Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I to those who are doing this, I need answers for c & d ..please help to solve or if can please kindly do a

I to those who are doing this, I need answers for c & d ..please help to solve or if can please kindly do a to d. Thank you so much

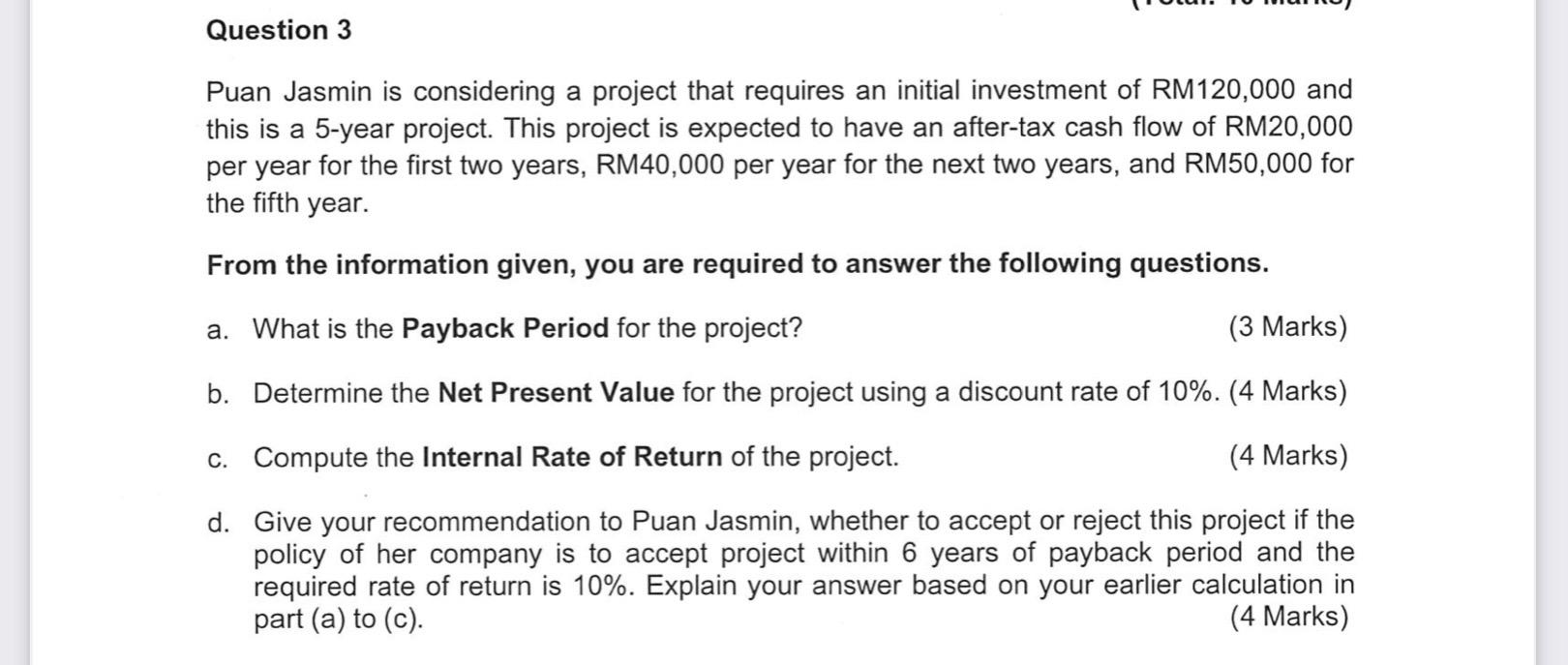

Question 3 Puan Jasmin is considering a project that requires an initial investment of RM120,000 and this is a 5-year project. This project is expected to have an after-tax cash flow of RM20,000 per year for the first two years, RM40,000 per year for the next two years, and RM50,000 for the fifth year. From the information given, you are required to answer the following questions. a. What is the Payback period for the project? (3 Marks) b. Determine the Net Present Value for the project using a discount rate of 10%. (4 Marks) c. Compute the Internal Rate of Return of the project. (4 Marks) d. Give your recommendation to Puan Jasmin, whether to accept or reject this project if the policy of her company is to accept project within 6 years of payback period and the required rate of return is 10%. Explain your answer based on your earlier calculation in part (a) to (c). (4 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started