000 cash and $20,000 of equipment. (Note: Owners may put cash or other valuables into a firm to increase their Paid in Capital) b. LivingLarge paid $1,000 cash for electricity to be used in July. (Hint: use "Pre-paid Expense") c. LivingLarge paid $1,500 cash for June rent. d. The company purchased $1,500 of equipment for its shop, and signed a zero interest note promising to pay for this amount within three vears e. Received a check for $500, for services previously provided and invoiced. (Note: in this text, receiving a check is the same as receiving cash) f. LivingLarge provided $4,000 of refurbishing services "on account" ("on account" in this case means "and invoiced its customers for this amount") g. A customer paid $1,000 of the amount due in f. above. h. The company paid S500 cash to an employee for working during the monthStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started