Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I think that I did part a correct but im unsure about part B Bradford Services Inc. (BSI) is considering a project that has a

I think that I did part a correct but im unsure about part B

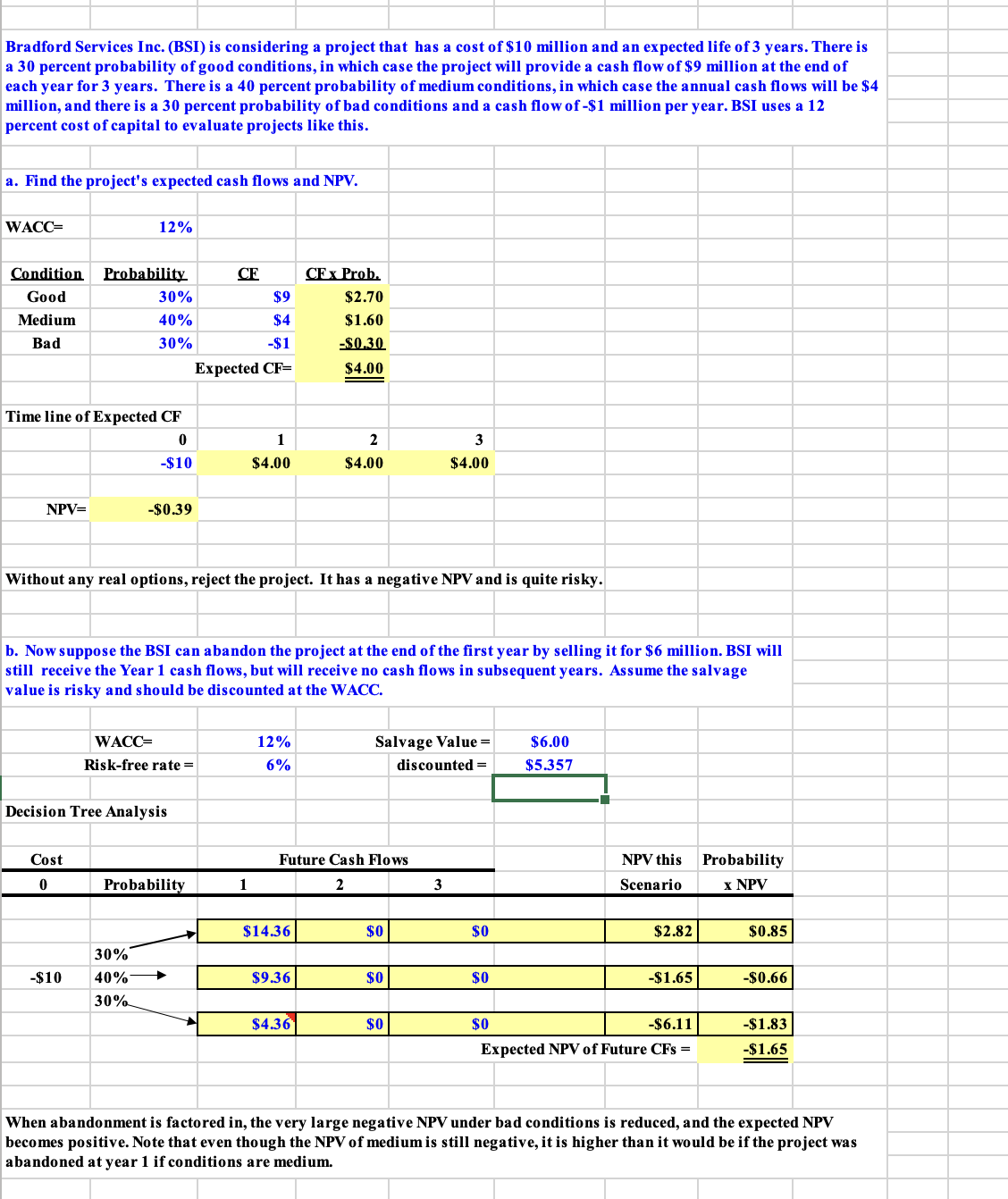

Bradford Services Inc. (BSI) is considering a project that has a cost of $10 million and an expected life of 3 years. There is a 30 percent probability of good conditions, in which case the project will provide a cash flow of $9 million at the end of each year for 3 years. There is a 40 percent probability of medium conditions, in which case the annual cash flows will be $4 million, and there is a 30 percent probability of bad conditions and a cash flow of $1 million per year. BSI uses a 12 percent cost of capital to evaluate projects like this. a. Find the project's expected cash flows and NPV. Without any real options, reject the project. It has a negative NPV and is quite risky. b. Now suppose the BSI can abandon the project at the end of the first year by selling it for $6 million. BSI will still receive the Year 1 cash flows, but will receive no cash flows in subsequent years. Assume the salvage value is risky and should be discounted at the WACC. \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & WACC = & 12% & \multicolumn{2}{|c|}{ Salvage Value =} & $6.00 & & \\ \hline \multicolumn{2}{|r|}{ Risk-free rate =} & 6% & & discounted = & $5.357 & & \\ \hline \multicolumn{8}{|c|}{ Decision Tree Analysis } \\ \hline & & \multirow{2}{*}{\multicolumn{3}{|c|}{ Future Cash Flows }} & & & \\ \hline Cost & & & & & & NPV this & Probability \\ \hline \multirow[t]{3}{*}{0} & Probability & 1 & 2 & 3 & & Scenario & x NPV \\ \hline & & $14.36 & $0 & $0 & & $2.82 & $0.85 \\ \hline & 30% & & & & & & \\ \hline \multirow[t]{6}{*}{$10} & 40% & $9.36 & $0 & $0 & & $1.65 & $0.66 \\ \hline & 30% & & & & & & \\ \hline & & $4.36 & $0 & $0 & & $6.11 & $1.83 \\ \hline & & & & \multicolumn{3}{|c|}{ Expected NPV of Future CFs = } & $1.65 \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline \end{tabular} When abandonment is factored in, the very large negative NPV under bad conditions is reduced, and the expected NPV becomes positive. Note that even though the NPV of medium is still negative, it is higher than it would be if the project was abandoned at year 1 if conditions are medium

Bradford Services Inc. (BSI) is considering a project that has a cost of $10 million and an expected life of 3 years. There is a 30 percent probability of good conditions, in which case the project will provide a cash flow of $9 million at the end of each year for 3 years. There is a 40 percent probability of medium conditions, in which case the annual cash flows will be $4 million, and there is a 30 percent probability of bad conditions and a cash flow of $1 million per year. BSI uses a 12 percent cost of capital to evaluate projects like this. a. Find the project's expected cash flows and NPV. Without any real options, reject the project. It has a negative NPV and is quite risky. b. Now suppose the BSI can abandon the project at the end of the first year by selling it for $6 million. BSI will still receive the Year 1 cash flows, but will receive no cash flows in subsequent years. Assume the salvage value is risky and should be discounted at the WACC. \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & WACC = & 12% & \multicolumn{2}{|c|}{ Salvage Value =} & $6.00 & & \\ \hline \multicolumn{2}{|r|}{ Risk-free rate =} & 6% & & discounted = & $5.357 & & \\ \hline \multicolumn{8}{|c|}{ Decision Tree Analysis } \\ \hline & & \multirow{2}{*}{\multicolumn{3}{|c|}{ Future Cash Flows }} & & & \\ \hline Cost & & & & & & NPV this & Probability \\ \hline \multirow[t]{3}{*}{0} & Probability & 1 & 2 & 3 & & Scenario & x NPV \\ \hline & & $14.36 & $0 & $0 & & $2.82 & $0.85 \\ \hline & 30% & & & & & & \\ \hline \multirow[t]{6}{*}{$10} & 40% & $9.36 & $0 & $0 & & $1.65 & $0.66 \\ \hline & 30% & & & & & & \\ \hline & & $4.36 & $0 & $0 & & $6.11 & $1.83 \\ \hline & & & & \multicolumn{3}{|c|}{ Expected NPV of Future CFs = } & $1.65 \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline \end{tabular} When abandonment is factored in, the very large negative NPV under bad conditions is reduced, and the expected NPV becomes positive. Note that even though the NPV of medium is still negative, it is higher than it would be if the project was abandoned at year 1 if conditions are medium Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started