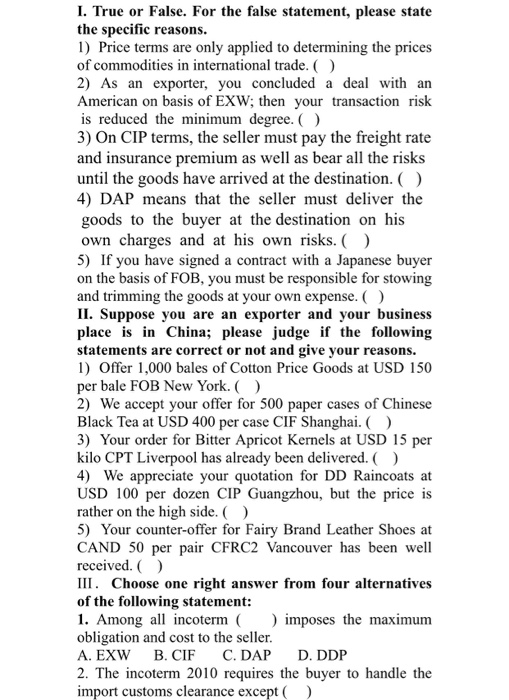

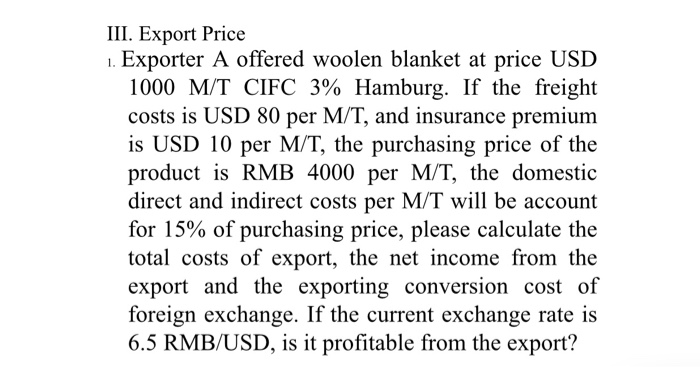

I. True or False. For the false statement, please state the specific reasons. 1) Price terms are only applied to determining the prices of commodities in international trade. ( ) 2) As an exporter, you concluded a deal with an American on basis of EXW; then your transaction risk is reduced the minimum degree. ( 3) On CIP terms, the seller must pay the freight rate and insurance premium as well as bear all the risks until the goods have arrived at the destination. ( ) 4) DAP means that the seller must deliver the goods to the buyer at the destination on his own charges and at his own risks. ) 5) If you have signed a contract with a Japanese buyer on the basis of FOB, you must be responsible for stowing and trimming the goods at your own expense. ) II. Suppose you are an exporter and your business place is in China; please judge if the following statements are correct or not and give your reasons. 1) Offer 1,000 bales of Cotton Price Goods at USD 150 per bale FOB New York. () 2) We accept your offer for 500 paper cases of Chinese Black Tea at USD 400 per case CIF Shanghai.( 3) Your order for Bitter Apricot Kernels at USD 15 per kilo CPT Liverpool has already been delivered. ) 4) We appreciate your quotation for DD Raincoats at USD 100 per dozen CIP Guangzhou, but the price is rather on the high side.( 5) Your counter-offer for Fairy Brand Leather Shoes at CAND 50 per pair CFRC2 Vancouver has been well received. ) III. Choose one right answer from four alternatives of the following statement: 1. Among all incoterm imposes the maximum obligation and cost to the seller. A. EXW B. CIF C. DAP D. DDP 2. The incoterm 2010 requires the buyer to handle the import customs clearance except() III. Export Price 1. Exporter A offered woolen blanket at price USD 1000 M/T CIFC 3% Hamburg. If the freight costs is USD 80 per M/T, and insurance premium is USD 10 per M/T, the purchasing price of the product is RMB 4000 per M/T, the domestic direct and indirect costs per M/T will be account for 15% of purchasing price, please calculate the total costs of export, the net income from the export and the exporting conversion cost of foreign exchange. If the current exchange rate is 6.5 RMB/USD, is it profitable from the export? I. True or False. For the false statement, please state the specific reasons. 1) Price terms are only applied to determining the prices of commodities in international trade. ( ) 2) As an exporter, you concluded a deal with an American on basis of EXW; then your transaction risk is reduced the minimum degree. ( 3) On CIP terms, the seller must pay the freight rate and insurance premium as well as bear all the risks until the goods have arrived at the destination. ( ) 4) DAP means that the seller must deliver the goods to the buyer at the destination on his own charges and at his own risks. ) 5) If you have signed a contract with a Japanese buyer on the basis of FOB, you must be responsible for stowing and trimming the goods at your own expense. ) II. Suppose you are an exporter and your business place is in China; please judge if the following statements are correct or not and give your reasons. 1) Offer 1,000 bales of Cotton Price Goods at USD 150 per bale FOB New York. () 2) We accept your offer for 500 paper cases of Chinese Black Tea at USD 400 per case CIF Shanghai.( 3) Your order for Bitter Apricot Kernels at USD 15 per kilo CPT Liverpool has already been delivered. ) 4) We appreciate your quotation for DD Raincoats at USD 100 per dozen CIP Guangzhou, but the price is rather on the high side.( 5) Your counter-offer for Fairy Brand Leather Shoes at CAND 50 per pair CFRC2 Vancouver has been well received. ) III. Choose one right answer from four alternatives of the following statement: 1. Among all incoterm imposes the maximum obligation and cost to the seller. A. EXW B. CIF C. DAP D. DDP 2. The incoterm 2010 requires the buyer to handle the import customs clearance except() III. Export Price 1. Exporter A offered woolen blanket at price USD 1000 M/T CIFC 3% Hamburg. If the freight costs is USD 80 per M/T, and insurance premium is USD 10 per M/T, the purchasing price of the product is RMB 4000 per M/T, the domestic direct and indirect costs per M/T will be account for 15% of purchasing price, please calculate the total costs of export, the net income from the export and the exporting conversion cost of foreign exchange. If the current exchange rate is 6.5 RMB/USD, is it profitable from the export