Answered step by step

Verified Expert Solution

Question

1 Approved Answer

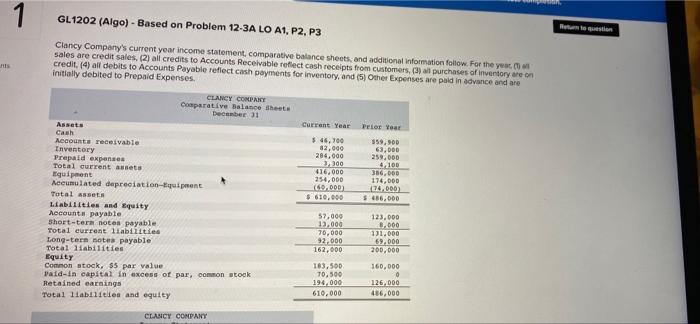

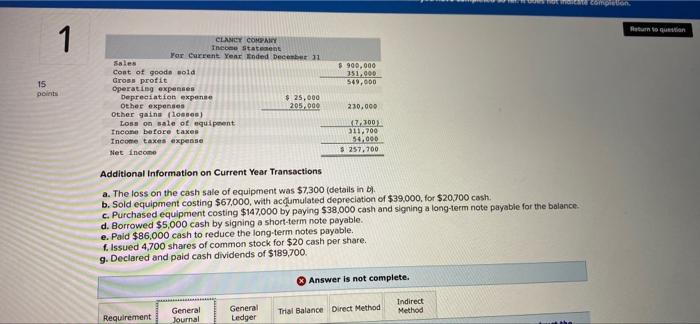

i thought i was doing it write but i was wrong. 1 GL1202 (Algo) - Based on Problem 12-3A LO A1, P2, P3 Clancy Company's

i thought i was doing it write but i was wrong.

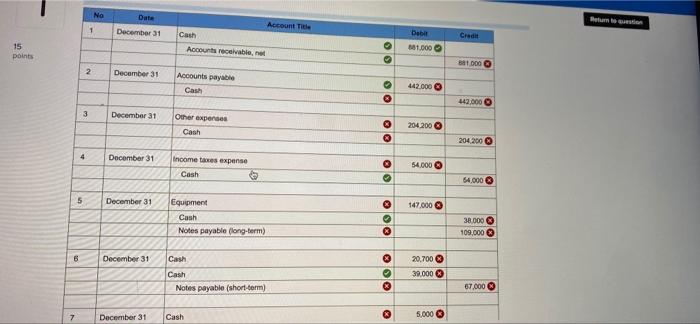

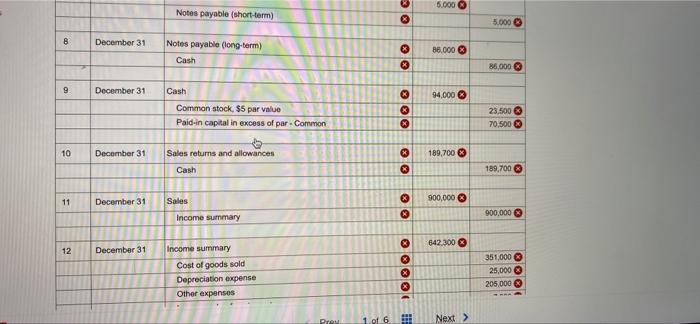

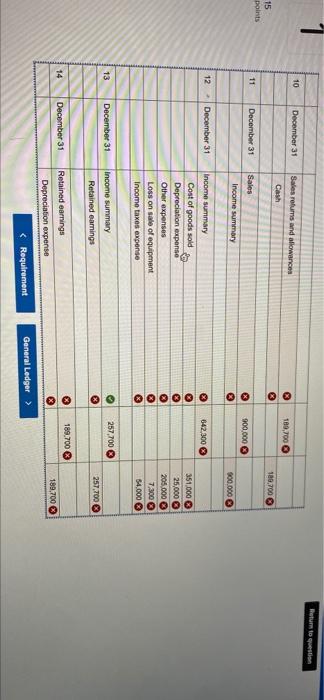

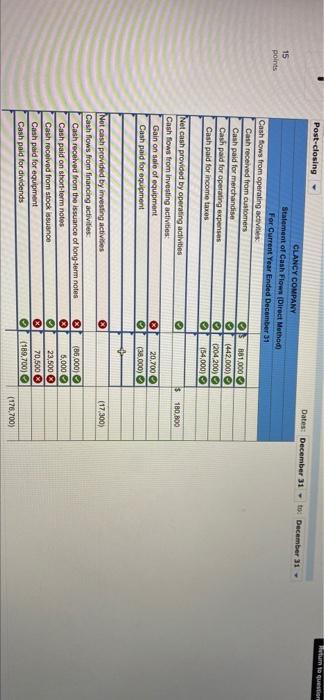

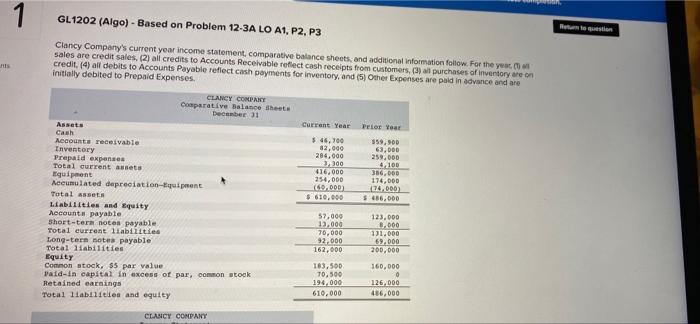

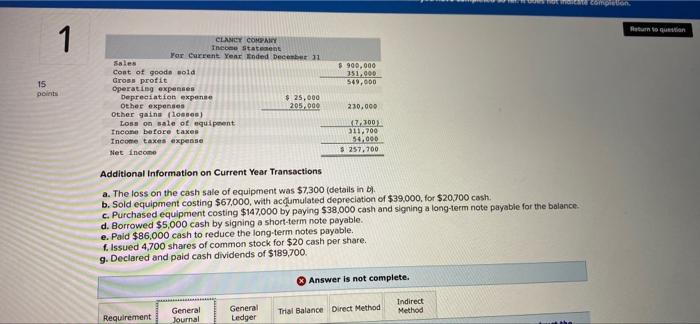

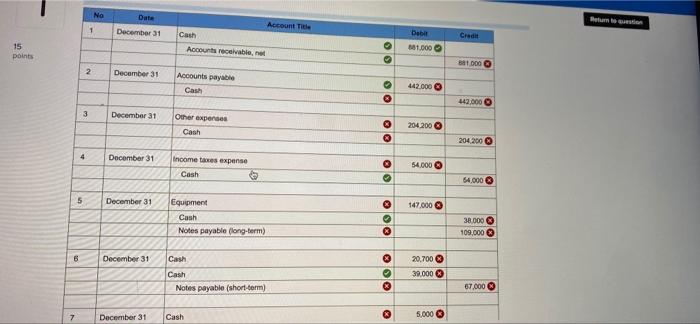

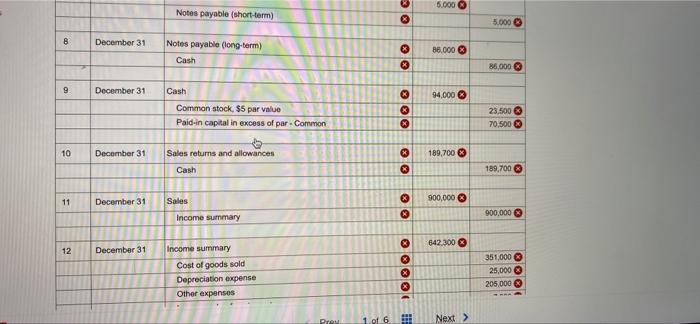

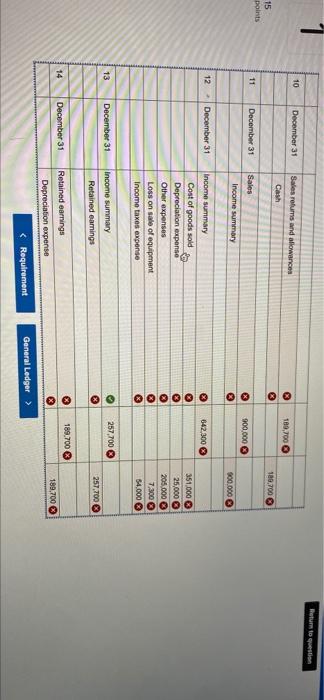

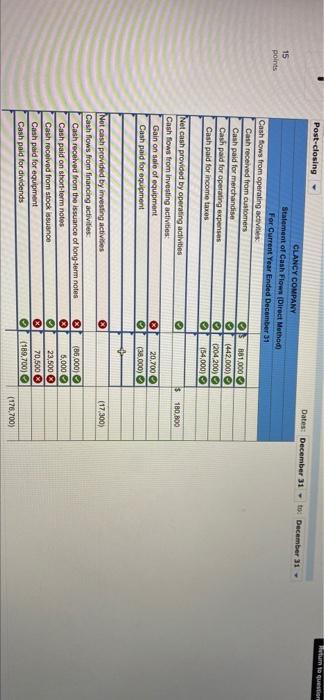

1 GL1202 (Algo) - Based on Problem 12-3A LO A1, P2, P3 Clancy Company's current year income statement comparative balance sheets, and additional information follow. For the yea sales are credit sales. (2) all credits to Accounts Receivable reflect cash receipts from customers, a purchases of inventory are on credit. (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses we paid in advance and are initially debited to Prepaid Expenses CLANCY COMPANY Comparative Balance sheets December 31 Assets Cash Accounts receivable Inventory Prepaid expenses Total current auto Equipment Accumulated depreciation qui pent Total assets Liabilities and Equity Accounts payable short-term notos payable Total liabilities Long-tern notes payable Total liabilities Equity Common stock. 55 par value Paid-in capital in excess of par, common stock Retained earnings Total liabilities and equity Current Year or Year $ 46.700 359,900 82,000 63.000 284.000 259.000 3,300 6.100 476,000 386,000 254,000 174,000 16.DOD 74.000 S486.000 57,000 12.000 70,000 92.000 162,000 123.000 0.000 111.000 69.000 200,000 183,500 70,500 194.000 610.000 160,000 o 126.000 436,000 CLANCY COMPANY completion Return to 1 $ 900,000 351.000 549,000 15 points CLANCY COMPANY Theme Statement Yar Current Year Ended December 31 Sales Cont of goods sold Gross profit operating expenses Depreciation expense $ 25,000 Other expenses 205,000 Other gains (losses) Losa on sale of equipment Income before taxes Income taxes expense Net income 230.000 23001 311,700 50.000 $ 257.700 Additional Information on Current Year Transactions a. The loss on the cash sale of equipment was $7,300 (details in bj. b. Sold equipment costing $67,000, with accumulated depreciation of $39,000, for $20,700 cash. c. Purchased equipment costing $147,000 by paying $38,000 cash and signing a long-term note payable for the balance d. Borrowed $5,000 cash by signing a short-term note payable. e. Pald $86,000 cash to reduce the long-term notes payable. f. Issued 4,700 shares of common stock for $20 cash per share. 9. Declared and paid cash dividends of $189,700. Answer is not complete. General Journal Indirect Method General Ledger Requirement Trial Balance Direct Method No Date Account Tide 1 December 31 Dabar 301.000 15 points Cash Accounts receivable, 581000 2 December 31 Accounts payable Cash 442.000 . 442.000 3 December 31 Other expenses 204.2000 Cash O o 204 200 4 December 31 Income taxes expense Cash 54.000 0 54,000 5 December 31 147.000 Equipment Cash Notes payable long-term) 38.000 109,000 O 6 December 31 Cash 20,700 . 39.000 O Cash Notes payable (short-term) oo 87.000 Q 7 3 December 31 Cash 5.000 5.000 Notes payable (short-term) 3 5.000 B December 31 Notes payable (long-term) Cash 86,000 83 3 85,000 3 9 December 31 94.000 Cash Common stock, $5 par value Paid-in capital in excess of par. Common @ 23,500 70.500 O 10 December 31 Sales returns and allowances 189,700 Cash 189,700 11 December 31 Sales * 900,000 . 900,000 Income summary 642.300 12 December 31 Income summary Cost of goods sold Depreciation expense Other expenses 351,000 25,000 205,000 E!! DOO Drou 1 of 6 18 Next > Butum og 10 December 31 Sales retums and allowances Cash 100.700 oc 180,700 15 points 11 December 31 Sales > 900.000 Income summary 900.000 12 December 31 Income summary 842.300 Cost of goods sold Depreciation expense Other expenses Loss on sale of equipment Income taxes expense OOOOO 351.000 25,000 205.000 7.300 34.000 13 December 31 . 257,700 Income summary Retained earnings 257,700 189.700 14 December 31 Retained earnings Depreciation expense . 189,700 Dates: December 31 : December 31 15 points Post-closing CLANCY COMPANY Statement of Cash Flow (Direct Method For Current Year Ended December 31 Cash flows from operating activities Cash received from customers 181,000 Cash paid for merchandise (442.000) Cash paid for operating expenses (204.2001 Cash paid for income taxes (54,000) O O O O ololo $ 180.800 Net cash provided by operating activities Cash flows from investing activities: Gain on sale of equipment Cash paid for equipment 20.700 (38.000) (17.300) Net cash provided by investing activities Cash flows from financing activities Cash received from the issuance of long-term notes Cash paid on short-term notes Cash received from stock Issuance Cash paid for equipment Cash paid for dividends lololololo (86,000) 5,000 23,500 70.500 (189.700) (176,700)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started