Question

(i) The sole proprietorship business X and the partnership business Y are carrying on business in Hong Kong and the profits/losses therein are arisen in

(i)

The sole proprietorship business X and the partnership business Y are carrying on business in

Hong Kong and the profits/losses therein are arisen in Hong Kong.

(ii)

The sole proprietorship business Z is carrying on business in Hong Kong, and had incurred a

tax loss of $50,000 in 2017/18. Mr. Park did not elect for personal assessment in 2017/18 and

the tax loss of $50,000 was therefore carried forward to 2018/19.

(iii)

Cayman Ltd is a company incorporated in the Cayman Islands. It is managed and controlled in

Hong Kong. Its profits, however, are agreed by the Assessor as being derived from outside

Hong Kong.

(iv)

Property A (located in Shatin) was solely owned by Mr. Park. It was rented to a tenant on 1

April 2017 for a term of two years at a monthly rent of $15,000 payable in advance. An initial

premium of $180,000 was also paid. It was agreed that the rates were payable by the tenant and

the costs of repairs were payable by Mr. Park.

(v)

Mr. Parks mother, a Hong Kong resident, is aged 68. She lives alone in Kowloon Tong

throughout the year. Mr. Park has two children and his wife passed away five years ago. His

elder son, aged 22, is a full-time student studying at the City University of Hong Kong. His

younger daughter, aged 15, is studying in a secondary school in Australia.

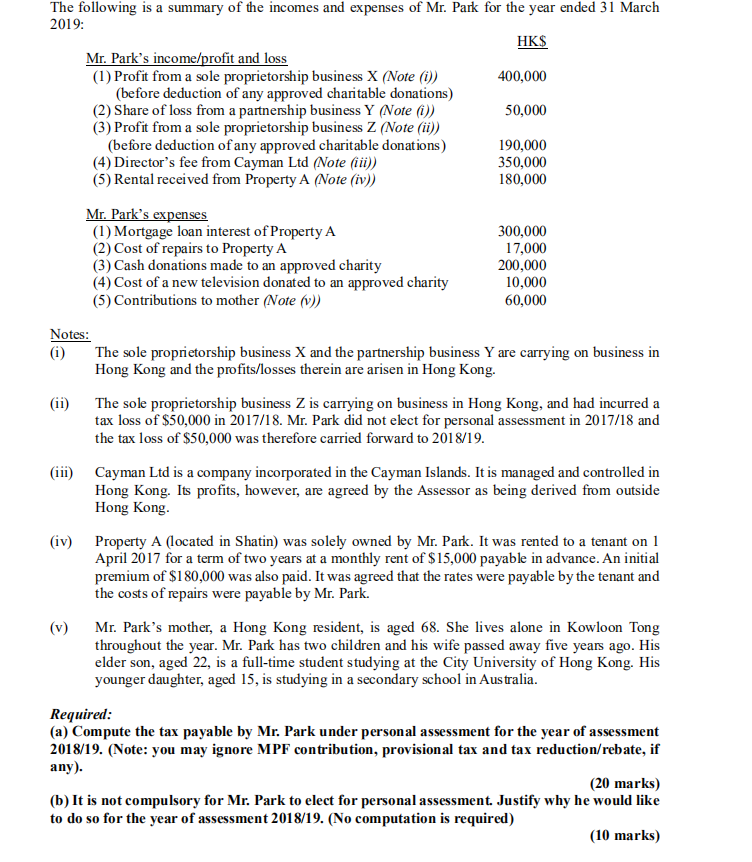

The following is a summary of the incomes and expenses of Mr. Park for the year ended 31 March 2019: HK$ Mr. Park's income/profit and loss (1) Profit from a sole proprietorship business X (Note (i)) 400,000 (before deduction of any approved charitable donations) (2) Share of loss from a partnership business Y (Note (i)) 50,000 (3) Profit from a sole proprietorship business Z (Note (ii)) (before deduction of any approved charitable donations) 190,000 (4) Director's fee from Cayman Ltd (Note fiii)) 350,000 (5) Rental received from Property A (Note (iv)) 180,000 Mr. Park's expenses (1) Mortgage loan interest of Property A 300,000 (2) Cost of repairs to Property A 17,000 (3) Cash donations made to an approved charity 200,000 (4) Cost of a new television donated to an approved charity 10,000 (5) Contributions to mother (Note (v)) 60,000 Notes: (i) The sole proprietorship business X and the partnership business Y are carrying on business in Hong Kong and the profits/losses therein are arisen in Hong Kong. (ii) The sole proprietorship business Z is carrying on business in Hong Kong, and had incurred a tax loss of $50,000 in 2017/18. Mr. Park did not elect for personal assessment in 2017/18 and the tax loss of $50,000 was therefore carried forward to 2018/19. (iii) Cayman Ltd is a company incorporated in the Cayman Islands. It is managed and controlled in Hong Kong. Its profits, however, are agreed by the Assessor as being derived from outside Hong Kong. (iv) Property A (located in Shatin) was solely owned by Mr. Park. It was rented to a tenant on 1 April 2017 for a term of two years at a monthly rent of $15,000 payable in advance. An initial premium of $180,000 was also paid. It was agreed that the rates were payable by the tenant and the costs of repairs were payable by Mr. Park. Mr. Park's mother, a Hong Kong resident, is aged 68. She lives alone in Kowloon Tong throughout the year. Mr. Park has two children and his wife passed away five years ago. His elder son, aged 22, is a full-time student studying at the City University of Hong Kong. His younger daughter, aged 15, is studying in a secondary school in Australia. Required: (a) Compute the tax payable by Mr. Park under personal assessment for the year of assessment 2018/19. (Note: you may ignore MPF contribution, provisional tax and tax reduction/rebate, if any). (20 marks) (b) It is not compulsory for Mr. Park to elect for personal assessment. Justify why he would like to do so for the year of assessment 2018/19. (No computation is required) (10 marks) (v) The following is a summary of the incomes and expenses of Mr. Park for the year ended 31 March 2019: HK$ Mr. Park's income/profit and loss (1) Profit from a sole proprietorship business X (Note (i)) 400,000 (before deduction of any approved charitable donations) (2) Share of loss from a partnership business Y (Note (i)) 50,000 (3) Profit from a sole proprietorship business Z (Note (ii)) (before deduction of any approved charitable donations) 190,000 (4) Director's fee from Cayman Ltd (Note fiii)) 350,000 (5) Rental received from Property A (Note (iv)) 180,000 Mr. Park's expenses (1) Mortgage loan interest of Property A 300,000 (2) Cost of repairs to Property A 17,000 (3) Cash donations made to an approved charity 200,000 (4) Cost of a new television donated to an approved charity 10,000 (5) Contributions to mother (Note (v)) 60,000 Notes: (i) The sole proprietorship business X and the partnership business Y are carrying on business in Hong Kong and the profits/losses therein are arisen in Hong Kong. (ii) The sole proprietorship business Z is carrying on business in Hong Kong, and had incurred a tax loss of $50,000 in 2017/18. Mr. Park did not elect for personal assessment in 2017/18 and the tax loss of $50,000 was therefore carried forward to 2018/19. (iii) Cayman Ltd is a company incorporated in the Cayman Islands. It is managed and controlled in Hong Kong. Its profits, however, are agreed by the Assessor as being derived from outside Hong Kong. (iv) Property A (located in Shatin) was solely owned by Mr. Park. It was rented to a tenant on 1 April 2017 for a term of two years at a monthly rent of $15,000 payable in advance. An initial premium of $180,000 was also paid. It was agreed that the rates were payable by the tenant and the costs of repairs were payable by Mr. Park. Mr. Park's mother, a Hong Kong resident, is aged 68. She lives alone in Kowloon Tong throughout the year. Mr. Park has two children and his wife passed away five years ago. His elder son, aged 22, is a full-time student studying at the City University of Hong Kong. His younger daughter, aged 15, is studying in a secondary school in Australia. Required: (a) Compute the tax payable by Mr. Park under personal assessment for the year of assessment 2018/19. (Note: you may ignore MPF contribution, provisional tax and tax reduction/rebate, if any). (20 marks) (b) It is not compulsory for Mr. Park to elect for personal assessment. Justify why he would like to do so for the year of assessment 2018/19. (No computation is required) (10 marks) (v)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started