Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I think I have to make some edits to DV 6 & 7 simplification. when solving for part B do we divide by 5 mil

- I think I have to make some edits to DV 6 & 7 simplification.

- when solving for part B do we divide by 5 mil or just purely use the obj function

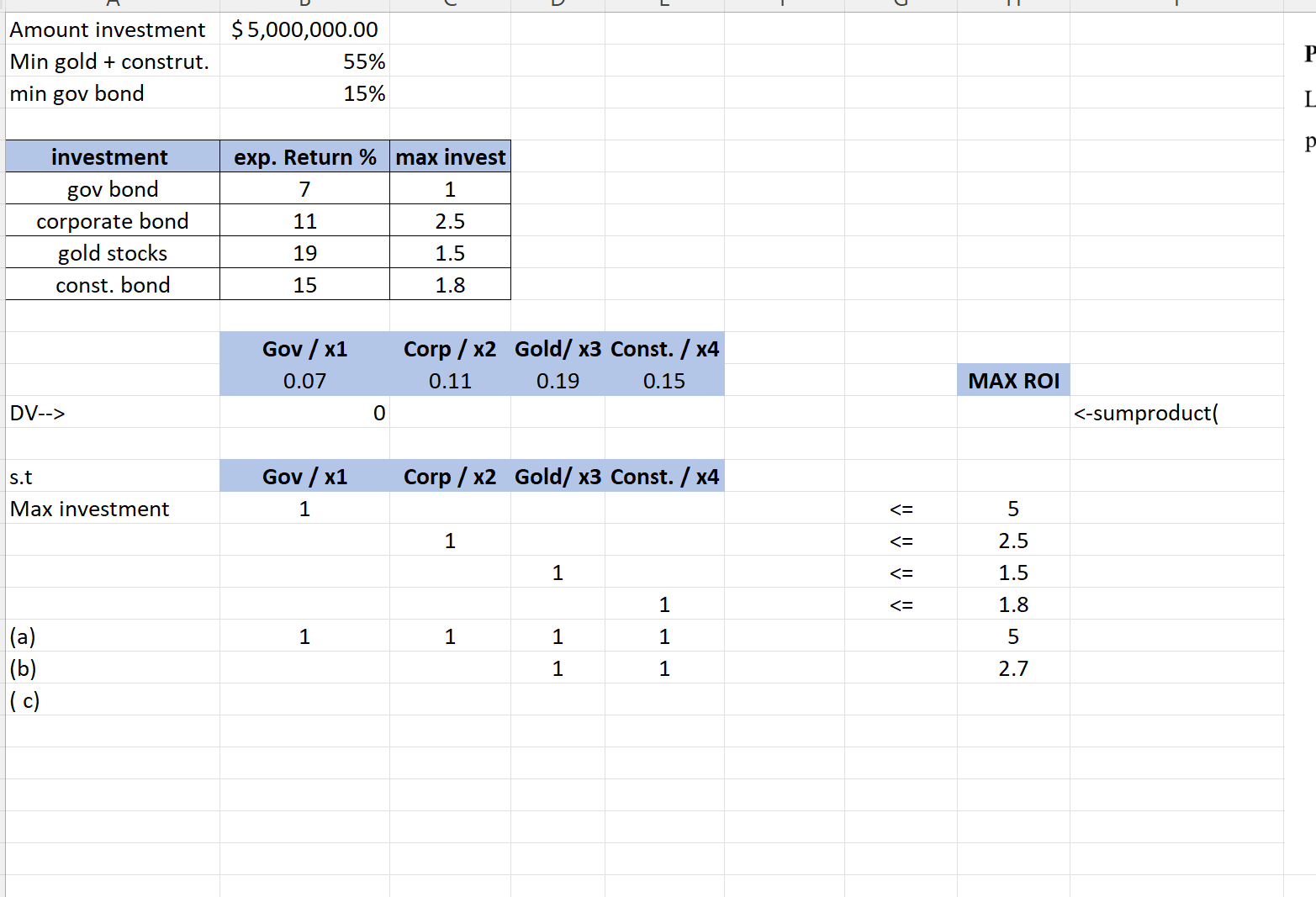

- how do I put this into excel to solve?

Below is the question and what I currently have.

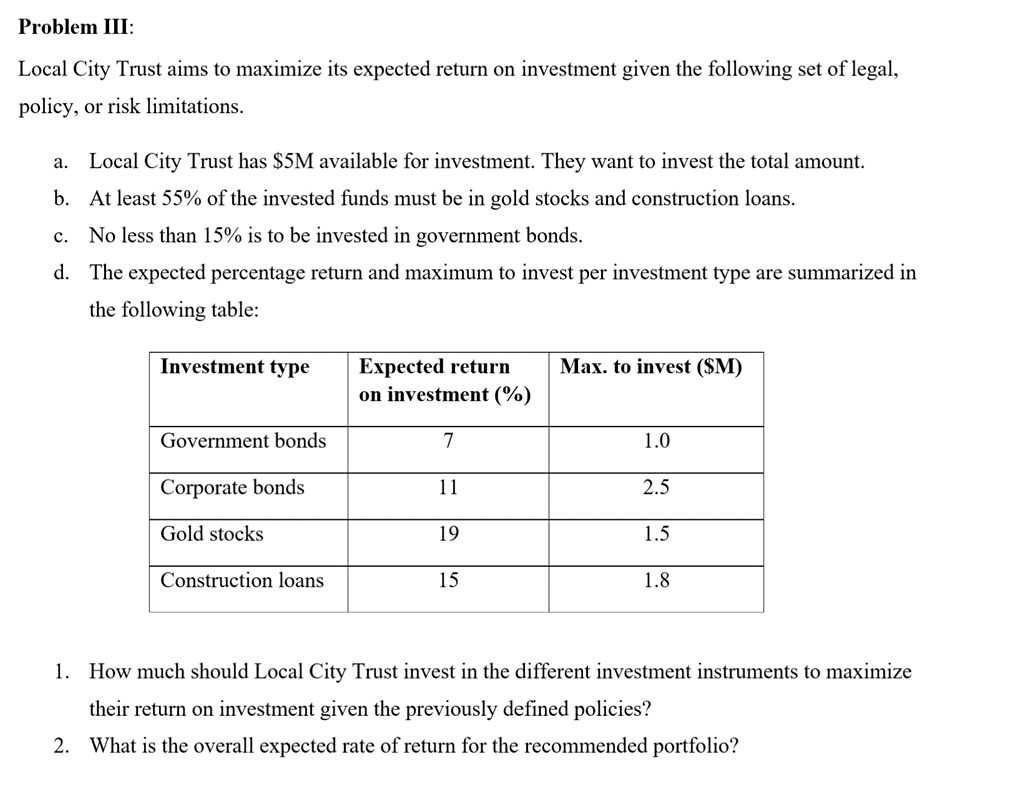

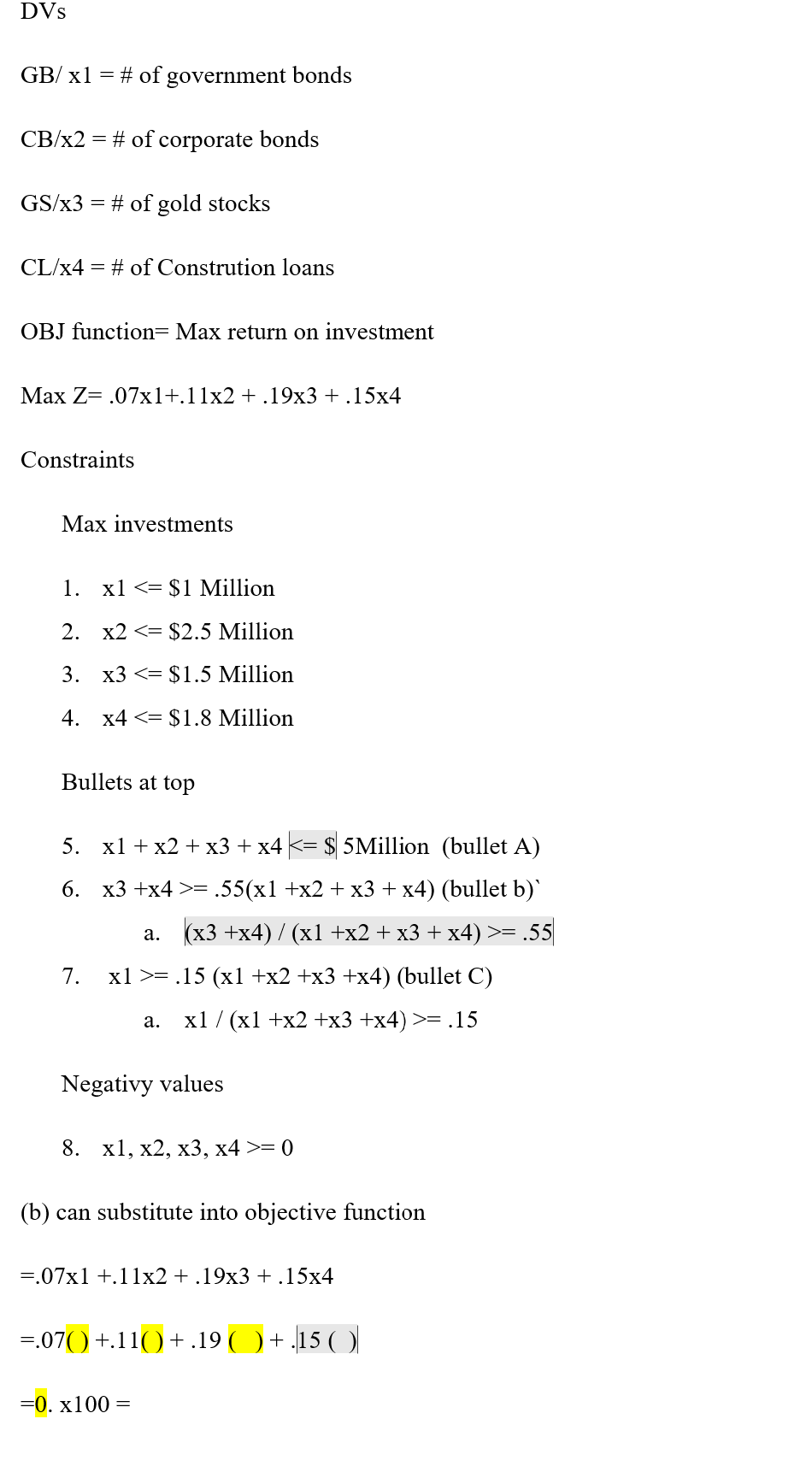

Problem III: Local City Trust aims to maximize its expected return on investment given the following set of legal, policy, or risk limitations. a. Local City Trust has $5M available for investment. They want to invest the total amount. b. At least 55% of the invested funds must be in gold stocks and construction loans. c. No less than 15% is to be invested in government bonds. d. The expected percentage return and maximum to invest per investment type are summarized in the following table: 1. How much should Local City Trust invest in the different investment instruments to maximize their return on investment given the previously defined policies? 2. What is the overall expected rate of return for the recommended portfolio? DVss GB/ x1=# of government bonds CB/x2=# of corporate bonds GS/x3=# of gold stocks CL/x4=# of Constrution loans OBJ function = Max return on investment MaxZ=.071+.112+.193+.154 Constraints Max investments 1. x1=.55(x1+x2+x3+x4) (bullet b) a. (x3+x4)/(x1+x2+x3+x4)>=.55 7. x1>=.15(x1+x2+x3+x4) (bullet C) a. x1/(x1+x2+x3+x4)>=.15 Negativy values 8. x1,x2,x3,x4>=0 (b) can substitute into objective function =.071+.112+.193+.154=.07()+.11()+.19()+.15()=0.100= Problem III: Local City Trust aims to maximize its expected return on investment given the following set of legal, policy, or risk limitations. a. Local City Trust has $5M available for investment. They want to invest the total amount. b. At least 55% of the invested funds must be in gold stocks and construction loans. c. No less than 15% is to be invested in government bonds. d. The expected percentage return and maximum to invest per investment type are summarized in the following table: 1. How much should Local City Trust invest in the different investment instruments to maximize their return on investment given the previously defined policies? 2. What is the overall expected rate of return for the recommended portfolio? DVss GB/ x1=# of government bonds CB/x2=# of corporate bonds GS/x3=# of gold stocks CL/x4=# of Constrution loans OBJ function = Max return on investment MaxZ=.071+.112+.193+.154 Constraints Max investments 1. x1=.55(x1+x2+x3+x4) (bullet b) a. (x3+x4)/(x1+x2+x3+x4)>=.55 7. x1>=.15(x1+x2+x3+x4) (bullet C) a. x1/(x1+x2+x3+x4)>=.15 Negativy values 8. x1,x2,x3,x4>=0 (b) can substitute into objective function =.071+.112+.193+.154=.07()+.11()+.19()+.15()=0.100=

Problem III: Local City Trust aims to maximize its expected return on investment given the following set of legal, policy, or risk limitations. a. Local City Trust has $5M available for investment. They want to invest the total amount. b. At least 55% of the invested funds must be in gold stocks and construction loans. c. No less than 15% is to be invested in government bonds. d. The expected percentage return and maximum to invest per investment type are summarized in the following table: 1. How much should Local City Trust invest in the different investment instruments to maximize their return on investment given the previously defined policies? 2. What is the overall expected rate of return for the recommended portfolio? DVss GB/ x1=# of government bonds CB/x2=# of corporate bonds GS/x3=# of gold stocks CL/x4=# of Constrution loans OBJ function = Max return on investment MaxZ=.071+.112+.193+.154 Constraints Max investments 1. x1=.55(x1+x2+x3+x4) (bullet b) a. (x3+x4)/(x1+x2+x3+x4)>=.55 7. x1>=.15(x1+x2+x3+x4) (bullet C) a. x1/(x1+x2+x3+x4)>=.15 Negativy values 8. x1,x2,x3,x4>=0 (b) can substitute into objective function =.071+.112+.193+.154=.07()+.11()+.19()+.15()=0.100= Problem III: Local City Trust aims to maximize its expected return on investment given the following set of legal, policy, or risk limitations. a. Local City Trust has $5M available for investment. They want to invest the total amount. b. At least 55% of the invested funds must be in gold stocks and construction loans. c. No less than 15% is to be invested in government bonds. d. The expected percentage return and maximum to invest per investment type are summarized in the following table: 1. How much should Local City Trust invest in the different investment instruments to maximize their return on investment given the previously defined policies? 2. What is the overall expected rate of return for the recommended portfolio? DVss GB/ x1=# of government bonds CB/x2=# of corporate bonds GS/x3=# of gold stocks CL/x4=# of Constrution loans OBJ function = Max return on investment MaxZ=.071+.112+.193+.154 Constraints Max investments 1. x1=.55(x1+x2+x3+x4) (bullet b) a. (x3+x4)/(x1+x2+x3+x4)>=.55 7. x1>=.15(x1+x2+x3+x4) (bullet C) a. x1/(x1+x2+x3+x4)>=.15 Negativy values 8. x1,x2,x3,x4>=0 (b) can substitute into objective function =.071+.112+.193+.154=.07()+.11()+.19()+.15()=0.100= Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started