Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I think my numbers are off for Year 2. Can someone verify, please? Cute Camel Woodcraft Company's income statement reports data for its first year

I think my numbers are off for Year 2. Can someone verify, please?

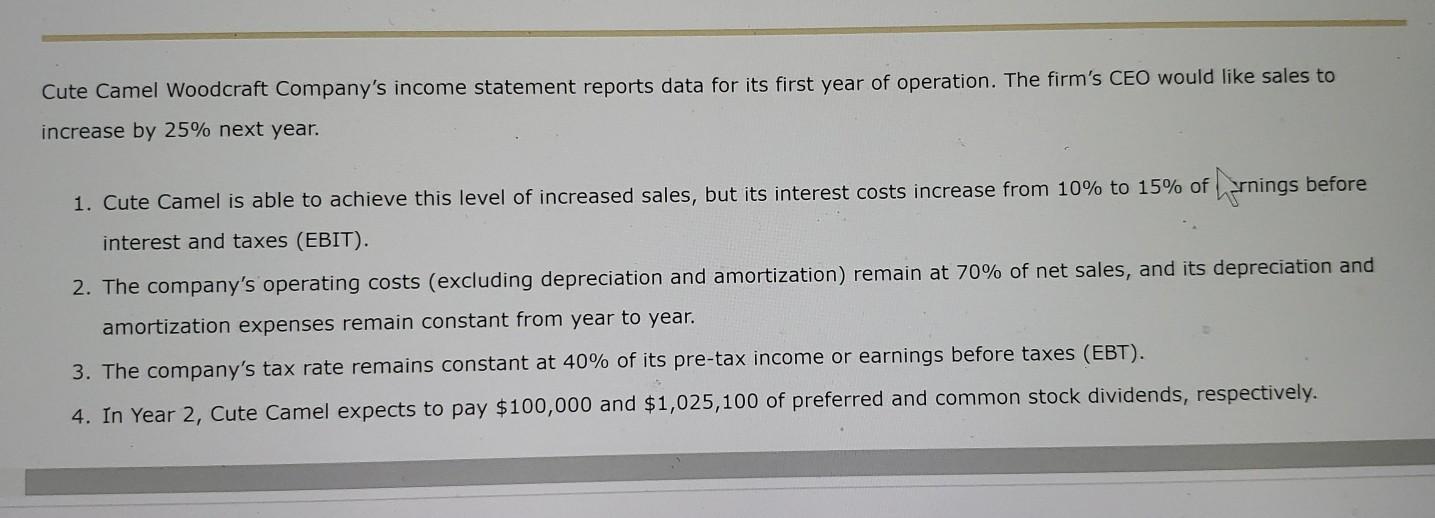

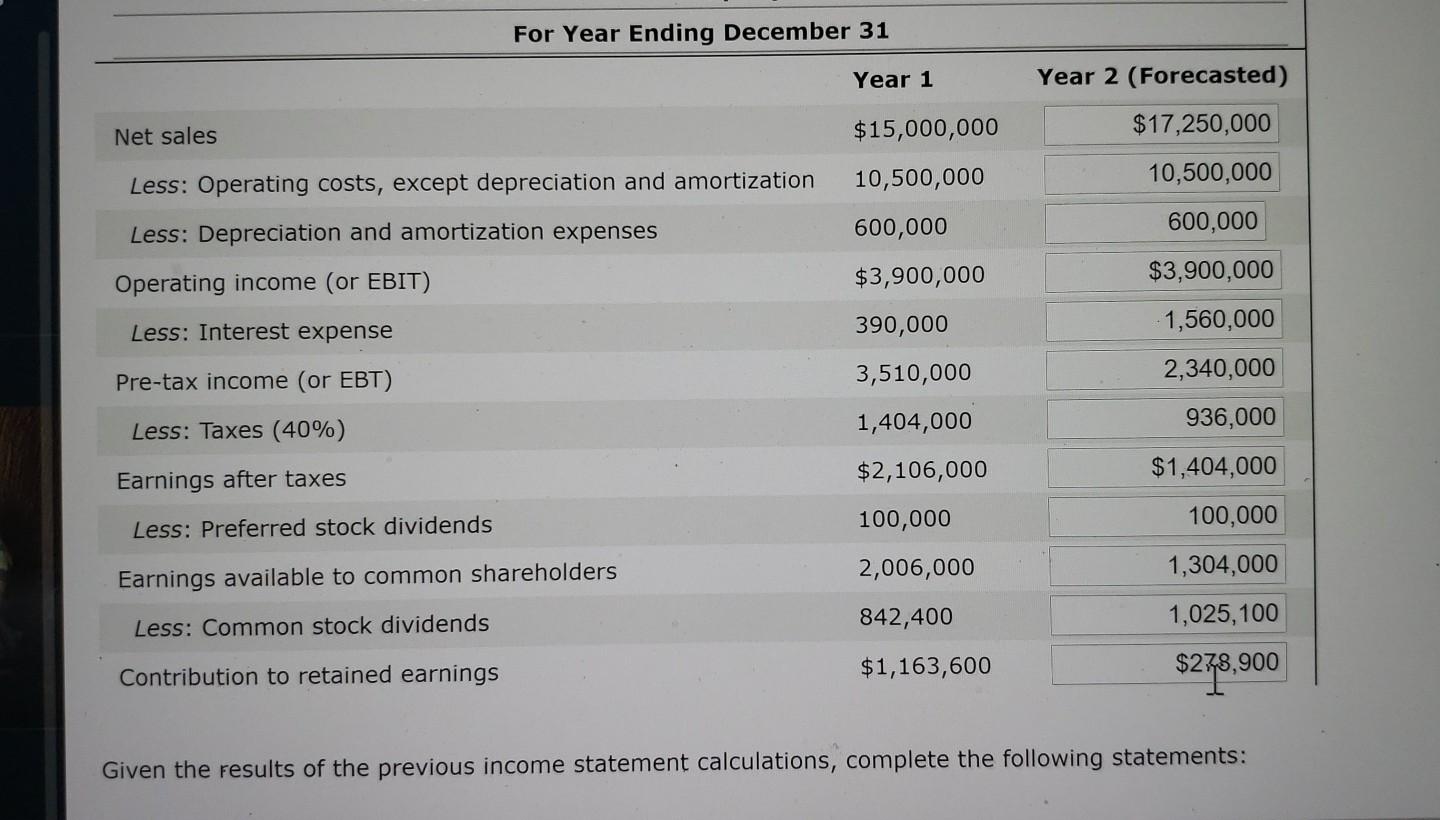

Cute Camel Woodcraft Company's income statement reports data for its first year of operation. The firm's CEO would like sales to increase by 25% next year. 1. Cute Camel is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of N-rnings before interest and taxes (EBIT). 2. The company's operating costs (excluding depreciation and amortization) remain at 70% of net sales, and its depreciation and amortization expenses remain constant from year to year. 3. The company's tax rate remains constant at 40% of its pre-tax income or earnings before taxes (EBT). 4. In Year 2, Cute Camel expects to pay $100,000 and $1,025,100 of preferred and common stock dividends, respectively. For Year Ending December 31 Year 1 Year 2 (Forecasted) $17,250,000 Net sales $15,000,000 10,500,000 Less: Operating costs, except depreciation and amortization 10,500,000 Less: Depreciation and amortization expenses 600,000 600,000 $3,900,000 $3,900,000 Operating income (or EBIT) Less: Interest expense 390,000 1,560,000 2,340,000 Pre-tax income (or EBT) 3,510,000 Less: Taxes (40%) 1,404,000 936,000 Earnings after taxes $2,106,000 Less: Preferred stock dividends 100,000 $1,404,000 100,000 1,304,000 Earnings available to common shareholders 2,006,000 842,400 1,025,100 Less: Common stock dividends Contribution to retained earnings $1,163,600 $278,900 Given the results of the previous income statement calculations, complete the following statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started