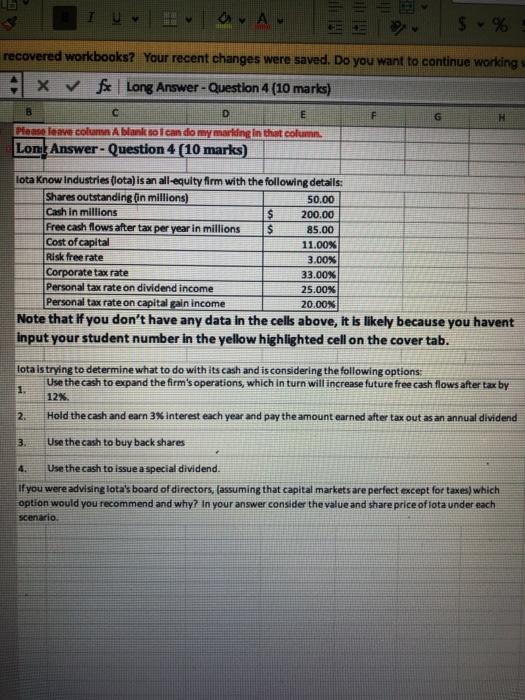

I U EA. $ recovered workbooks? Your recent changes were saved. Do you want to continue working 4 x V x Long Answer - Question 4 (10 marks) B C D E Please leave column A blank so I can do my mariding in that colum. Lont Answer - Question 4 (10 marks) lota Know Industries lota) is an all-equity firm with the following details: Shares outstanding in millions) 50.00 Cash in millions $ 200.00 Free cash flows after tax per year in millions $ 85.00 Cost of capital 11.00% Risk free rate 3.00% Corporate tax rate 33.00% Personal tax rate on dividend income 25.00% Personal tax rate on capital gain income 20.00% Note that if you don't have any data in the cells above, it is likely because you havent input your student number in the yellow highlighted cell on the cover tab. 12 2. lota is trying to determine what to do with its cash and is considering the following options: Use the cash to expand the firm's operations, which in turn will increase future free cash flows after tax by 1. Hold the cash and earn 3% interest each year and pay the amount earned after tax out as an annual dividend 3. Use the cash to buy back shares 4. Use the cash to issue a special dividend. If you were advising lota's board of directors, (assuming that capital markets are perfect except for taxes) which option would you recommend and why? In your answer consider the value and share price of iota under each scenario I U EA. $ recovered workbooks? Your recent changes were saved. Do you want to continue working 4 x V x Long Answer - Question 4 (10 marks) B C D E Please leave column A blank so I can do my mariding in that colum. Lont Answer - Question 4 (10 marks) lota Know Industries lota) is an all-equity firm with the following details: Shares outstanding in millions) 50.00 Cash in millions $ 200.00 Free cash flows after tax per year in millions $ 85.00 Cost of capital 11.00% Risk free rate 3.00% Corporate tax rate 33.00% Personal tax rate on dividend income 25.00% Personal tax rate on capital gain income 20.00% Note that if you don't have any data in the cells above, it is likely because you havent input your student number in the yellow highlighted cell on the cover tab. 12 2. lota is trying to determine what to do with its cash and is considering the following options: Use the cash to expand the firm's operations, which in turn will increase future free cash flows after tax by 1. Hold the cash and earn 3% interest each year and pay the amount earned after tax out as an annual dividend 3. Use the cash to buy back shares 4. Use the cash to issue a special dividend. If you were advising lota's board of directors, (assuming that capital markets are perfect except for taxes) which option would you recommend and why? In your answer consider the value and share price of iota under each scenario