Answered step by step

Verified Expert Solution

Question

1 Approved Answer

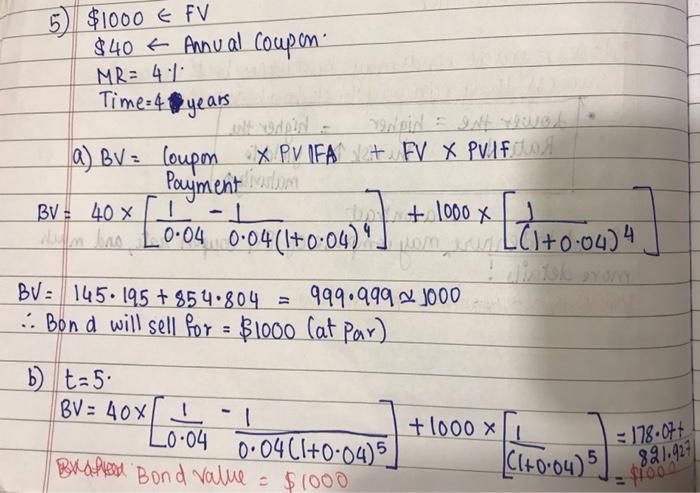

i tried solving this question, is the part b right? we need to find the bond value when t= 5 years right? and the bond

i tried solving this question, is the part b right? we need to find the bond value when t= 5 years right? and the bond is at par?

5. A $1000 bond pays an annual coupon of $40. The market rate of return is 4%. The bond is four years from maturity. a) What should the bond sell for? b) What if the bond is five years from maturity? 5 $1000 FV $40 Annual coupon MR= 4.1: Time 4 years a) BV = Coupon X PVIFAFV x PVAFISA Payment rastom BV = 40% + 1000 x 1 -0.04 0.04(1+0:04)". 40 x [ + ] Women BV: 145.195 +854.804 = 999.9992000 .. Bon d will sell for = $1000 Cat par) b) t=5 BV: 40 -1 0.04(1+0.04)5 Brasheed Bond value = $1000 Loo +1000xi [C1+0:04) 5 = 178.071 821.927 $100 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started