Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I tried to solve the question throuth the Excel. But I cannot find a correct answer. In my opinion, we ought to stop making our

I tried to solve the question throuth the Excel. But I cannot find a correct answer.

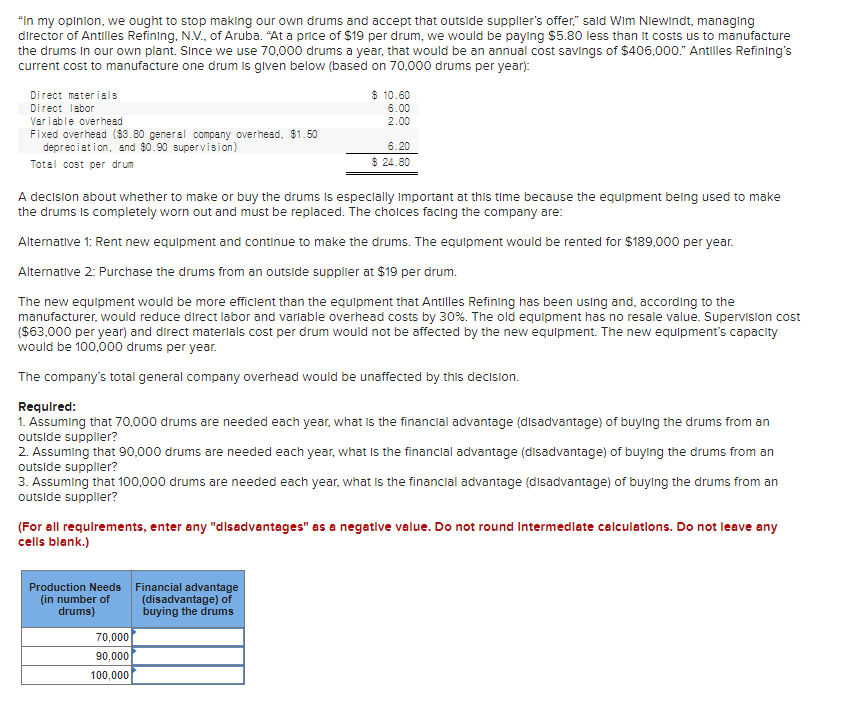

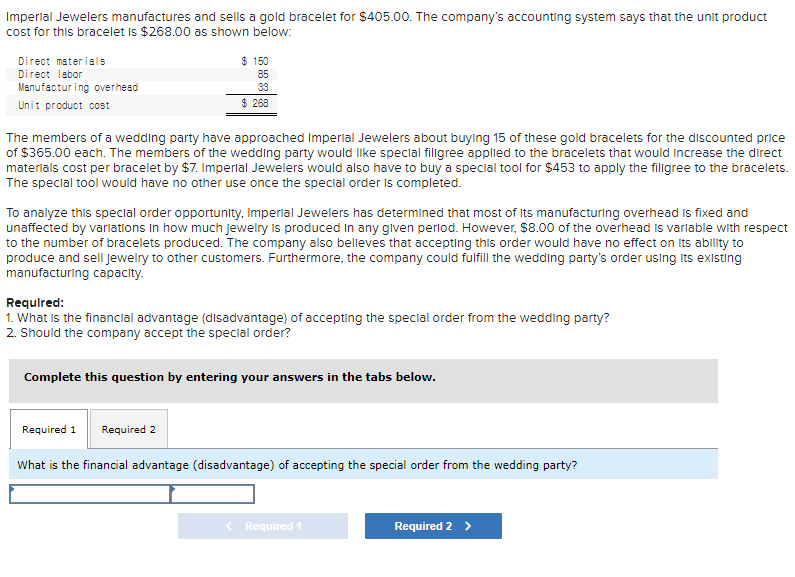

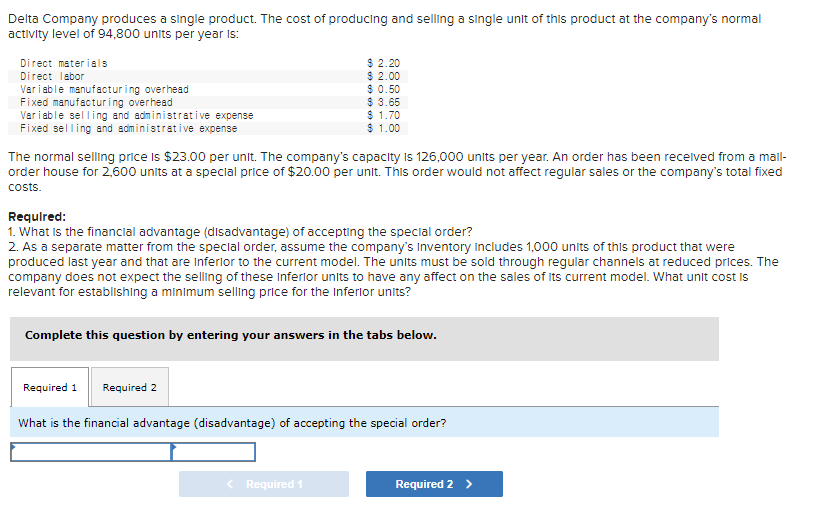

"In my opinion, we ought to stop making our own drums and accept that outside supplier's offer," sald Wim Niewindt, managing director of Antilles Refining, N.V., of Aruba. At a price of $19 per drum, we would be paying $5.80 less than It costs us to manufacture the drums in our own plant. Since we use 70,000 drums a year, that would be an annual cost savings of $406,000." Antilles Refining's current cost to manufacture one drum is given below (based on 70,000 drums per year): $10.60 6.00 2.00 Direct materials Direct labor Variable overhead Fixed overhead ($9.80 general company overhead. $1.50 depreciation, and $0.90 supervision) Total cost per drum 6.20 $ 24.80 A decision about whether to make or buy the drums is especially important at this time because the equipment being used to make the drums is completely worn out and must be replaced. The choices facing the company are: Alternative 1: Rent new equipment and continue to make the drums. The equipment would be rented for $189,000 per year. Alternative 2: Purchase the drums from an outside supplier at $19 per drum. The new equipment would be more efficient than the equipment that Antilles Refining has been using and, according to the manufacturer, would reduce direct labor and variable overhead costs by 30%. The old equipment has no resale value. Supervision cost ($63,000 per year) and direct materials cost per drum would not be affected by the new equipment. The new equipment's capacity would be 100.000 drums per year. The company's total general company overhead would be unaffected by this decision. Required: 1. Assuming that 70,000 drums are needed each year, what is the financial advantage (disadvantage) of buying the drums from an outside supplier? 2. Assuming that 90,000 drums are needed each year, what is the financial advantage (disadvantage) of buying the drums from an outside supplier? 3. Assuming that 100,000 drums are needed each year, what is the financial advantage (disadvantage) of buying the drums from an outside supplier? (For all requirements, enter any "disadvantages" as a negative value. Do not round Intermediate calculations. Do not leave any cells blank.) Production Needs Financial advantage (in number of (disadvantage) of drums) buying the drums 70.000 90,000 100,000 Imperial Jewelers manufactures and sells a gold bracelet for $405.00. The company's accounting system says that the unit product cost for this bracelet is $268.00 as shown below: Direct materials Direct labor Manufacturing overhead Unit product cost $ 150 85 33 $ 268 The members of a wedding party have approached Imperial Jewelers about buying 15 of these gold bracelets for the discounted price of $365.00 each. The members of the wedding party would like special filigree applied to the bracelets that would increase the direct materials cost per bracelet by $7. Imperial Jewelers would also have to buy a special tool for $453 to apply the filigree to the bracelets. The special tool would have no other use once the special order is completed. To analyze this special order opportunity, Imperial Jewelers has determined that most of its manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However, $8.00 of the overhead is variable with respect to the number of bracelets produced. The company also believes that accepting this order would have no effect on its ability to produce and sell Jewelry to other customers. Furthermore, the company could fulfill the wedding party's order using its existing manufacturing capacity. Required: 1. What is the financial advantage (disadvantage) of accepting the special order from the wedding party? 2. Should the company accept the special order? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is the financial advantage (disadvantage) of accepting the special order from the wedding party? Delta Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 94,800 units per year is: Direct materials $ 2.20 Direct labor $ 2.00 Variable manufacturing overhead $ 0.50 Fixed manufacturing overhead $ 3.65 Variable selling and administrative expense $ 1.70 Fixed selling and administrative expense $ 1.00 The normal selling price is $23.00 per unit. The company's capacity is 126,000 units per year. An order has been received from a mall- order house for 2,600 units at a special price of $20.00 per unit. This order would not affect regular sales or the company's total fixed costs. Required: 1. What is the financial advantage (disadvantage) of accepting the special order? 2. As a separate matter from the special order, assume the company's Inventory Includes 1,000 units of this product that were produced last year and that are inferior to the current model. The units must be sold through regular channels at reduced prices. The company does not expect the selling of these inferior units to have any affect on the sales of its current model. What unit cost is relevant for establishing a minimum selling price for the Inferior units? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is the financial advantage (disadvantage) of accepting the special order?Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started