Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I think this question has already been solved but I just do not understand what is happening in the solution so it would be great

I think this question has already been solved but I just do not understand what is happening in the solution so it would be great if the question could be explained again with an explanation of what is happening in each line of working please! or just even an overview of what we are trying to do in the question please.

Thanks

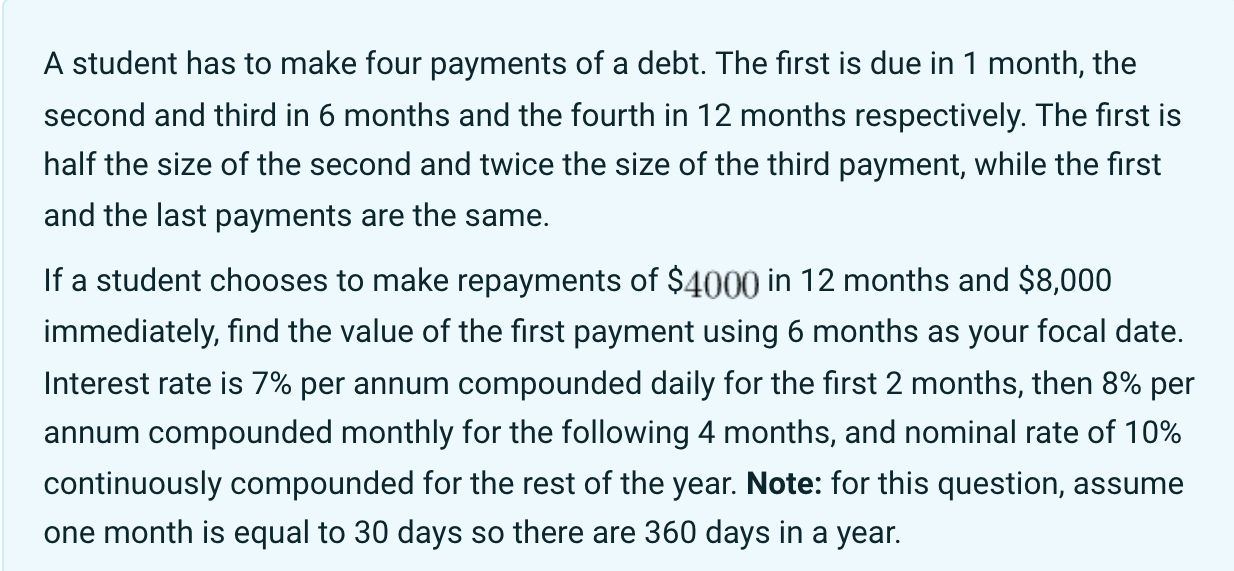

A student has to make four payments of a debt. The first is due in 1 month, the second and third in 6 months and the fourth in 12 months respectively. The first is half the size of the second and twice the size of the third payment, while the first and the last payments are the same. If a student chooses to make repayments of $4000 in 12 months and $8,000 immediately, find the value of the first payment using 6 months as your focal date. Interest rate is 7% per annum compounded daily for the first 2 months, then 8% per annum compounded monthly for the following 4 months, and nominal rate of 10% continuously compounded for the rest of the year. Note: for this question, assume one month is equal to 30 days so there are 360 days in a year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started