Answered step by step

Verified Expert Solution

Question

1 Approved Answer

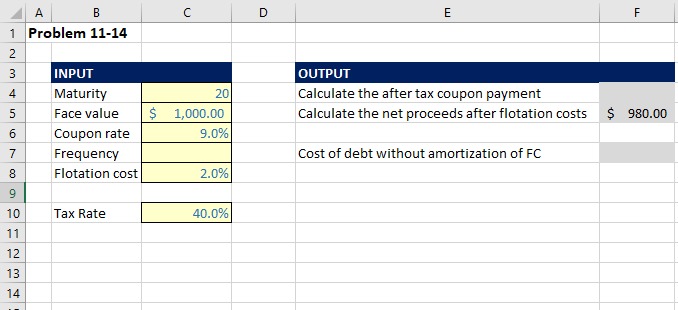

I tried to fill out what I can but I do not know what to put for the frequency and also do not know how

I tried to fill out what I can but I do not know what to put for the frequency and also do not know how to calculate the after tax coupon payment or cost of debt without amortization of FC. Please answer those three things and show work. Thank you!

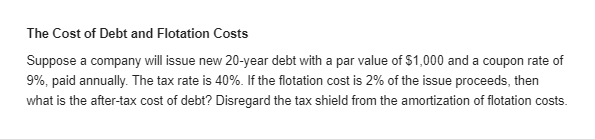

The Cost of Debt and Flotation Costs Suppose a company will issue new 20-year debt with a par value of $1,000 and a coupon rate of 9%, paid annually. The tax rate is 40%. If the flotation cost is 2% of the issue proceeds, then what is the after-tax cost of debt? Disregard the tax shield from the amortization of flotation costs. C D E F w N A B 1 Problem 11-14 2 3 INPUT 4 Maturity 5 Face value 6 Coupon rate 7 Frequency 8 Flotation cost 9 20 $ 1,000.00 9.0% OUTPUT Calculate the after tax coupon payment Calculate the net proceeds after flotation costs $ 980.00 Cost of debt without amortization of FC 2.0% 10 Tax Rate 40.0% 11 12 13 14Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started