Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I think I calculated question #14 incorrectly. would the year 4 perpetuity be considered delayed? I'm having trouble with the vocabulary, or would this question

I think I calculated question #14 incorrectly. would the year 4 perpetuity be considered delayed? I'm having trouble with the vocabulary, or would this question simply be non constant cash flows?

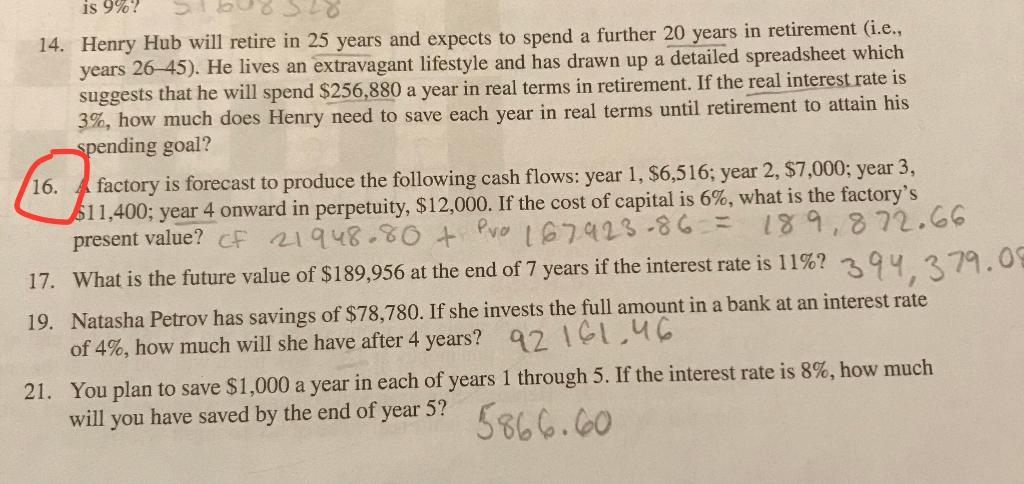

is 9%? 188 14. Henry Hub will retire in 25 years and expects to spend a further 20 years in retirement (i.e., years 26-45). He lives an extravagant lifestyle and has drawn up a detailed spreadsheet which suggests that he will spend $256,880 a year in real terms in retirement. If the real interest rate is 3%, how much does Henry need to save each year in real terms until retirement to attain his spending goal? 16. factory is forecast to produce the following cash flows: year 1, $6,516; year 2, $7,000; year 3, $11,400; year 4 onward in perpetuity, $12,000. If the cost of capital is 6%, what is the factory's present value? CF 21948.80 + Pro 167423-86 = 189,872.66 17. What is the future value of $189,956 at the end of 7 years if the interest rate is 11%? 394,379.09 19. Natasha Petrov has savings of $78,780. If she invests the full amount in a bank at an interest rate of 4%, how much will she have after 4 years? 92 164.46 21. You plan to save $1,000 a year in each of years 1 through 5. If the interest rate is 8%, how much will you have saved by the end of year 5? 5866.60Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started