Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I understand this is more than one question but they go together. I will take any help I can get. Blue Llama Mining Company is

I understand this is more than one question but they go together. I will take any help I can get.

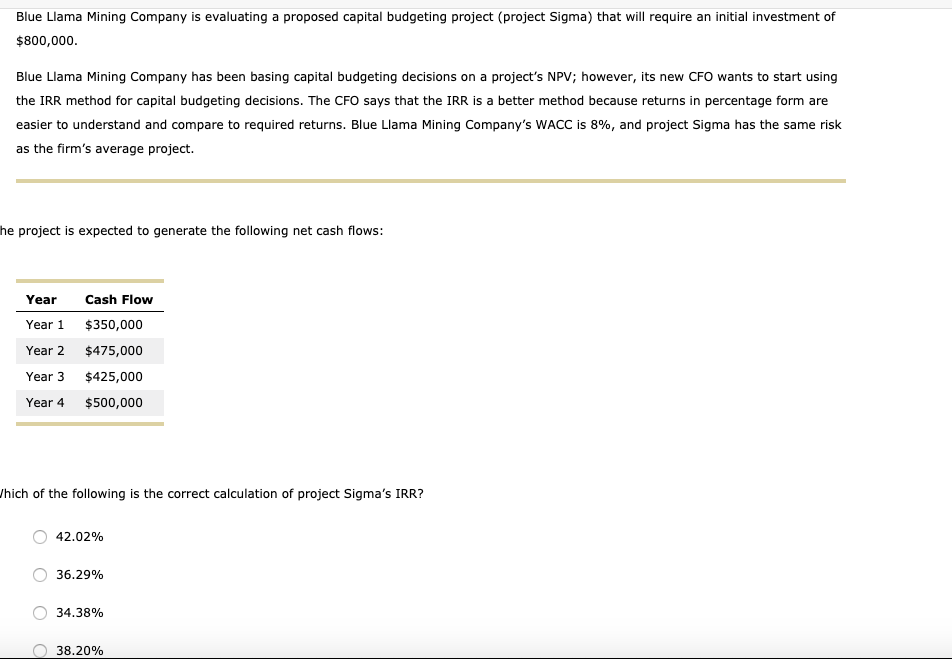

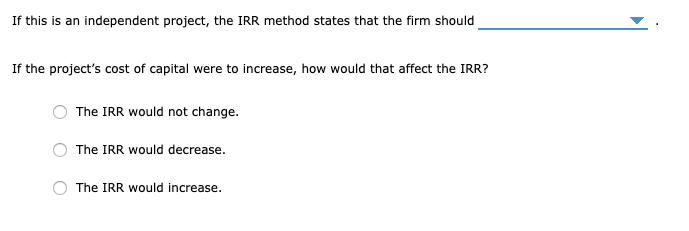

Blue Llama Mining Company is evaluating a proposed capital budgeting project (project Sigma) that will require an initial investment of $800,000. Blue Llama Mining Company has been basing capital budgeting decisions on a project's NPV; however, its new CFO wants to start using the IRR method for capital budgeting decisions. The CFO says that the IRR is a better method because returns in percentage form are easier to understand and compare to required returns. Blue Llama Mining Company's WACC is 8%, and project Sigma has the same risk as the firm's average project. the project is expected to generate the following net cash flows: Year Year 1 Year 2 Year 3 Year 4 Cash Flow $350,000 $475,000 $425,000 $500,000 Which of the following is the correct calculation of project Sigma's IRR? O 42.02% 36.29% O 34.38% 38.20% If this is an independent project, the IRR method states that the firm should If the project's cost of capital were to increase, how would that affect the IRR? O The IRR would not change. The IRR would decrease. O The IRR would increaseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started