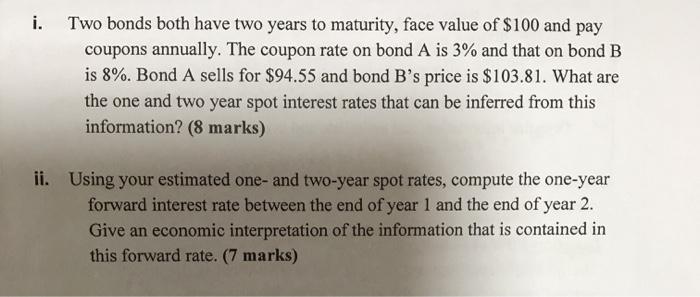

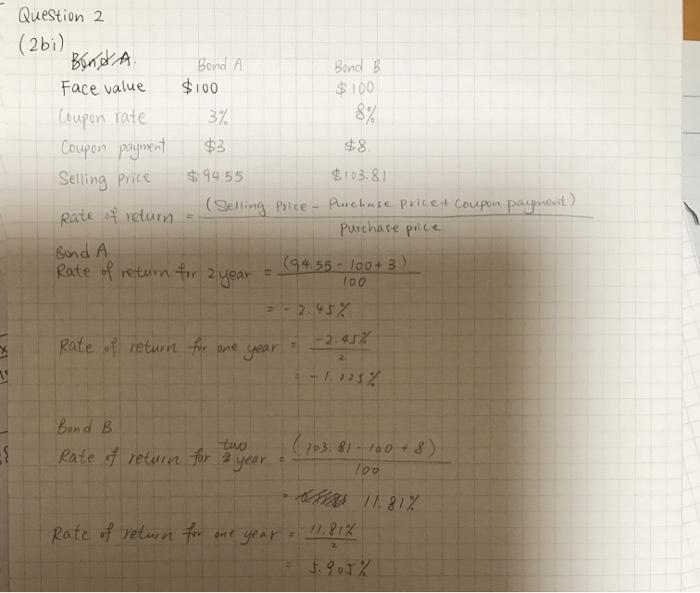

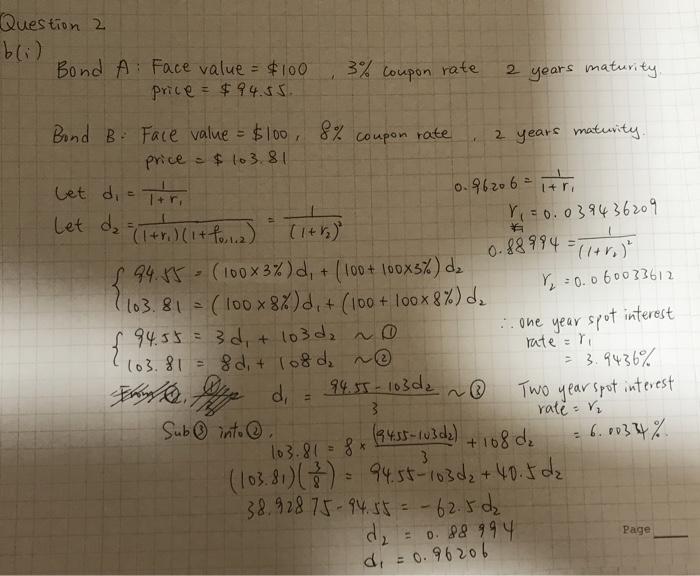

i. Two bonds both have two years to maturity, face value of $100 and pay coupons annually. The coupon rate on bond A is 3% and that on bond B is 8%. Bond A sells for $94.55 and bond B's price is $103.81. What are the one and two year spot interest rates that can be inferred from this information? (8 marks) ii. Using your estimated one- and two-year spot rates, compute the one-year forward interest rate between the end of year 1 and the end of year 2. Give an economic interpretation of the information that is contained in this forward rate. (7 marks) as well Im. Can it Sorry, I don't think I have that information possibly be an assumption? For part (1), I was I first tried the wondering which method is correct . 8% $8 Question 2 (261) Benda Bond A Bond B Face value $100 $100 Coupon rate 37 Coupon payment $3. Selling Price $9455 $103.81 Rate of returna (Selling Price - Purchase pricet coupon payment) Purchase price Bond A Rate of return for 2 year (94.55lpot 3) 100 2.45% Rate of return for -2.9% 1.712 > 2 70 Bond B two (703. 81-100+8) Rate of return for 2 year oss 11.81% Rate of return for one year a $.905% But then I thought another method may work too, teach me what is the difference between these rates and which one is conect? Appreciated! can you Question 2 Bond A: Face value = $100 price = $94.55. 3% coupon rate 2 years maturity 1 r Bond B: Face value = $100 $100, 8% coupon rate 2 years maturity. price $103.81 Let di 0.96.20 6 = + let d2 = (1+r) (itto 1.2) (1+r) r = 0.039436209 0.88 994 = 114.) $ 94.15 - (100X3%)d, + ( 100 + 100x5%)d, 1103.81 = ( 100x8%)d,+ (100 + 100x8%) d, r = 0.060033612 { 94.55 = 3d,+ 103d, no rateri 103.81 = 8 d + lofda = 3.9436% d 94.55-103de Two year spot interest rater Sub into 103.81= fx = 6.0034% (103.81) () = 94.58 -103d + 40. 8 de 38.928 75-94.55 =-62.5 dz de = 0.88994 .. one year spot interest 3 (34.55-103 dz) +108 de 3 Page d = 0.96206 i. Two bonds both have two years to maturity, face value of $100 and pay coupons annually. The coupon rate on bond A is 3% and that on bond B is 8%. Bond A sells for $94.55 and bond B's price is $103.81. What are the one and two year spot interest rates that can be inferred from this information? (8 marks) ii. Using your estimated one- and two-year spot rates, compute the one-year forward interest rate between the end of year 1 and the end of year 2. Give an economic interpretation of the information that is contained in this forward rate. (7 marks) as well Im. Can it Sorry, I don't think I have that information possibly be an assumption? For part (1), I was I first tried the wondering which method is correct . 8% $8 Question 2 (261) Benda Bond A Bond B Face value $100 $100 Coupon rate 37 Coupon payment $3. Selling Price $9455 $103.81 Rate of returna (Selling Price - Purchase pricet coupon payment) Purchase price Bond A Rate of return for 2 year (94.55lpot 3) 100 2.45% Rate of return for -2.9% 1.712 > 2 70 Bond B two (703. 81-100+8) Rate of return for 2 year oss 11.81% Rate of return for one year a $.905% But then I thought another method may work too, teach me what is the difference between these rates and which one is conect? Appreciated! can you Question 2 Bond A: Face value = $100 price = $94.55. 3% coupon rate 2 years maturity 1 r Bond B: Face value = $100 $100, 8% coupon rate 2 years maturity. price $103.81 Let di 0.96.20 6 = + let d2 = (1+r) (itto 1.2) (1+r) r = 0.039436209 0.88 994 = 114.) $ 94.15 - (100X3%)d, + ( 100 + 100x5%)d, 1103.81 = ( 100x8%)d,+ (100 + 100x8%) d, r = 0.060033612 { 94.55 = 3d,+ 103d, no rateri 103.81 = 8 d + lofda = 3.9436% d 94.55-103de Two year spot interest rater Sub into 103.81= fx = 6.0034% (103.81) () = 94.58 -103d + 40. 8 de 38.928 75-94.55 =-62.5 dz de = 0.88994 .. one year spot interest 3 (34.55-103 dz) +108 de 3 Page d = 0.96206