Answered step by step

Verified Expert Solution

Question

1 Approved Answer

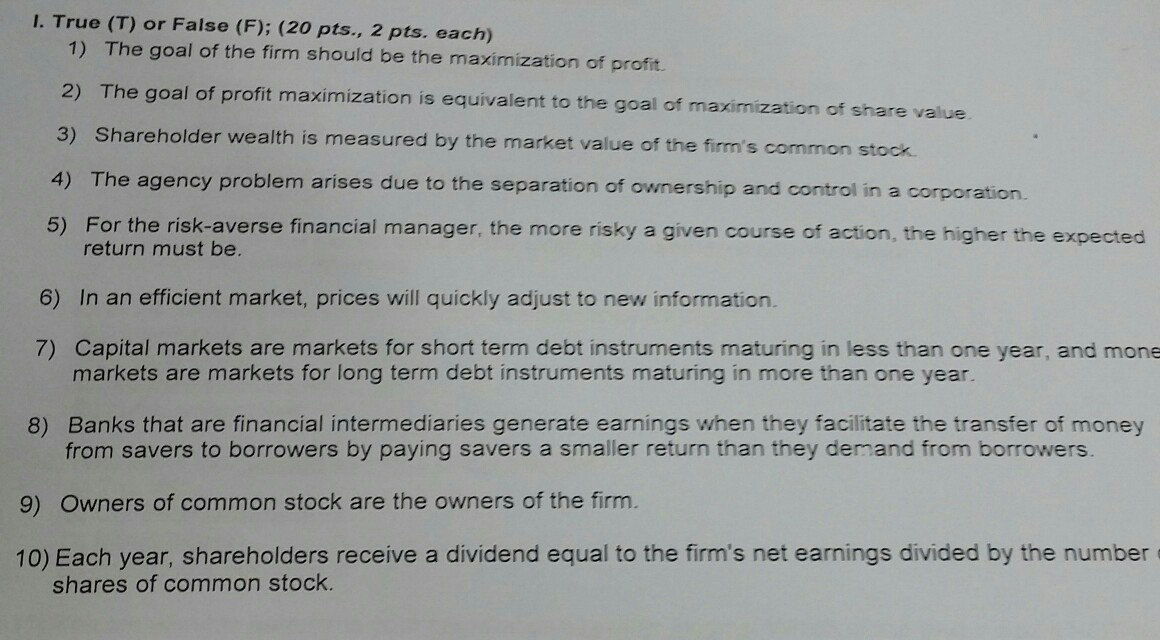

I. True (T) or False (F); (20 pts., 2 pts. each) 1) The goal of the firm should be the maximization of profit. 2) The

I. True (T) or False (F); (20 pts., 2 pts. each) 1) The goal of the firm should be the maximization of profit. 2) The goal of profit maximization is equivalent to the goal of maximization of share val 3) Shareholder wealth is measured by the market value of the firm's common stock. 4) The agency problem arises due to the separation of ownership and control in a corporation. For the risk-averse financial manager, the more risky a given course of action, the higher the return must be. 5) expected 6) In an efficient market, prices will quickly adjust to new information. 7) Capital markets are markets for short term debt instruments maturing in less than one year, and mone markets are markets for long term debt instruments maturing in more than one year Banks that are financial intermediaries generate earnings when they facilitate the transfer of money from savers to borrowers by paying savers a smaller return than they demand from borrowers. 8) 9) Owners of common stock are the owners of the firm. 10) Each year, shareholders receive a dividend equal to the firm's net earnings divided by the number shares of common stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started